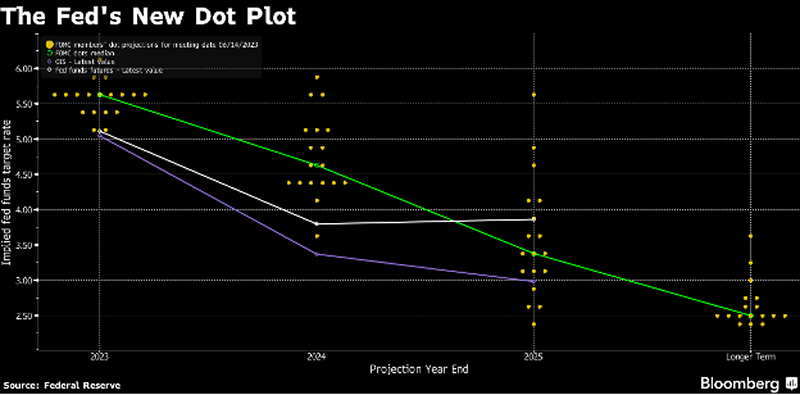

So, this is what we are working with. Inflation is a now a big problem. The Federal Reserve sees it and has gone into a full throttle hike cycle. By most estimates, earnings are going to be flat at best this year. There has already been at least one run on the banks. And credit lending standards have tightened materially. All this and the markets are still somehow having a stellar year? I’m shooting you straight here, they are. Now bust out the fireworks and let’s celebrate a birthday.

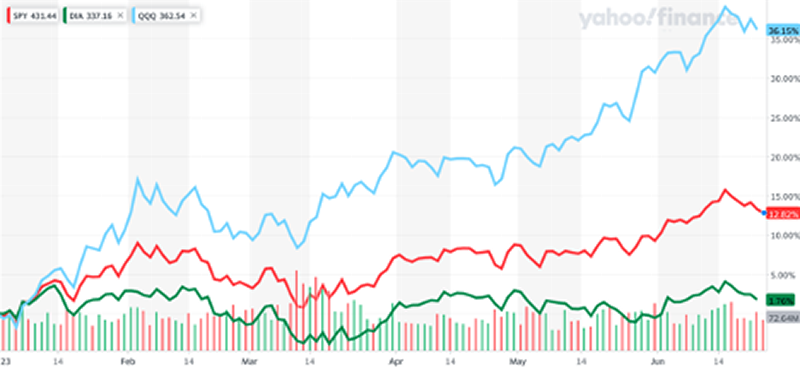

One of the highlights of writing financial commentary is to be able to see when the difference between what consensus was going in, gets very wide compared to what is happening. And that’s what we have been gifted in the first half of the year 2023. The NASDAQ is on fire. The S&P 500 hotter than West Texas in August. And only the DJIA seems to be missing out.

Where does that leave the bulls? Well, even more bullish. And for good reason. Word on the street is the dude with the faux horns on his head is a short seller.

If we have made it this far, with this much in the way of theoretical and real headwinds, imagine what’s going to happen when inflation finally moderates, and the markets can begin to absorb rates at a more ‘normalized’ level.

To put some Ying into that Yang, there are some reasonably qualified minds out there who are thinking we’ve seen the best for this year, and the third and fourth quarters are going to be much tougher. High on that list is Morgan Stanley’s Mike Wilson, who earlier this week left those with fear in their bones a little hope for the future with this missive….

“The headwinds significantly outweigh the tailwinds and we believe risks for a major correction have rarely been higher”.

Now, as big as that call might seem, his crystal ball only has the downside at 10% from here. Which, given the gains we’ve seen, is not a whole lot. A big reason for his bearishness is the Morgan Stanley house call that S&P 500 earnings for the year are going to come in closer to $185, versus the consensus of $210 to $220.

Digression back to the real world, as part of another venture I’m involved with, I follow the consumer packaged goods products world closely. About two years ago I came across my first can of a Liquid Death at the market. At first blush I thought this was an even more absurd version of Monster or Red Bull. Turns out I was wrong. It’s a water company. A straight up water company that was bestowed the name out of complete irreverence and farcical fun. On Monday, CEO Mike Cesario made an appearance on CNBC and it’s well worth watching to learn how he went from $2,000,000 to $20,000, 000 in revs from 2019 to 2020, off a novelty concept.

