This Week in the Market - March

with Bryan Goligoski - Axxcess Editor at Large

Changes, they are a coming….

After seven years of the same format and same distribution model for This Week in the Markets, I’m changing things up. As a man of the people, and you are my people, a new version of the weekly piece is going to be condensed into a quicker blog style read. Many of you are viewing it that way already, and you are going to like the new version. Think of it as this amount of quality thoughts and information, in a weekly, easy to swallow pill form.

Once a month, we will be going out bigger as I put you onto the metaphorical drift boat of finance and guide you out into the Mid Current of the river of intellectual curiosity. Might even get you into some idea fish of real consequence. There are some serious hogs out there, my goal is to get you onto a few of them.

For the past year I’ve been building the 'Gonzo Capitalist' into something worth tuning in to and it’s finally getting some airtime. Along with this is a branding effort I’m putting in towards well curated content via various social media outlets. You can find Gonzo on these outlets under….

gonzocapitalist

Is any of this going to win an Emmy? Not likely. But is it worth the look? Indeed, it is. The ‘Capitalist’ part of the name is self-evident. The ‘Gonzo’ comes from the legendary writer Hunter Thompson, and his provocative and irreverent writing style. May I be so lucky as to be in his company someday in journalistic heaven, along with the Pulitzer Prize nominated, Bobby Goligoski.

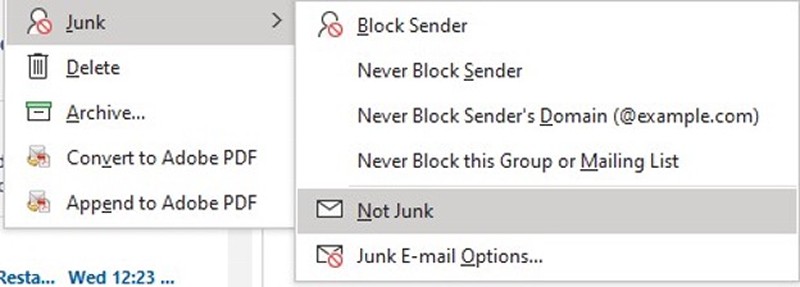

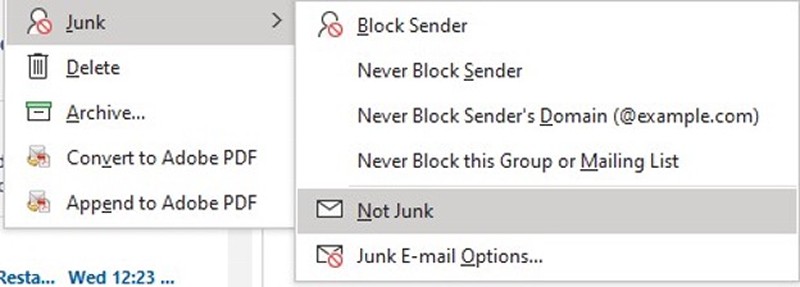

As part of the update, I’m moving the web hosting as well as the marketing distribution management from legacy systems to something new. I will do my best to keep everyone on the distribution who wants to be included. Your e-mail system might pick up the new server as coming from spam, or the e-mails being phished. If you inform it that isn’t the case, we should be good to go. If you drop off completely, and don’t see any additional e-mails in the coming weeks, please let me know at

Back to the business of telling it like it is and suffering the consequences, and if that means making you dive down the rabbit hole of intellectual curiosity, then I’ll take those consequences all day long. And if Alice’s mind can go out for a stroll, let’s let ours do as well.

Scrambling to find an opinion piece that the respected economist and market observer, Mohamad El-Erian wrote for the Wall Street Journal this week, I instead stumbled across some ideas he gave in an interview from November of last year. When I read it, I said out loud with nobody around, ‘That’s it, that’s effing it’…

"What consensus has been expecting, has gone from a soft landing to hard landing, to no landing, back to hard landing, to crash landing, back to hard landing, back to soft landing. That's an incredible sequence and it tells you that we've lost our anchors. We've lost our economic anchors, we've lost our policy anchors, and we've lost our technical anchors…"While I’m just a piker compared to Mohamad, we share the same opinion. Probably more so now three months later. When I look around at markets, at prices, at economics, at our emotional state, at politics, at tribalism, what I see is an untethering. Not all to the same degree, but for sure a release from that which held things together. These were anchors that we knew we could rely on, and they are now sitting on the floor of the ocean. Still there, but no longer attached to anything we thought we knew.

