This Week in the Markets

with Bryan Goligoski - Axxcess Editor at Large

If you are feeling like this is strange time for markets, you aren’t alone. A small number of bank failures has everyone on edge, as does the pending arrival of an economic recession, at least if you are listening to the drumbeat of the regular gaggle of talking heads on CNBC.

Keep in mind, this gaggle does serve a purpose, and they all probably make way more than I do. At the same time, it’s a parlor game to some extent. And that’s what the market is going through right now. This talk of pending economic trouble, busted banks, and reversal of fiscal policy is indeed “intensely amusing and perfectly harmless.” This too shall pass, but pass through it must.

Perfectly harmless, how can that be? Here is why. Under no uncertain terms, Washington is not going to let the banking system fail. While some regional banks have messed up their balance sheets by being too long various forms of Treasuries, they aren’t long too many mortgages that are on the brink of going south.

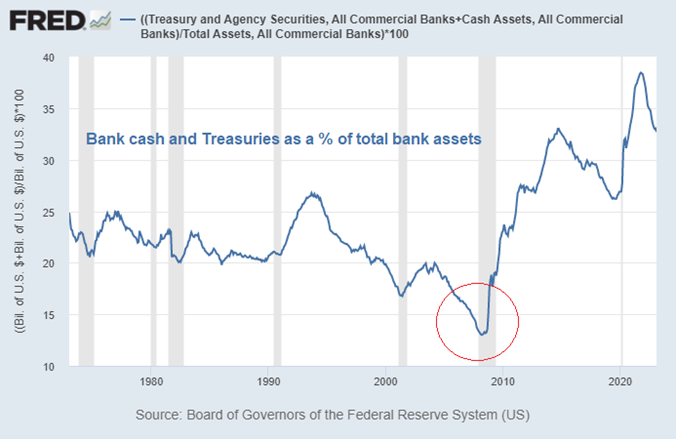

In 2009 banks held an incredibly low amount of inventory in the most secure debt there is, treasuries backed by the full faith of the United States government. What took its place? Subprime loans and junk corporates, baby, and lots of them! If one bank was reaching for yield, the other guys felt like they had to do it as well.

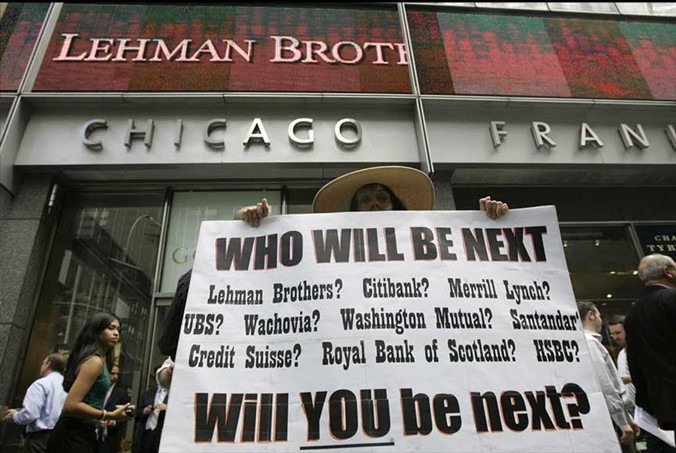

How did that all work out?

And truth be told, the banks on this list above were a lot closer to going under than many people knew at the time. Like within a matter of days closer. So that is why I would caution everyone to recognize that all bank crises are not the same. This one is pretty run of the mill and maybe gets to a 4 out of 10, at worst. Simply my thoughts, but they are reasonable given the circumstances. The market seems to be agreeing. While the regional bank index is off 25% on the year, the money center banks like Citi, Goldman, and JP Morgan have barely budged.

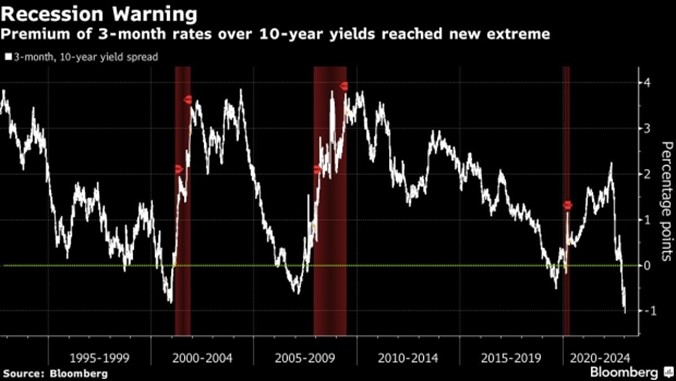

Back to the boogie man no longer under the bed: recession. It’s so obvious, and so telegraphed that we are headed there soon, it’s not even like seeing the pitch. It’s standing on home plate looking at the ball on the tee. It’s right freaking there. A bunch of things say that, and this is the one most often pointed at today. This severely inverted yield curve shows how important it is to have cash held in the short term, ready and liquid.

