This Month in the Markets - July

with Bryan Goligoski - Axxcess Editor at Large

Mid-way through the year, and it’s starting to happen. Bears, and even skeptical bulls, are starting to capitulate as the pain of a very resilient equity market has them tapping out.

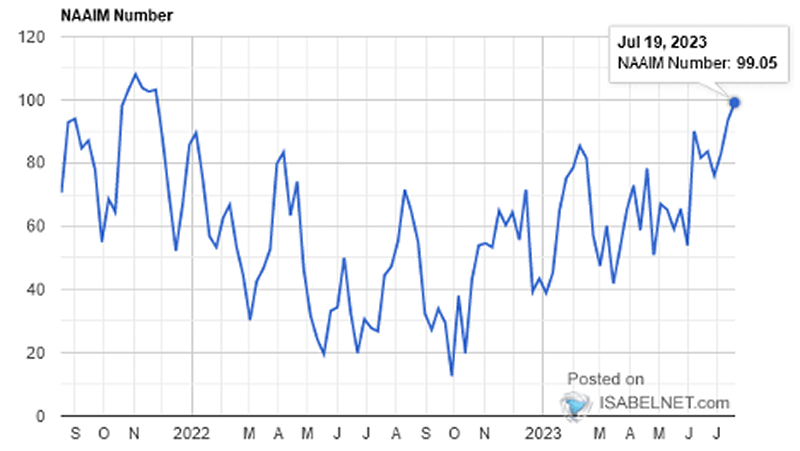

Looking for something technical to confirm, the active portfolio manager index of bullishness is back to November 2021 levels. That was at a time when the Fed was still showing maximum dovishness.

The NAAIM Exposure Index represents the average exposure to US Equity markets reported by members of the National Association of Active Investment Managers.

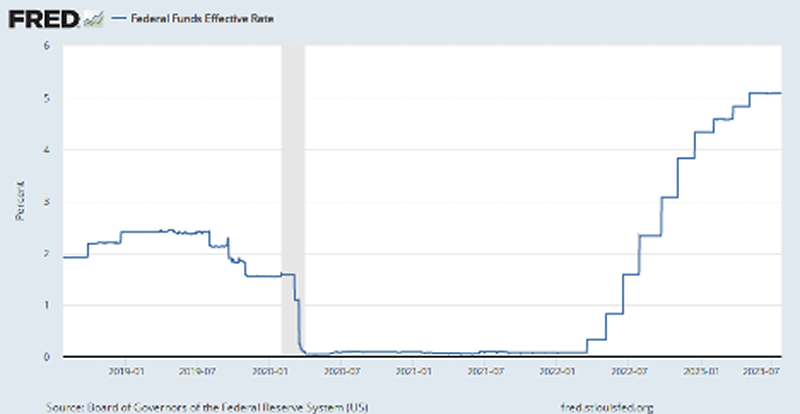

What’s different from then and now? In the fall of 2021 the Fed was in max doveish position and the effective fed funds rate was 0.10%. Today, it’s 5.00%. That’s a remarkable turn of events given the fact that a far far far more restrictive monetary policy is now having little effect on the desire of professional investors to want to get in. And the Fed just jacked up rates, again!!!

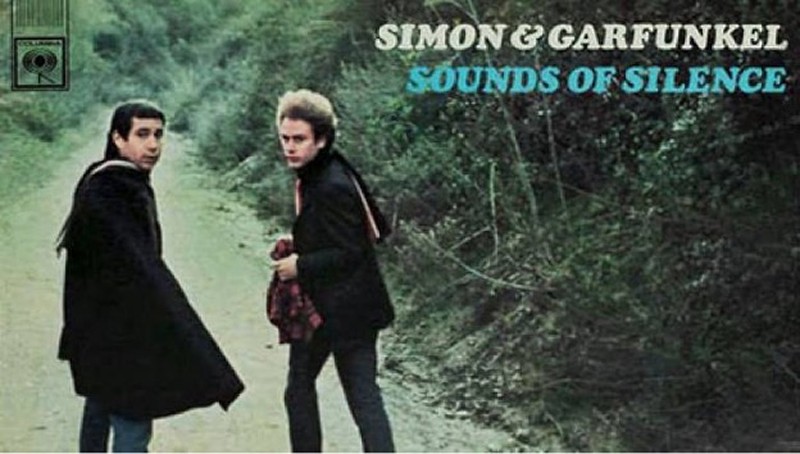

Economic darkness, you are moving down the bench. There is a new market theme in town, and it isn’t to be messed with. Pass me that (largely) legal now “J” and sing along, ‘Hello soft landing my old friend, I’ve come to talk to you again…” The sad truth is, from a professional money managers perspective, you either keep up, or you don’t. The latter can keep his job and that fancy country club membership, the latter winds up washing windows. No disrespect to those who chose melted sand maintenance as their vocation.

