This Month in the Markets - June

What is it about the pace of how fast the world is spinning that makes us feel like we are aging in years counted by canines? I don’t have the answer. But what I do have is the mid-year whip around the economy and sectors of the market. Read on to make a little more sense of what is happening on our space rock floating in nothingness in a universe that is ever expanding.

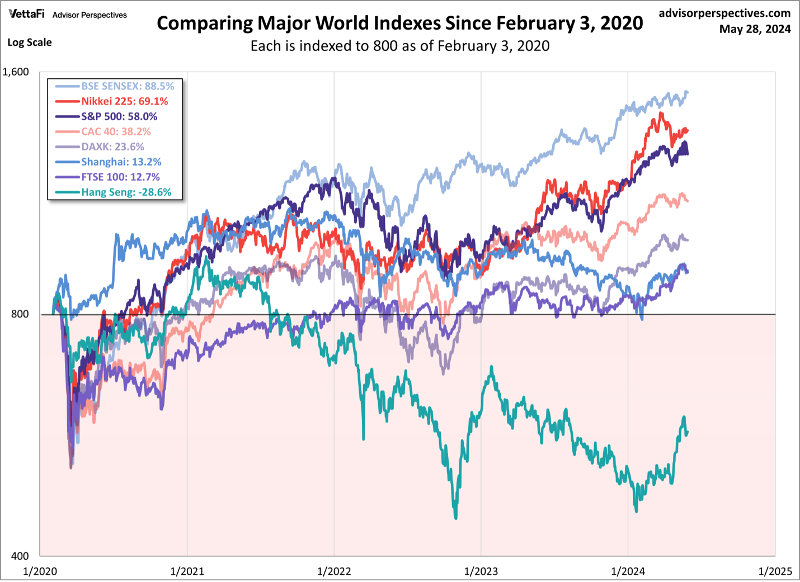

I’ve seen a lot in 25 years of watching and speculating, and this is indeed a special set of circumstances. Four years ago the world went into an almost full stop out of fear of a pandemic that was bearing down on it. Today, the return for global equity averages says we emerged just fine. Our S&P 500 is up just shy of 60% since the onset.

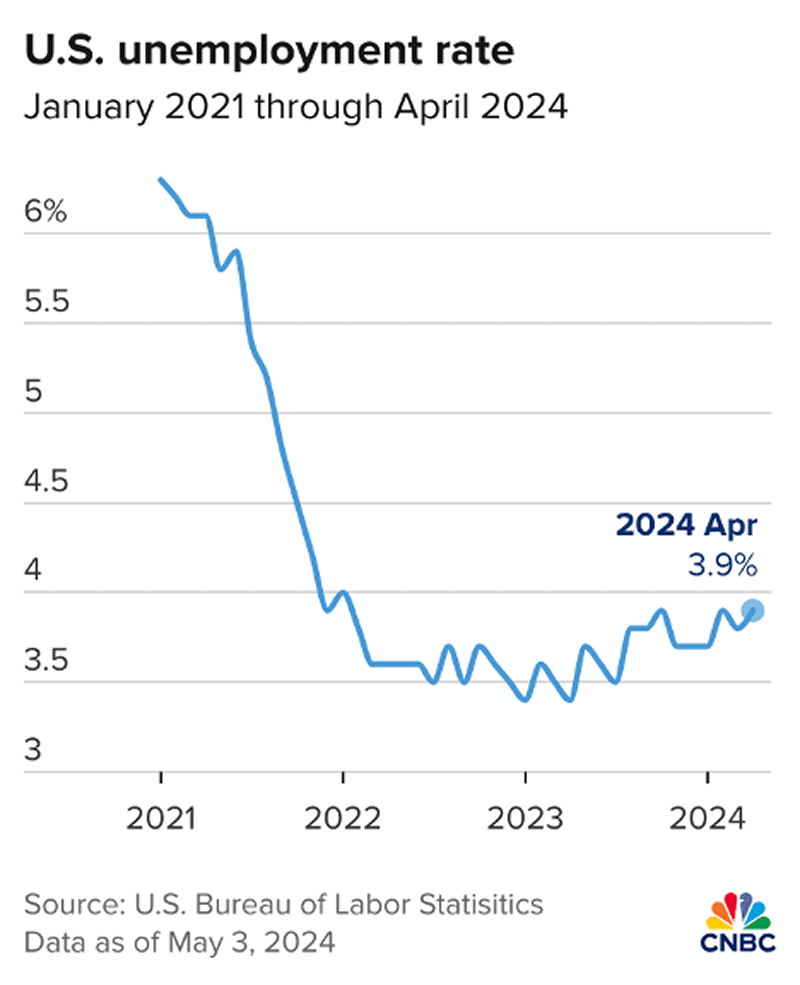

Unemployment in the United States is pretty much at rock bottom rates, and has been for going on two years now.