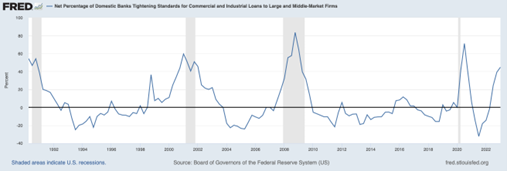

As I say all these things about how well the markets are holding up, and that there are no surprises, I want to interject one concern that is not as widely held as it should be. A tightening in consumer and commercial lending that chokes off growth at a time the economy is going to need it.

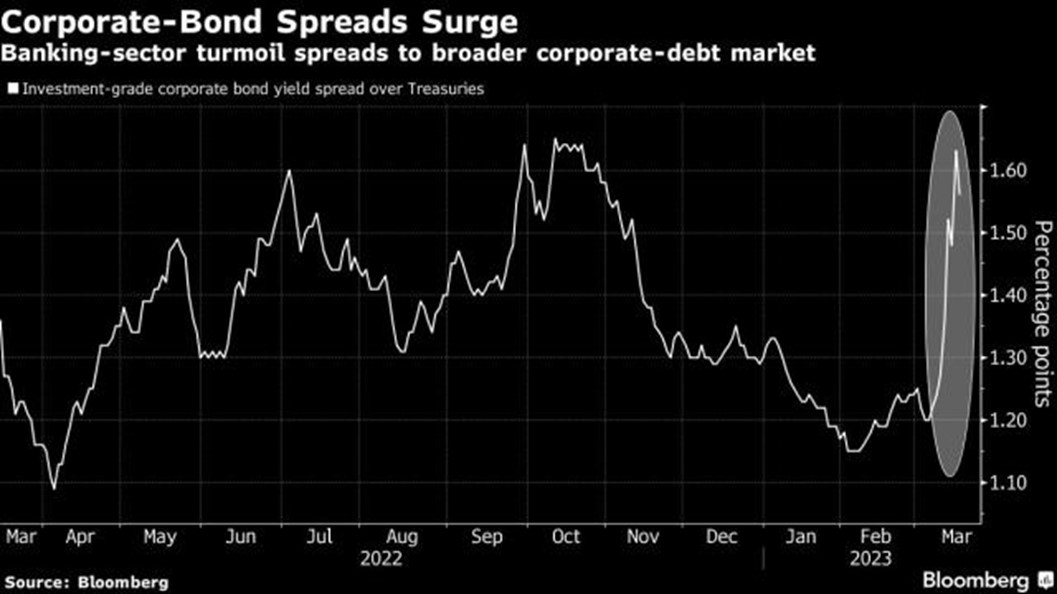

Let me throw a couple scarier charts your way. Charts that everyone knows about at this point, therefore the surprise factor is low. First off, we’ve had a quick spike in investment graded corporate debt. But that’s what happens when a top twenty bank collapses in 72 hours.

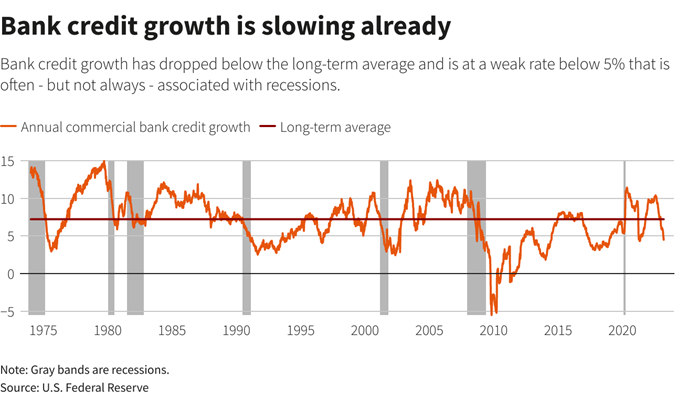

Next up, the rate at which credit is growing. Sure, it’s not where it was at 10%, but 5% is no slouch either. That’s simply the lower end of the band we’ve seen over the past 50 years. When this recession comes, and it will, look for lending growth to slow to the 2% to 3% level. But a true credit crisis like we saw in 2009, this is not.

I would be less than honest if I didn’t tell you that the pulling back of the purse strings is real. Our little dip and salsa company needs slugs of $15k to $25k to keep producing product for the shelves, and we are being thwarted at every turn except for friends and family. That said, the business is still small, and we simply don’t qualify for certain pools of capital. But then again, the ask is small. If you take away one ‘chart of the week’ let it be this one. Money is getting tighter.

Disclosures

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.