“Be it ever so humble, there’s no place like home….”

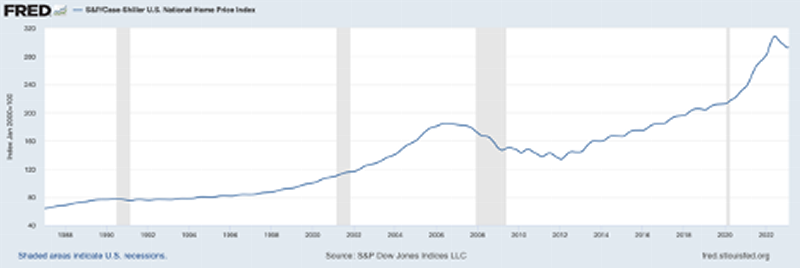

Welcome everyone to the oh so joyful look at what’s happening in the residential real estate markets, how it’s impacting the economy. Let’s start off with the obvious, the combo plate of ‘work from wherever you like’ and a ZIRP, with an emphasis on ‘Z’, has lit a bonfire of epic proportions under the value of homes in the United States. After a decade long recovery from 2007 to 2017, some modest gains in 2018 and 2019, the market has since gone parabolic.

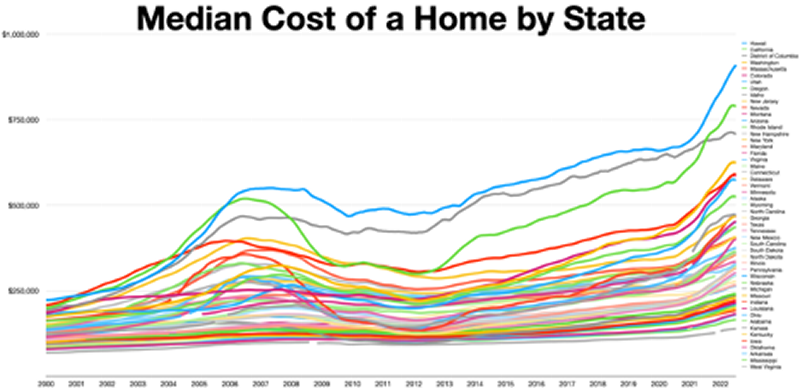

And here is how it looks by state. A simple abode in California was running on average $550,000 going into 2020 and ended 2022 at $750,000. Let’s do the math, $200/$550 = 37%. You aren’t seeing things, that’s a 24 month increase of almost 40%. And that’s just the average.

Take a hot area like the one I lived in, Montecito CA, and it’s at least a double. Want to know how I know? Thrice (2016, 2017 & 2018) I hired a broker to sell a decently sized home in one of the lesser areas of the 93108. Think of it as Beverly Hills Adj. All I was asking is my $2.1 million money back from the ill timed 2007 purchase. On the third try it finally moved. Two weeks ago, the same house that could not get a bid for 18 months, went on the market for $4.75 and sold in days.

Full disclosure, I was happy for the new owners and for sure got my money’s worth out of good old 434 Nicholas Lane. They probably put around $750k into it, but the structure was largely the same. In owning the home, I got to send my kids to Cold Spring School, the number one school in the land. It probably saved me $1 million in private school tuition over the years…

3 boys x $50k year x 21 total years (k-6) = $1,050,000

But none of this changes the fact that if one were to look around for a bubble that has formed, residential real estate would be my number one pick. I thought I was smart playing the 2018 and 2019 rates rise as a chance to take a breather and wait out better prices for my next home. At least that was my plan. God clearly heard me, smacked open a fresh pack of Marlboro reds, took a heavy drag, and then laughed a good laugh.