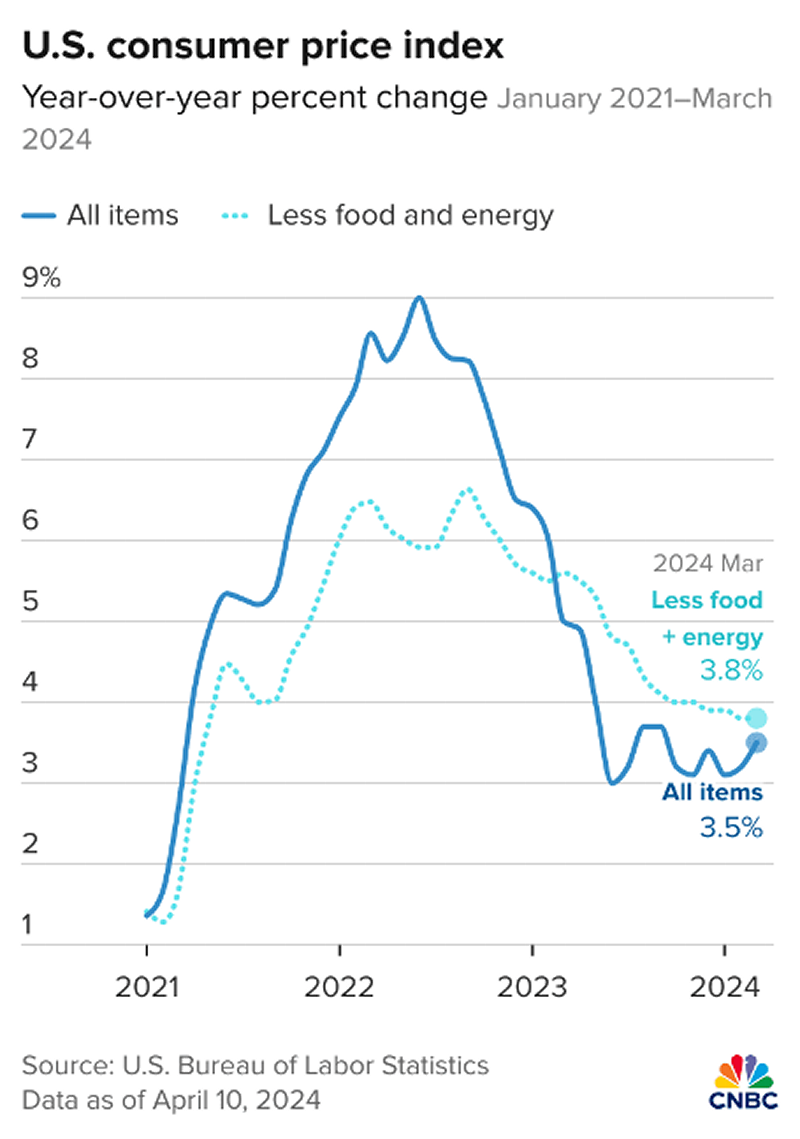

And thank God they did as inflation skyrocketed. And while moderate it did, a 3.5% rate is still a long way from the Federal Reserve’s long term targeted goal of 2%.

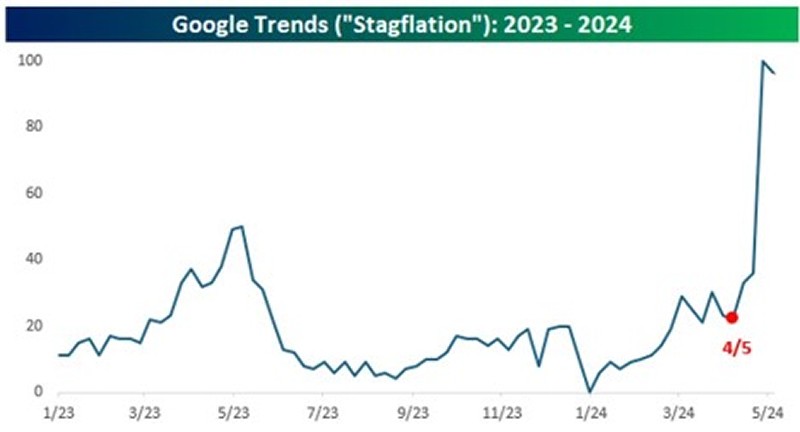

If inflation with a three handle is the new’ish norm, and unemployment begins to rise, get ready for an avalanche of hyperbole about the return of stagflation. Google it….