In news that is only loosely related to irreverently named drinking water, the push to get psylocibin FDA approval for treatment of multiple mental health issues is getting some bigger names, and bigger money, behind it. This week Tom’s Shoes founder Blake Mycoskie pledged $100 million to its research. A week earlier hedge fund legend Steven Cohen committed $5 million from his family foundation. As an advocate for the advancement of the cause I would counsel putting the subject high on your list to understand and get involved with on the investment side when the timing is right. These are early innings, very early innings. Last week the largest gathering of those interested in psychedelics took place in Denver where 11,000 people gathered at the Psychedelic Sciences 2023 conference.

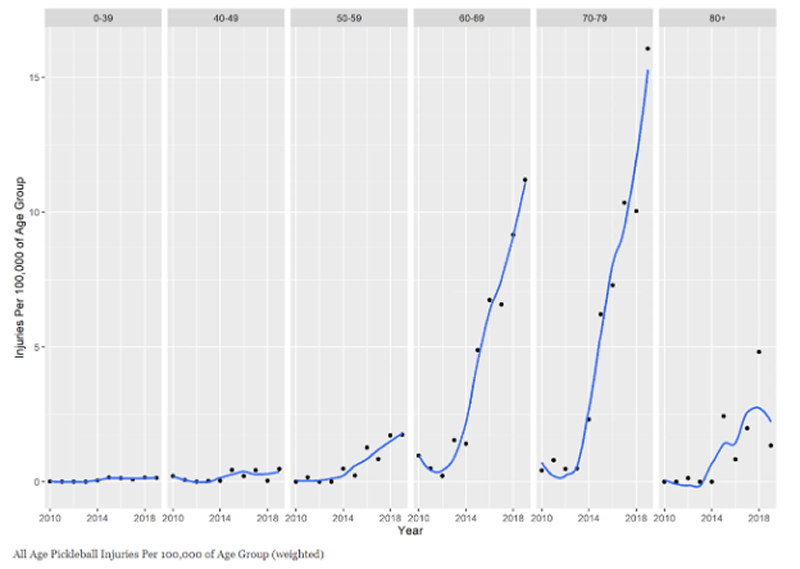

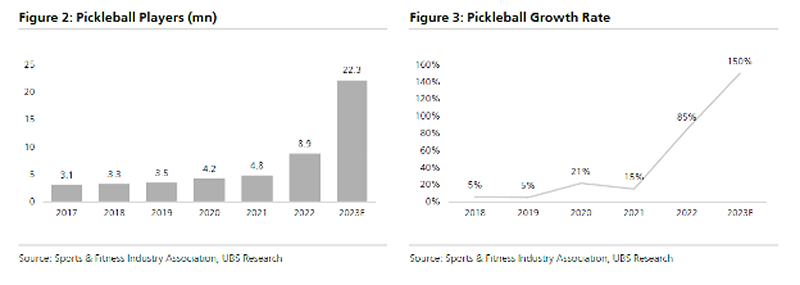

In a note published last week UBS Group analyst Andrew Mok attributed the current higher than normal healthcare insurance utilization rates to a rise in pickleball related injuries, especially in the 60 to 80 year old demographic. The good news, players of the sport tend to ‘skew higher’ in terms of disposable income and wealth. Which should come as a surprise to exactly nobody.

Couple of things to add. I’ve played the sport a few times and am shockingly good at it, which of course puts the athleticism of said game in question. The history of the game itself goes back a surpassingly long way to 1965 on Bainbridge Island, Washington. The United States Pickleball Association provides a great recount of its history and growth since Congressman Joel Pritchard invented the sport.