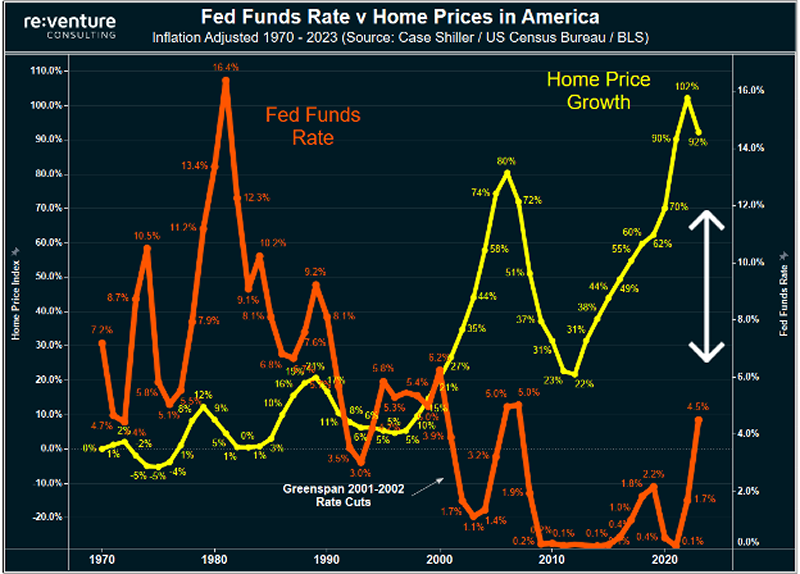

Back to the Fed, and how they play into bubbles. We old timers get ornery when they start to form because we are just too smart for our own good and don’t want to speculate. The younger crowd is different. They only know a Fed that will backstop risk when the wheels come off and it’s a bid wanted scenario. Full disclosure: I know people that did these things…by name! Jordy Belfort himself cold called me in 1996. Man, I’m old!

As has been the case for decades now, the Fed is not interested in managing bubbles as they build. Their value is in juicing the system with free money and picking up the pieces after the they burst. That is a very true statement. Lesson being, do not fade this man! He will make you lots of money if you let him.

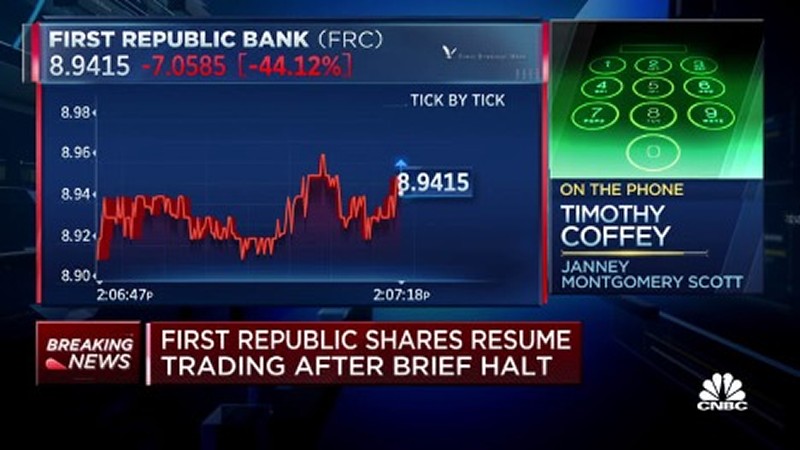

As I’ve said a couple of times, both here and as my alter ego the Gonzo Capitalist, more regional banks are going to fail. Next in line looks to be First Republic. They, and right there next to Silicon Valley Bank in terms of client profile. If their balance sheet holds up, good on em’. If it doesn’t, and First Republic owns too much in the way of marked down treasuries, then the writing is on the wall.

Ironically, this is a good thing as the markets need a little bit in the way of security that the tightening going on in lending right now is going to do the trick of slowing the economy and reigning in inflation. Cut back on the hooch going into the punchbowl, and the partygoers start heading for the exits.