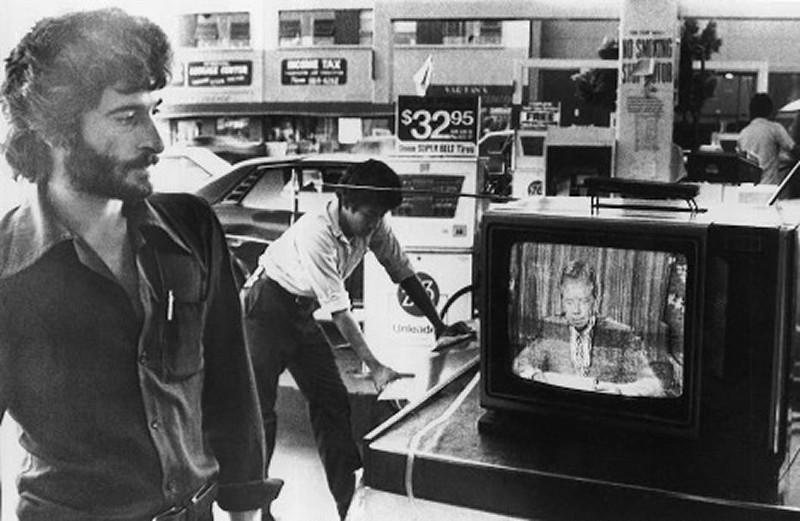

I can only hope and pray that my guy Sleepy Joe doesn’t get on the horn and make mention of a ‘National Malaise’. That one left a mark on President Carter that he didn’t come back from. That said, he was a ‘Country First’ kind of guy, as was his replacement. That’s a refreshing thought given the hand we are playing today.