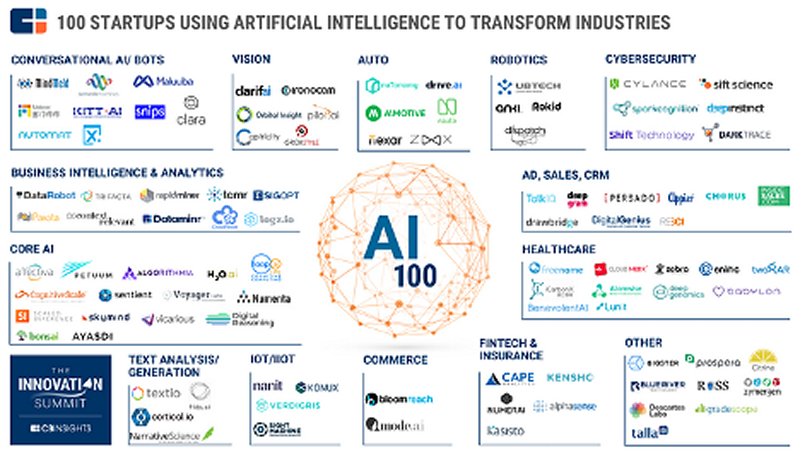

Now, let’s get out of the esoteric soft stuff and get down to making money. While not an active manager of money, which is probably a good thing given my own untethering from anchors, I still know a thing or two. And what I can tell you is this, with a very high degree of certainty we are in some sort of an AI fueled bubble. I can also tell you is that it looks to be early innings. A younger, less mature version of myself would hate both the players…and the game in this situation. A mature and reformed version of me now is a better follower of the rules.

"Don't hate the player, hate the game."

And I’ll take that even one step further, if you want to make real 'FU' money, don’t hate either. Fortunes, absolute fortunes, have been made by speculators speculating. That’s what this feels like again. But at the same time, we all go room temp at some point. Might as well have a little fun while you are 98.6 degrees.

Unbeknownst to me until I caught a few minutes of CNBC last week, we have a new name for the FANGs…’The Magnificent Seven’. Spend a little time listening to the well pedigreed carnival barkers on the financial news outlets and you will hear them speak breathlessly about how they are all on the leading edge of generative AI. While at the same time have little in way of a clue what they are saying.

When you get charts like this making the rounds, and making the rounds they are, people tend to get a little excited. After all, a tenfold expansion of a market in a decade’s time does not come around that often. Assuming of course it comes around at all.

My final bubble indicator, and one that I’m not alone in using, is the price of Bitcoin. Full disclosure, I see both sides of the argument that it’s not real, or also possibly completely real. I favor the former, but people have made millions taking the latter all the way to the crypto bank. The Coin made of Bits is up over 200% in the last year, and over 90% since the big ‘risk on’ rally started last November. This data and chart are from CoinDesk.