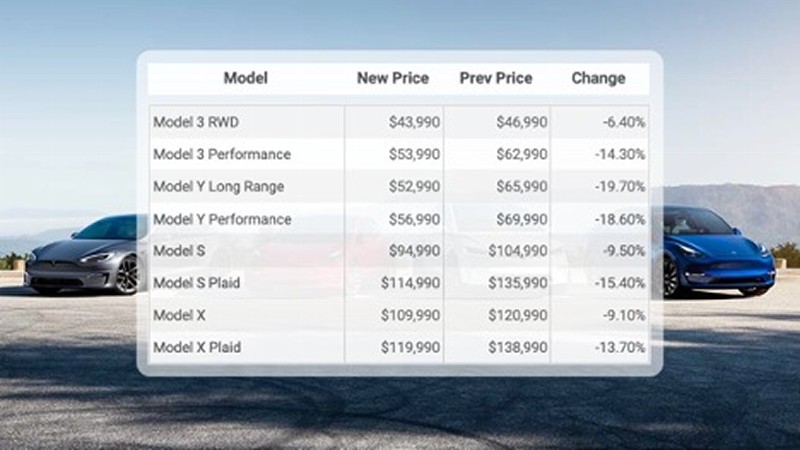

Big news in the auto industry this week as the uber hip, uber cool, and uber everywhere in the parking lot of the Alpine Inn, Tesla cut prices for its cars across the board. The stories as to what span the Gaussian bell curve. Is it because there is trouble moving product, or is this an attempt to crush everyone around into the technological lord and savior Elon Musk? The latter, go with the latter.

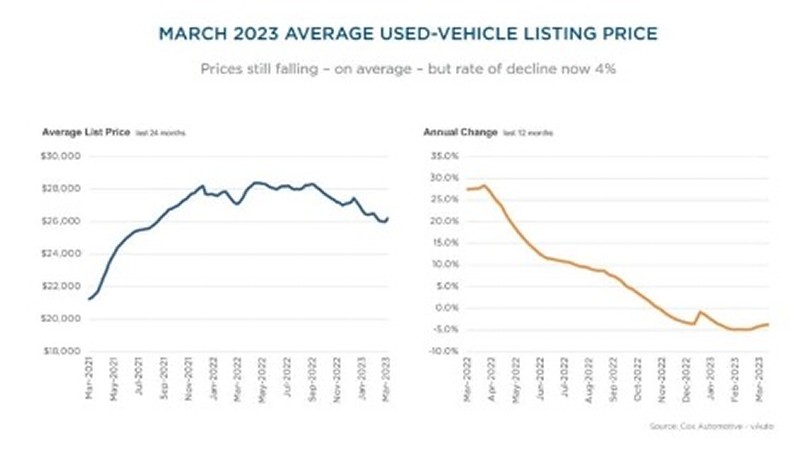

In related news, used car prices continue to move sideways to down. This is a big deal as vehicles touch the lives of everyone, and a tight market for product with prices that only go up is a huge pinch on a consumer who is already beaten down by inflation.

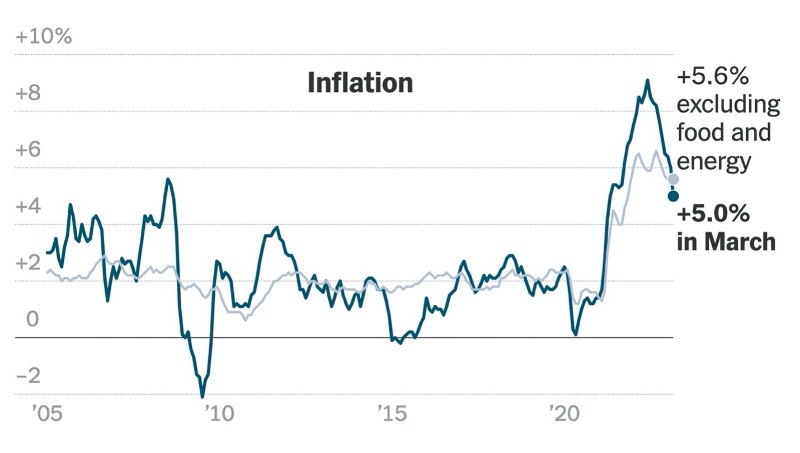

Next week we get a good look at what’s in the Fed’s head when the FOMC reports out its decision about the direction of interest rates. Everyone knows what they are looking at, and the ‘at’ is consumer prices. As I’ve been saying for a while now, if the rate isn’t getting worse, it’s getting better. And this takes the heat off the higher for longer call