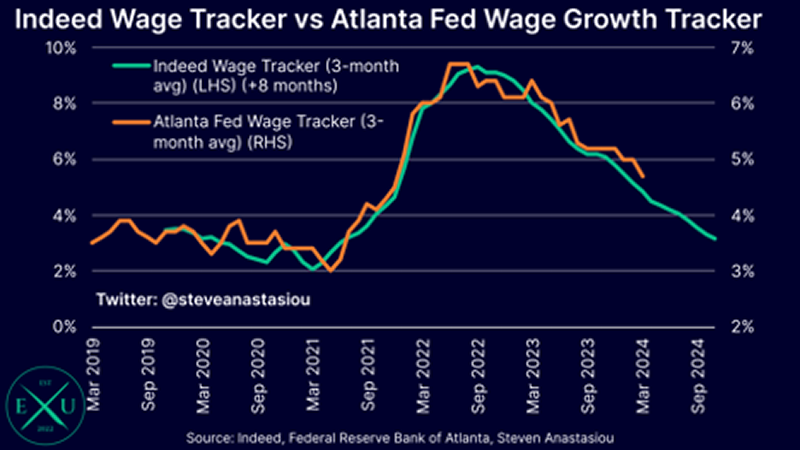

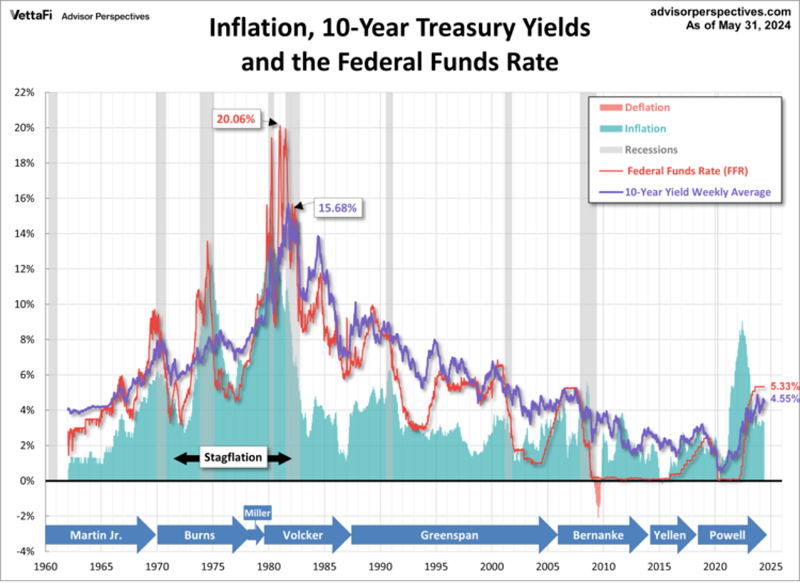

And while this next one is a super busy chart, it tells an extremely interesting longer-term tale. Maybe after 45 years the trend has finally changed and going forward, debt needs to be refinanced at consistently higher rates.

thinking you're gonna be fine until it's not fine?’

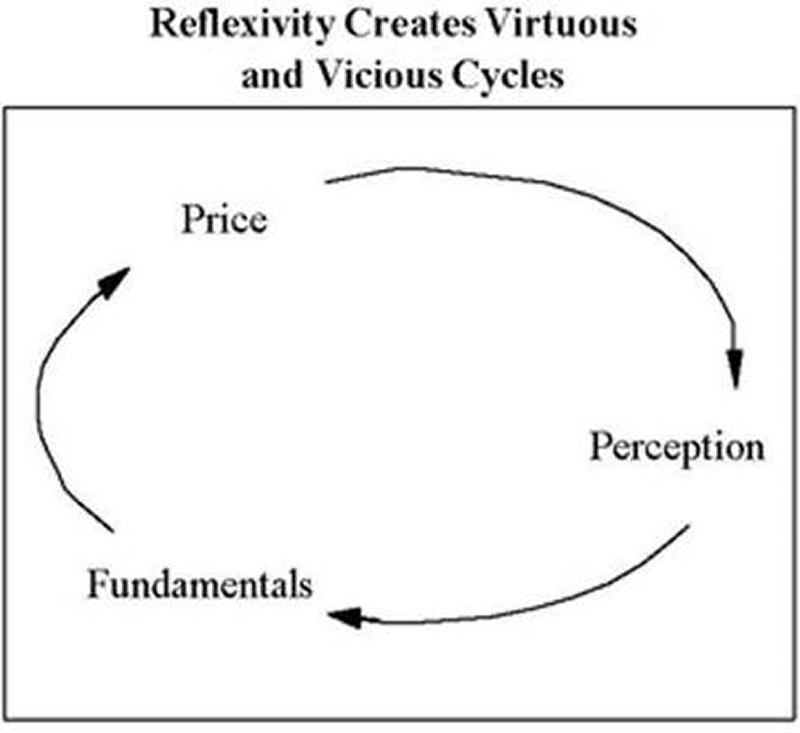

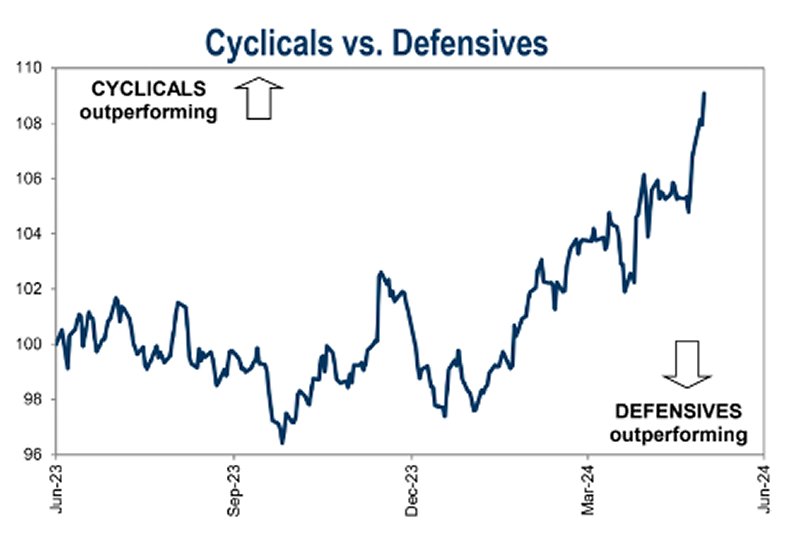

Now let’s drop it down to the (Wall) Street level. A place where reflexivity is abundant, and myth has become reality.