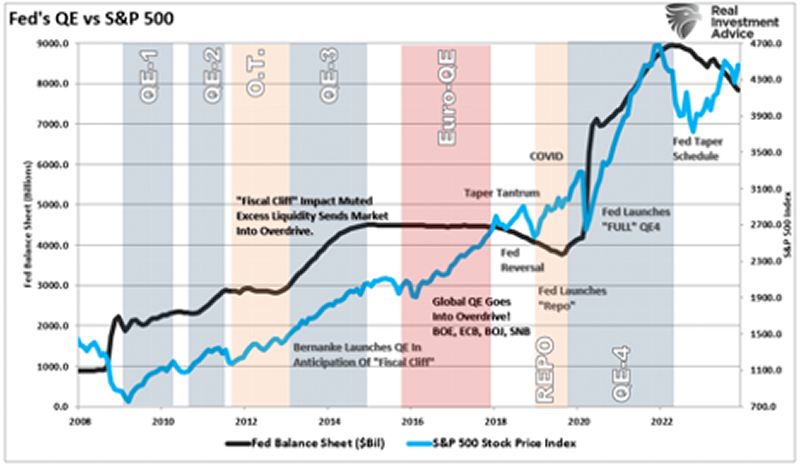

I focus a lot of time writing on inflation and the misguided notion that the Federal Reserve is anywhere close to being ahead of the curve. It’s also important because the correlation of money getting cheaper to borrow and stock prices going up is about 100%. In fact, the money itself doesn’t even need to get cheaper for stocks to go up, it just needs to seem to be about to get cheaper, which is why the huge rally in equities beginning in November of last year.

It does not matter the why, what matters is that free or cheap money makes it a lot easier to load up on assets of all kinds. But don’t worry, that’s not really inflation according to the Federal Reserve. Again, don’t hate Jerome Powell, hate the game that the body he leads has become the backstop for risk on a global basis. A literal insurance policy that you will not lose money owning assets if you can wait things out until the monetary calvary shows up.

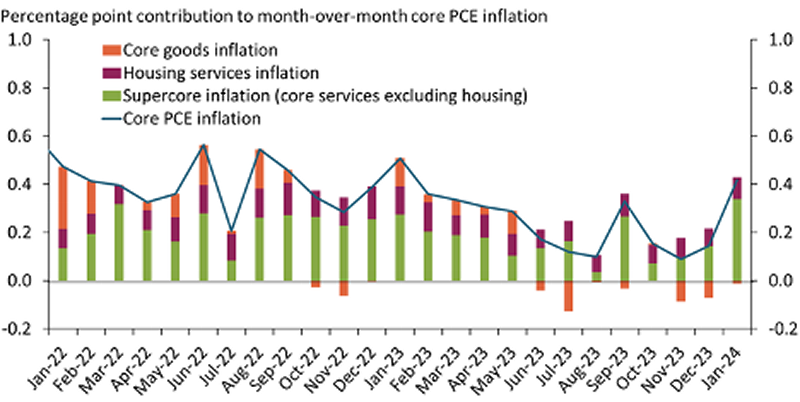

I’m still holding out, on a very lightly inhabited island, that inflation is nowhere near being tamed. Look around at your world, does it seem like that at all. Like I said earlier this year, if it does, give me your address as that’s where I’m moving. One of the Fed’s key metrics, Personal Consumption Expenses (PCE) had a nasty little rise earlier this year. With that, my little island's real estate just got more valuable.

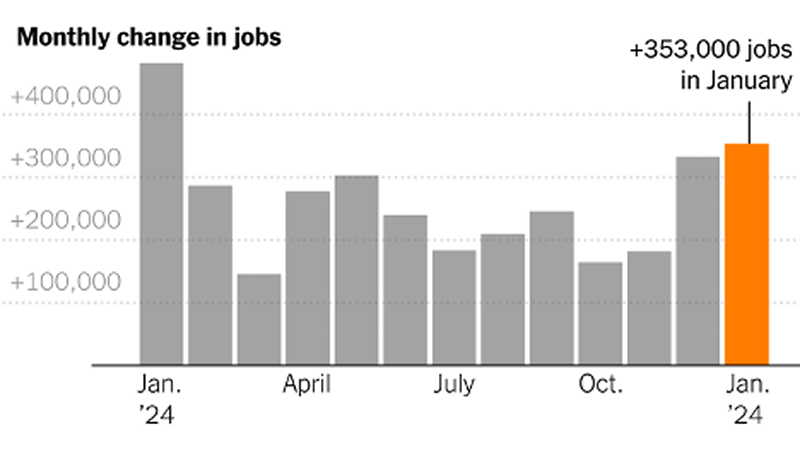

Coming up this week is a further read on employment with the release of the February jobs report on Friday. Employment has been one of the most resilient foundations of the economy for the past two years. Even with higher interest rates, and a tightening of liquidity, the job marker has continued its hedonistic rage. These are not small job growth numbers. Not small numbers for a long long time.