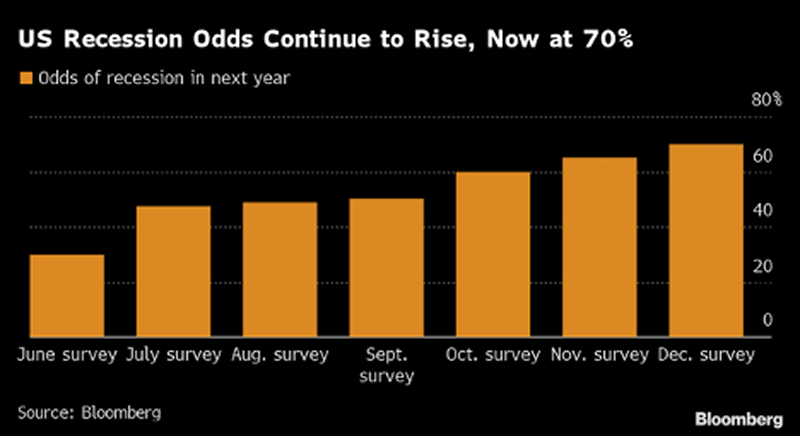

A big reason for the newly forced bullishness, is that the odds for a much anticipated recession are now slipping away. And there were a lot of economists and market analysts who are anchored to that view. Don’t think they are? Think again. In December of 2022, a not small survey of economists predicted a 70% change of recession this year.

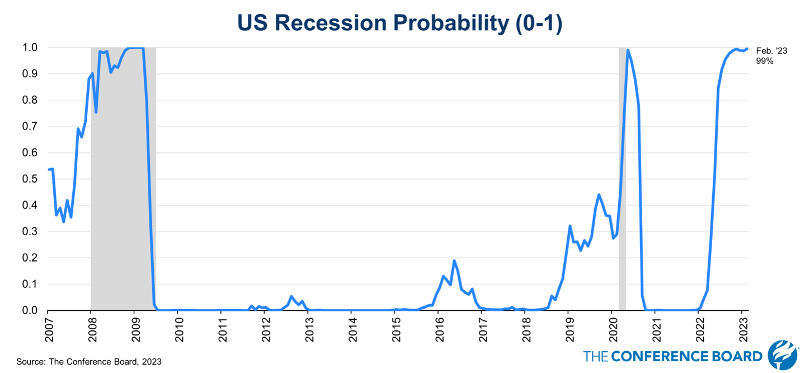

The Conference Board, a reasonably respected body that uses a broad measure of indicators to develop their predications, called it 99% chance of recession just five months ago.

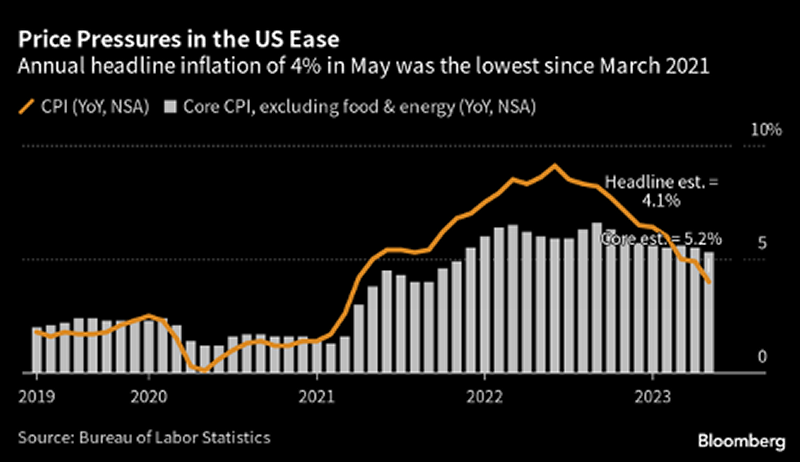

A big reason for the change in heart is this chart of the immaculate tempering of inflation….