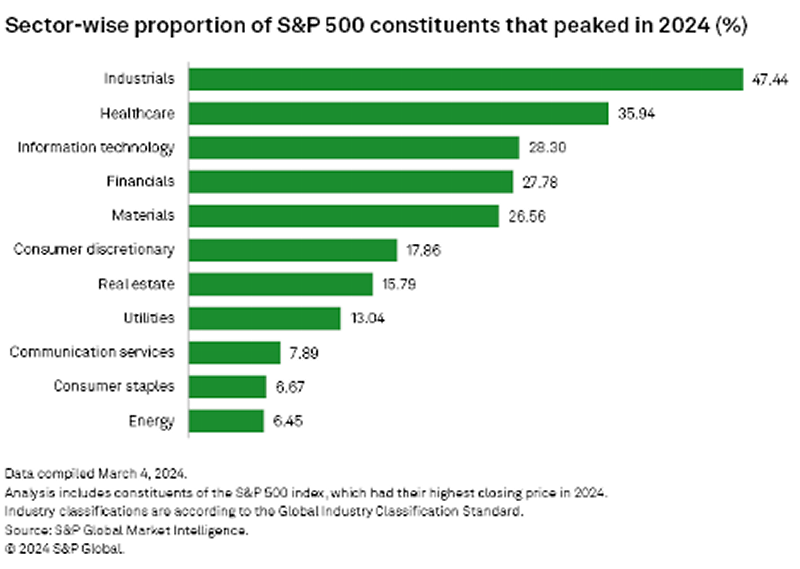

Let’s start with what we already know. Indexes are a conglomeration of stocks. These conglomerations of stocks vary in price and value. There are times, many times in fact, where certain stocks and sectors become overweighted, and they become ‘top heavy’. And that’s where we are with our new leadership group.

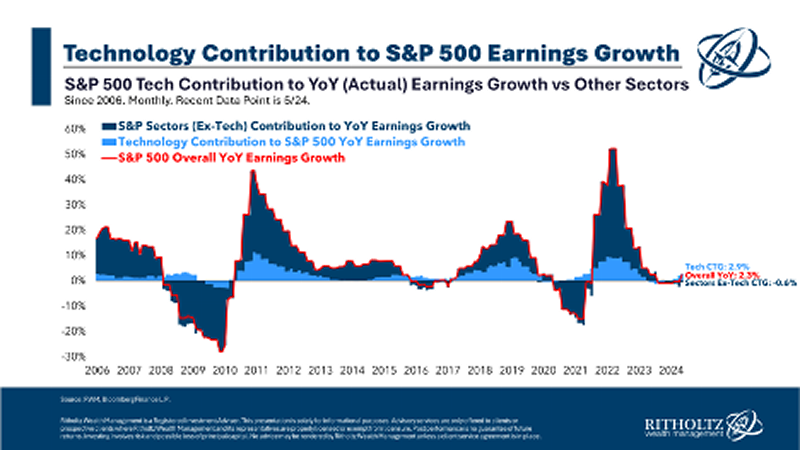

And why not have technology lead the indexes? It has something to do with ‘dancing with the hand that brought you’. Earnings growth that is twice that of the overall index is a hand you want to dance with.

Viewed similarly from the venerable House of Ritholtz…

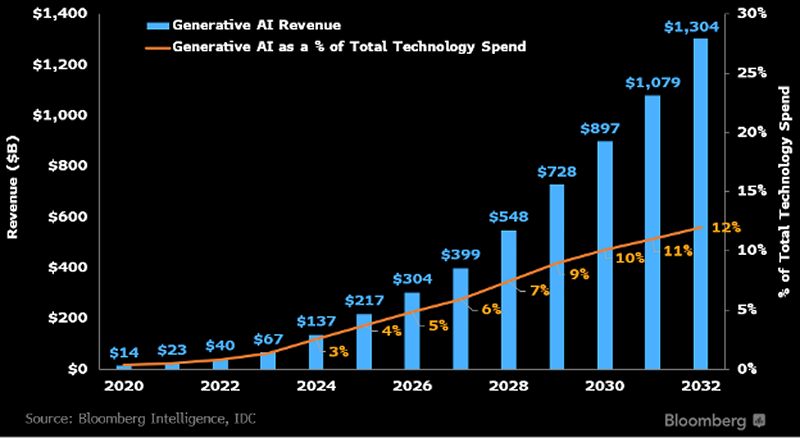

If you are a dedicated observer of markets, or even a casual one, you know the reason why there is so much hope and promise. If we are indeed in the early innings in the pending parabolic growth of AI spending, hell yes, I want in on it. Life is short, and most everyone I know would like to be at this kind of party for the next decade.