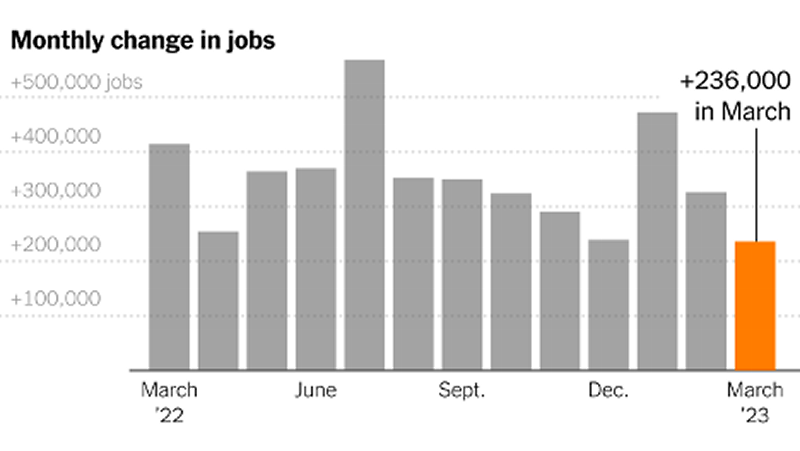

Next Friday, we get a fresh look at employment and what is going on within the labor force. Even as the headlines lead with a sporadic laying off of 4,000 here and 10,000 there, it isn’t showing up in the big numbers. My observation at the start of the year is that this should start to change. Hasn’t happened yet, but when it does, the game will begin to be changed.

Next week we enter the fifth month of the year, and it seems like it is flying by. I’ve been busy hustling back and forth from Montana to California in what can only be described as one of the toughest winters in a while. The struggle is real, like really real.

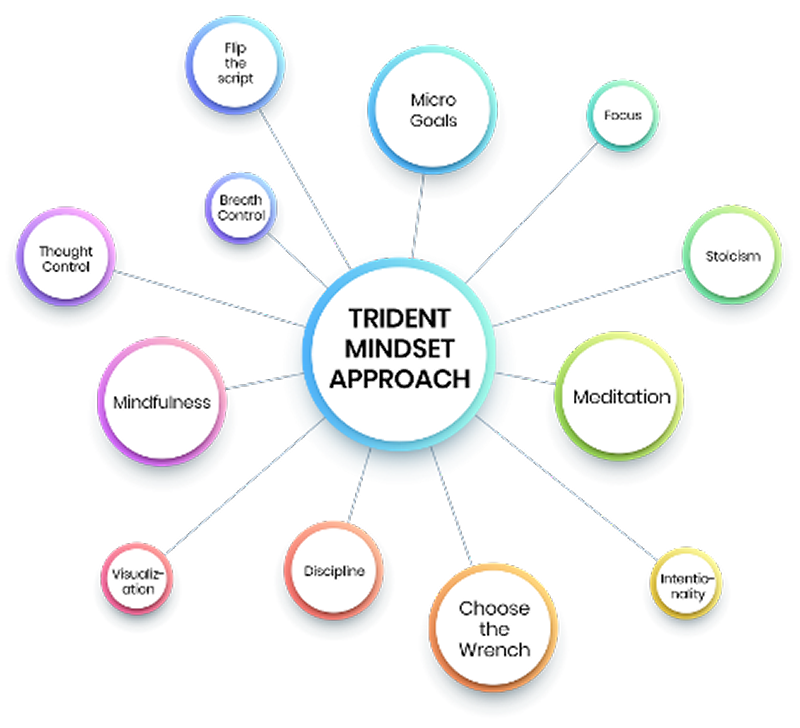

Like many of you, I’m a little spent at this point. Too much rain, snow, bank failures, rising rates, a pending recession, and the list goes on. One of the things I’ve been doing is engaging something called the Trident Mindset. It’s a mental health/self-help/awareness program put together by former SEALs.

While this is by no means a produce plug, if it can help me and my beautiful spectrum rich bi-polar mind, it can probably help a lot of people. Case in point, last Sunday I was having a particularly challenging time shaking off decisions in life both made, and not made. Driving back, I was brought down by a case of the Sunday blues. Instead of crawling in a hole, I reminded myself the lesson of ‘micro goals’. At that moment, I needed to stop the unanswered OCD thought loop.

So, I reminded myself that it wasn’t Sunday. It was just a day, like any other day. And tomorrow will be another day. That little reminder calmed down my manic mind, and I slipped into a restful night. Point being, slow down. Just slow it all down. We are all headed to the same place eventually, enjoy where you are today. Peace be with you, always.