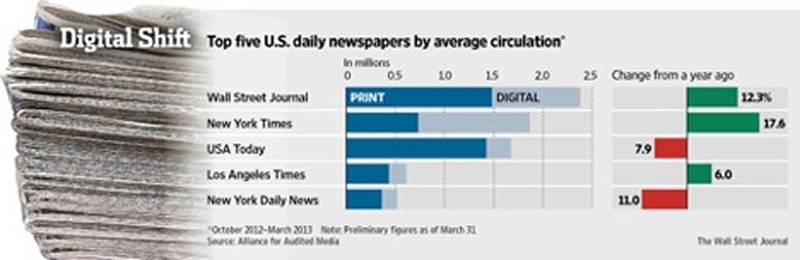

The venerable Wall Street Journal ran three pieces worth passing along recently, though to read the full article requires a subscription. Out of respect for the copyright protections of original work, I will limit my use of the written word to those that are already publicly available. For while the Los Angeles Times might be in a death throe of their own making, the final word on Wall Street soldiers on.

In a piece that ran in early February the Journal started with the headline 'Why Are American’s Down on Such a Strong Economy?' Like what El-Erian said a few months earlier, there is a feeling of being adrift, even while old secure anchors are still theoretically attached. In it they wrote…

'There’s a striking disconnect between the widely shared pessimism among Americans and measures that show the economy is actually robust. Consumers are spending briskly—behavior that suggests optimism, not retrenchment. Inflation has tempered. Unemployment has been below 4% for 24 straight months, the longest such stretch since the 1960s.

The disconnect has puzzled economists, investors and business owners. But press Americans harder, and the immediate economy emerges as only one factor in the gloomy outlook. Americans feel sour about the economy, many say, because their long-term financial security feels fragile and vulnerable to wide-ranging social and political threats.

Reliable steps up the economic ladder, such as a college degree, no longer look like a good investment. War overseas, and an emboldened set of hostile nations, have made the world feel dangerous. Uninspiring leaders at home, running a government widely seen as dysfunctional, have left people without hope that America is up to the challenge of fixing its problems.'

To further prove their point, the WSJ went with these uplifting images of what looks like some sort of flyover zombie wasteland. Exactly one of these six people is smiling. Thank you, little girl in leopard print top, you’ve given me hope.

Everybody has their ‘kink’ as a friend says occasionally to me. Mine are of the somewhat normal and humorous variety. One of which is buying a singular soft serve cone at the Columbus' McDonalds next to the Flying J truck stop on I-90 in Montana. Probably goes back to the days of taking my boys there after a good day fishing the Yellowstone River on the way home. On a trip through there last Sunday I decided to live on the edge and order a seasonal favorite, Shamrock Shake and one standard off the rack hamburger. I have not had the former since H.W. was president. It was a religious experience.

Aside from the culinary pleasure the shake provided. The order also let me see and feel what the common man experiences by ordering an almost inedible burger from a place that has served over 350 billion of them. My bill came to $7.00 before tax, of which $2.50 was the burger, and $4.50 was the shake. Must be a bull market in mint right now. In terms of the burger, it looked nothing like this version that McDonalds holds out to be real. The patty I had was 30% to maybe even 50% smaller than this. I had extra pickels.

But that’s just the appetizer to a much bigger story here. Smaller restaurants and chains are finally hitting the financial post pandemic recovery wall. This was laid out in excruciating detail by the WSJ this week. The struggle is real, like really real. Labor costs are ramping like never before, and the cost of raw ingredients has not returned to anything that looks like normal. By burger example…

The result is that restaurants are being forced to raise prices to levels that the consumer is simply saying ‘no’ with their wallet. If a $12 burger is red line, then a $14 - $16 is where the engine overheats and breaks down. And sadly, that’s where we are. That being said, the Minetta Tavern Burger in Lower Manhattan is worth every penny of the exorbitant price, at least once. It was Tony Bourdain’s favorite.

One excerpt from the Wall Street Journal story focused on the pinch Karen LuKanic, owner of Chef Zorba’s in Denver is facing down...