But while not an economist I say firmly to all of this…

In British…”rubbish”.

In Midwestern….”horse feathers”.

In New Yorker…”getthefugoutahere”.

And in Californian…”dude, noooo way”.

Inflation, in some form or another, is here to stay for a long time. It will be persistent, annoying, and painful for most of the goods consuming public. The irony in this picture is real. While policy actions may have saved the economy during covid, the long term inflationary impact will be ten times greater. In my not always humble opinion.

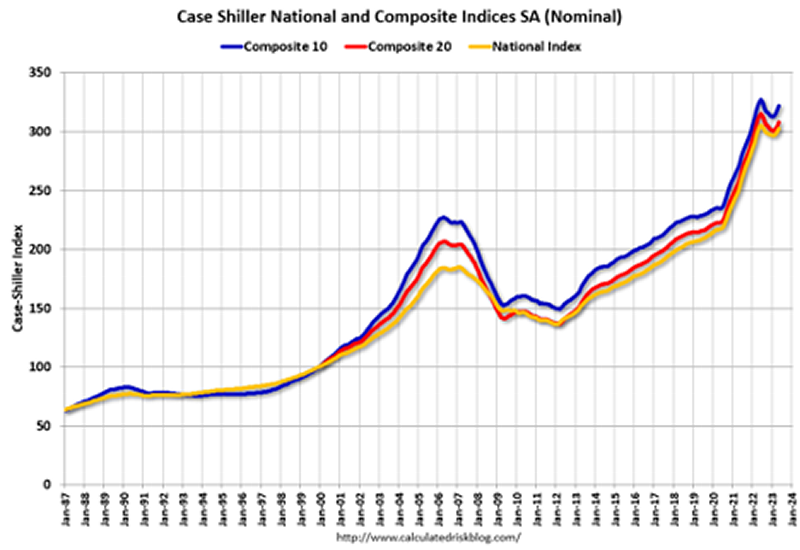

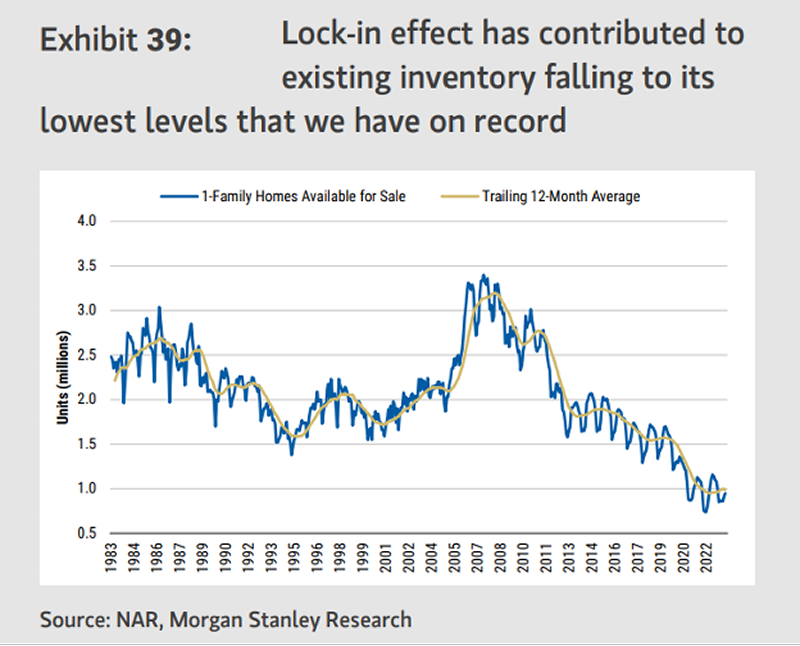

Last reason, at least for now, as to why I think inflation is here to last is home prices. They went up 50% when money started to be given away. Now, there is no inventory, so the prices have remained high. Why? Because nobody can afford to move. People are literally stuck in an asset that has a sever rise in value over the last three years. Are they making 50% more? Negative. Did the economy get that much better? No again? It happened because of free money. Maybe it will take a while to settle in, but ZIRP (Zero Interest Rate Policy) is probably in a deep hibernation, only to come out when the next big crisis hits the economy.