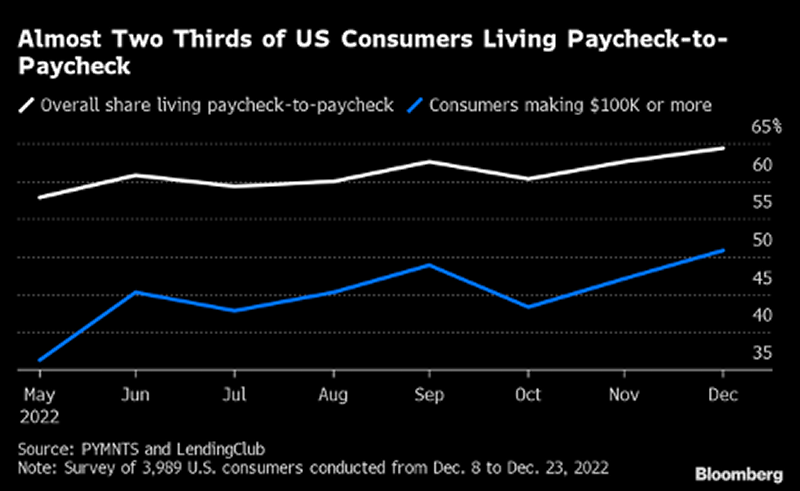

Regarding healthcare spending, mega pharmacy Walgreens this week announced lower earnings guidance on the waning need for Covid vaccines and a consumer that are sitting on their pocketbooks probably out of fear that the well-publicized recession may or may not be on its way. Which should come as little surprise given the paycheck to paycheck nature of the economy.

While the Walgreens consumer might be sitting on their wallet, the Sriracha buyer isn’t. And it’s been a real struggle to find the red rooster for the past year. The cause is two-fold, the maker, Huy Fong Foods got in a dispute with their California provider of red peppers that worked out unfavorably for Huy Fong. The second part, and a critical lesson in business continuity, they wound up single sourcing their peppers in Mexico. Mexican farmers were in turn reliant on water from the western United States. The drought hit, pepper production went away.

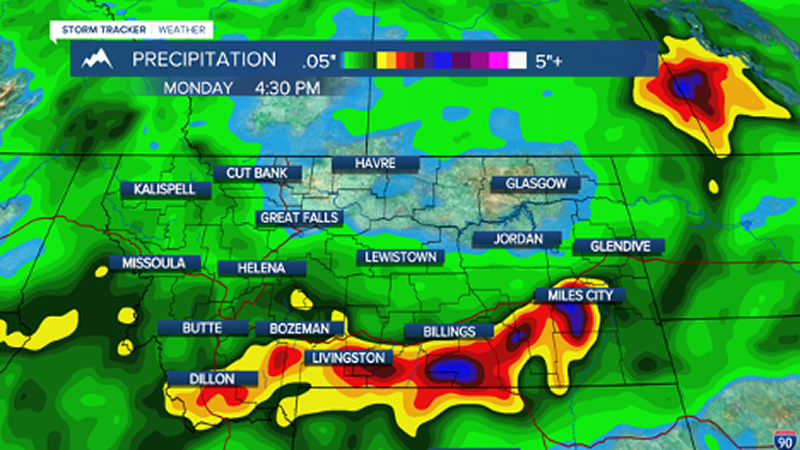

Speaking of weather disruptions, this week the country is feeling the full force of climate ‘evolution’. Thunderstorms have flights cancelled throughout the east coast, with New York taking the biggest hit. Texas is about to go through its first heat wave of the summer. And the Rocky Mountains have yet to emerge from a wet spring. The ground is so saturated in Montana that three inches of projected rain cause a ‘flood watch’. Good times, good times.

In a week we will be celebrating our countries 247th birthday, which is truly not a long time. And as a practitioner of the art of barbecue. As I’ve been asked often, what is the best rib recipe in the arsenal of rib recipes I have. The pinnacle for me, and one that is as easy they come, is Twillard Mayweather’s version of his Memphis ribs that was published in Saveur’s Cooks Authentic American.

I hope you all enjoy a great week, and a fantastic weekend. Whether it be at the lake house, your fancy yacht club, watching fireworks with 10,000 of your best friends, or just hanging with the neighbors. Go out there and be the best version of you. I plan on doing the same from Section G, Row 4, Seat 16 at the Home of Champions Rodeo. Let’s ride!