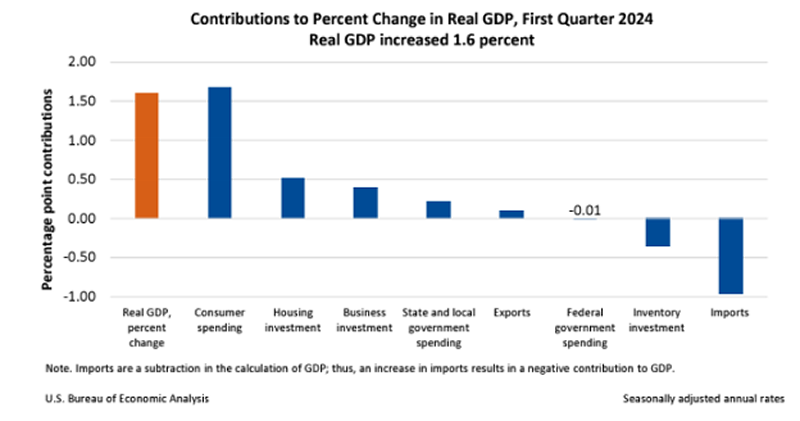

Having made the point that there is good reason why tech is the queen of this hive, let’s look at the rest of the worker bees. First up is the biggest of them all, the seemingly unflinching American consumer. The driver of 70% of GDP, the thing that saved Q1 GDP. If there is no 1.6% contribution from Joe and Josie Six Pack, there is no growth. If there is no growth, there is a recession. Them just be the economic facts.

