This Month in the Markets - Welcome to 2024

with Bryan Goligoski - Axxcess Editor at Large

As a colleague of mine once said, the minute the clock strikes midnight on December 31st, a little old man comes out and wipes the chalkboard clean. New Year, new slate, new performance clock. You don’t always get to pick your own ‘little old man’. If I could though, mine would be Mr. Hand. And I would offer him a mighty ‘Aloha!’ Only hopping to get a robust ‘Aloha’ in return.

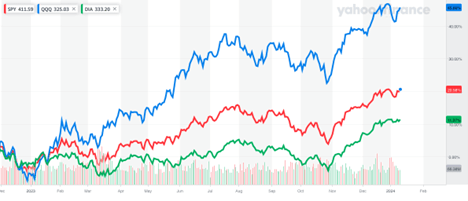

And after last year’s blistering run by stocks, the performance clock landed white hot at the end of 2023. I’ve seen many things in my twenty-sum-odd years in this business, but the late year ‘power move’ by the equity indexes in the last two months was something to behold.

If you’ve spent even just a little time this year reading this piece, you know what triggered the ‘risk on…and on…and on’ trade.

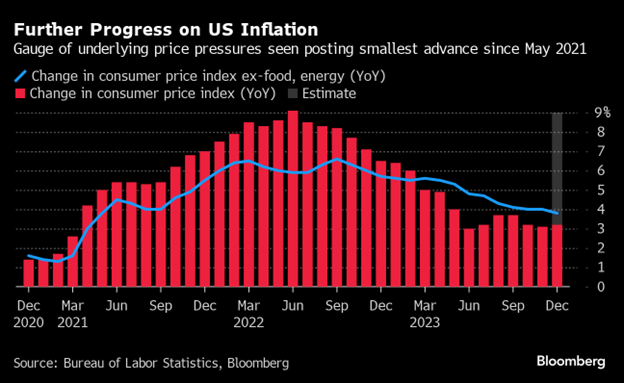

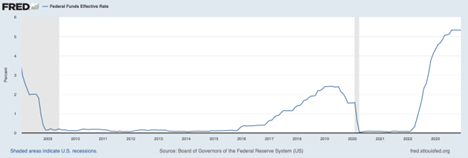

Smart minds can differ, and they often do. That’s what makes a market as they say. What the masses are reacting to is the implied next move by the Federal Reserve to begin the process of cutting interest rates after a near vertical rise over the past two years. Just parabolic compared to where they have been for the past fifteen years.

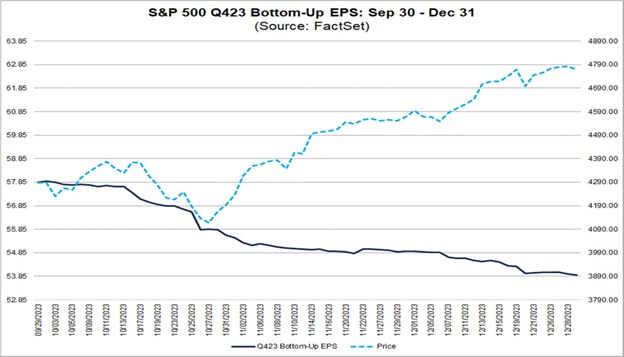

A subtle, but very possible reason the markets are reacting in such a positive way to a potential rate cutting regime change is the slowing in earnings expectations for the S&P 500. Over the course of the last three months expected earnings have gone from $57.85 to $53.05. May not sound like much, but that’s still a 10% haircut. In the meantime, the S&P 500 index has gone from 4,290 to 4,790. That’s a 10% rise.

Source: FactSet

With that I’ve given you a great cold open to the start of this New Year. Only it’s not just live just from New York, it’s live from everywhere. Money never sleeps. We have a great year for you ahead, not to mention some of the smartest minds on Wall Street to help us make sense of different market. It’s going to a be both a spring, and a marathon at times. Good news for you, I was a great ‘tweener’ back in my day.

Source: The Way Back Machine

The contents of this commentary: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, and (ii) may not be relied upon in making an investment decision related to any investment offering by Axxcess Wealth Management, LLC (“AWM”), an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure.

Market data, articles and other content in this commentary are based on generally available information and are believed to be reliable. AWM does not warrant the accuracy or completeness of the information contained herein. Opinions are the author’s current opinions and are subject to change without notice. The views expressed in this commentary are subject to change based on market and other conditions. This commentary may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information contained above is for illustrative purposes only.