The Case-Shiller Index tracks monthly change in the value of single-family U.S. homes. it is based on the repeat-sales pricing technique developed by Robert Shiller. The national Case-Shiller index is supplemented by composite indexes tracking prices in 10 and 20 key U.S. metro areas, as well as indexes tracking sales based on the home's price relative to the market average. The index is based on successive arms-length sales of the same house recorded in local property records.

It’s partly the ‘lock in’ effect of those who are sitting on an ultra low mortgage, and in a highly appreciated asset. Morgan Stanley’s James Egan described it this way…

“A lot of homeowners were able to either buy their home or refinance their mortgage at record low rates, and so they have these 30-year fixed rate mortgages where they’re just incentivized not to list their home for sale,” Egan says. “If you don’t have those homes listed for sale, then all of a sudden, despite the fact that affordability might theoretically warrant lower home prices, homeowners aren’t willing to sell — or they’re not forced to sell — into those lower home prices that affordability might theoretically warrant.”

Wonder why this subject is so fascinating to me? On top of it being a main driver of the economy, I hold the painful distinction of getting out of the housing market in the fall of 2018 when I finally sold the home I had lived in for the prior decade, living a good life and raising three boys in Santa Barbara. All three times I put it out there for sale at $2.1. During the year and a half I had it listed it was I got a $1.5 low ball written offer, and a $2.1 written offer at the ask. The same houses traded at $4.5 two months ago after 72 hours on the market. Oh well, you win some you lose some, and then you lose a few more. But complain I shouldn’t. It was a great run in 9301. Onward.

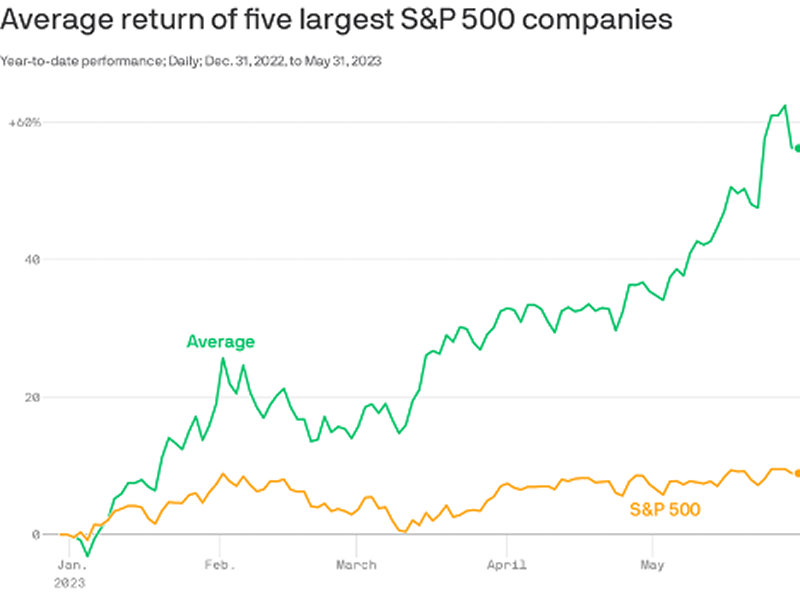

Back to stocks, if you aren’t feeling the love this year in terms of your returns given how strong the indexes have done, there is a reason. A total of five stocks; Amazon, Microsoft, Apple, Google, and Nvidia, and driving this train. They are shown as the green composite versus the return of the S&P 500 in yellow.

Source: Axios

Shorter note than usual this week as I too am out enjoying the 100 degree heat in the mountain states while burning gas and rubber advancing the cause of the side gig. While everyone gets to fly their freak flag, I for sure have been seeing more of the wayward this year than ever before. Get this, Mel Gibson wants to play me in next years guaranteed box office smash, ‘Bryan the Brokensouled, Barbarian of West’, YO to the LO!

Disclosures:

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Axxcess Wealth Management, LLC (“AWM”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure. The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. The information contained above is for illustrative purposes only.