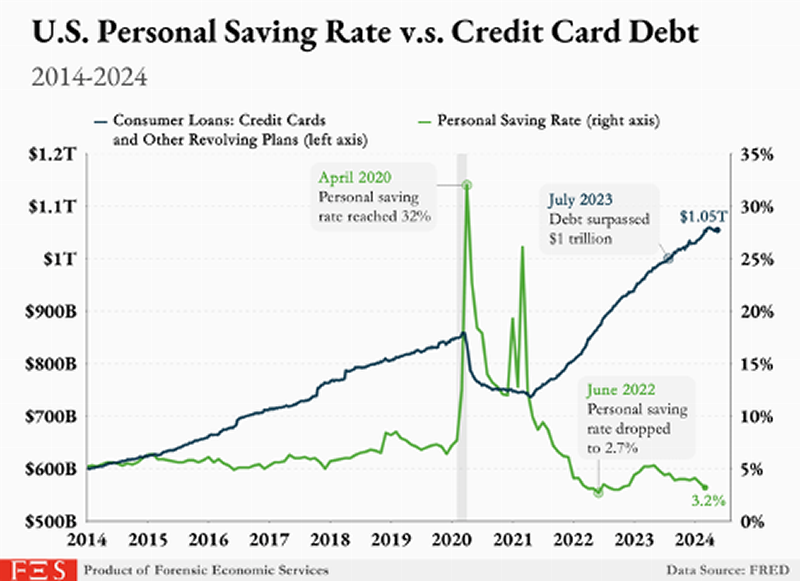

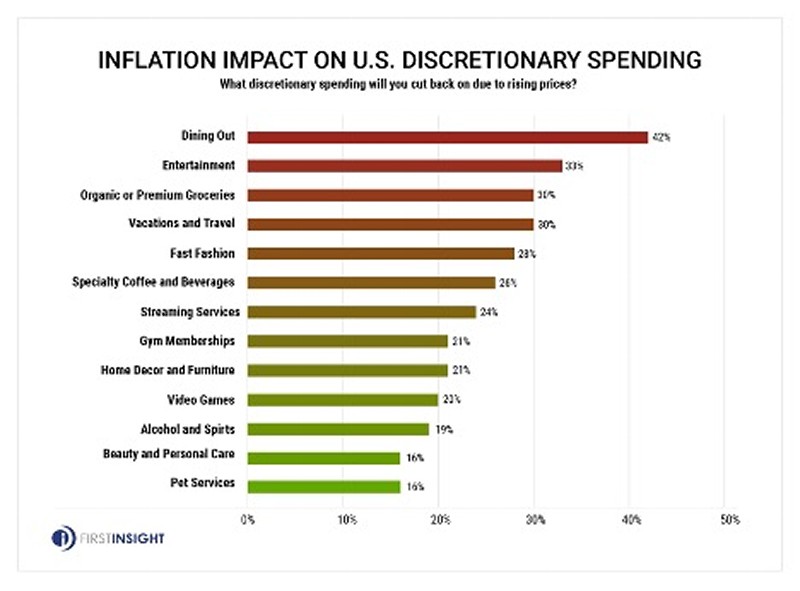

Big paycheck, small paycheck, pretty much everyone is looking to back off the dining out, going to the movies, trips to Whole Foods, and even vacations at home and abroad. Even that $3.95 medium oat milk latte is at risk.

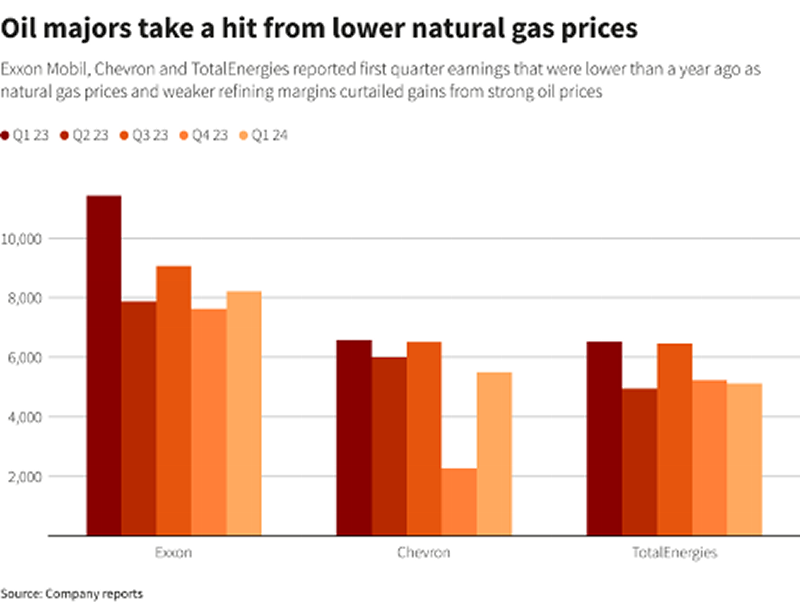

But are things as rosy as the price at the pump make it look for ‘super major’ oil producers? Negative. Earnings have been flat for the past few quarters. For as much hyperbole there is out there about price gouging, and massive profits, there are still margins in the business that need to be managed. Keep in mind, refineries have margins. When refining margins get hit because of upside down input prices, profits are tougher to find.

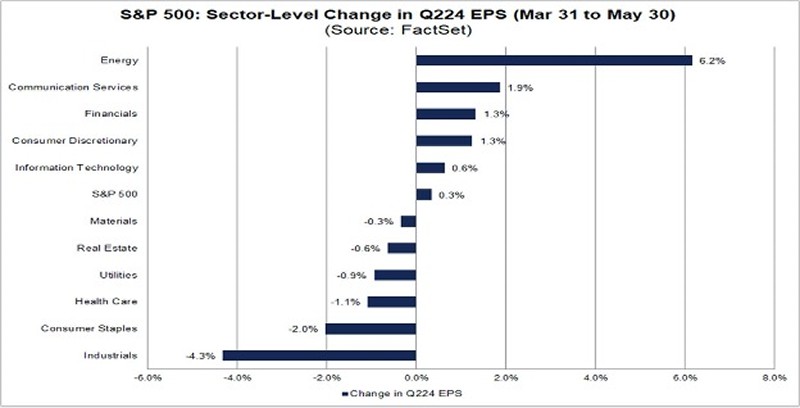

While even though margins are getting the squeeze, earnings for Big Oil are still seeing revisions to the upside.

The contents of this commentary: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, and (ii) may not be relied upon in making an investment decision related to any investment offering by Axxcess Wealth Management, LLC (“AWM”), an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure.

Market data, articles and other content in this commentary are based on generally available information and are believed to be reliable. AWM does not warrant the accuracy or completeness of the information contained herein. Opinions are the author’s current opinions and are subject to change without notice. The views expressed in this commentary are subject to change based on market and other conditions. This commentary may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information contained above is for illustrative purposes only.