'The restaurant’s real-estate taxes have increased 60% since 2019, and energy costs 30%. Theft has added costs: Thieves have carted off Chef Zorba’s propane tanks, outdoor heaters, a $600 storage shed and racks the restaurant had chained up outside. Even rubber floor mats have disappeared while drying behind the restaurant. In addition to minimum-wage increases, LuKanic now spends thousands of dollars a year for paid sick leave and other employee benefits. She said she’s increased salaries of her managers to around $65,000 a year to remain in line with her hourly workers’ additional pay.'

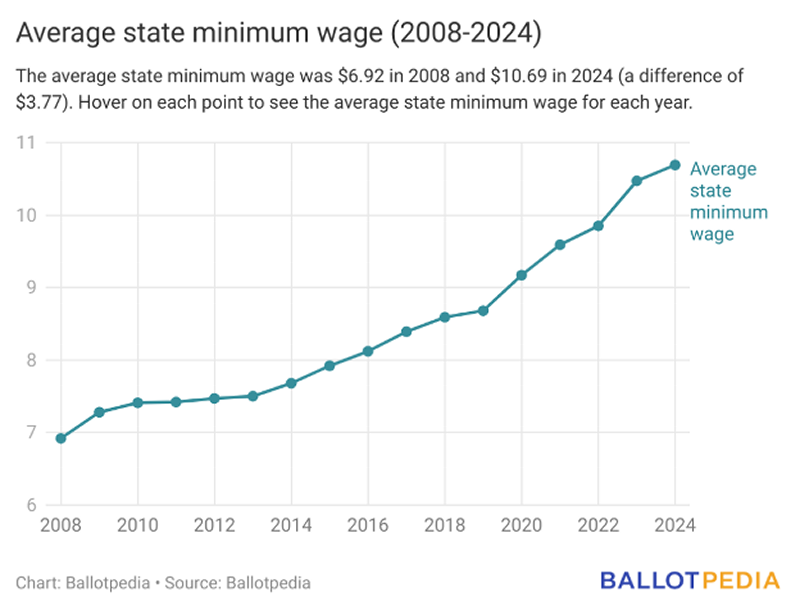

Let’s assume this chart below is accurate, and we have no reason not to. It took ten years (2008 to 2018) for minimum wage to rise 20%. It’s now taken five years (2019 – 2023) for minimum wage to go up another 25%. And given the ethos of never letting a crisis go to waste, every governor and state legislator is ‘all in’ on raising the minimum wage rate even further.

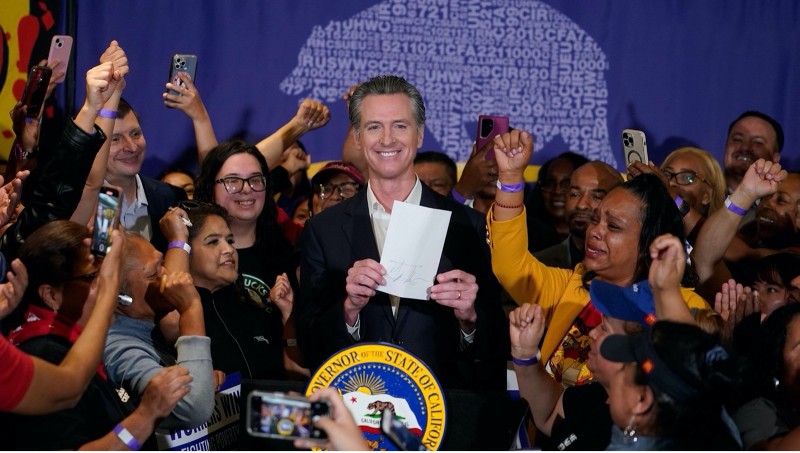

To bring that subject home to a painful roost, on April 1st, fast food worker minimum wage goes from $16 to $20 per hour in California. Another 25% increase in labor on top of other costs going up. This is Governor Hairdo (Wall Street legend Stan Druckenmiller’s name for Gavin Newsom) signing the bill into law with members of SEIU local 721 in Los Angeles last September.

Sidebar, I sat in on a presentation Stan made at USC last spring and his comment “Aside from warm weather and palm trees, I don’t know why you all live here in California” got the best laugh from the group.

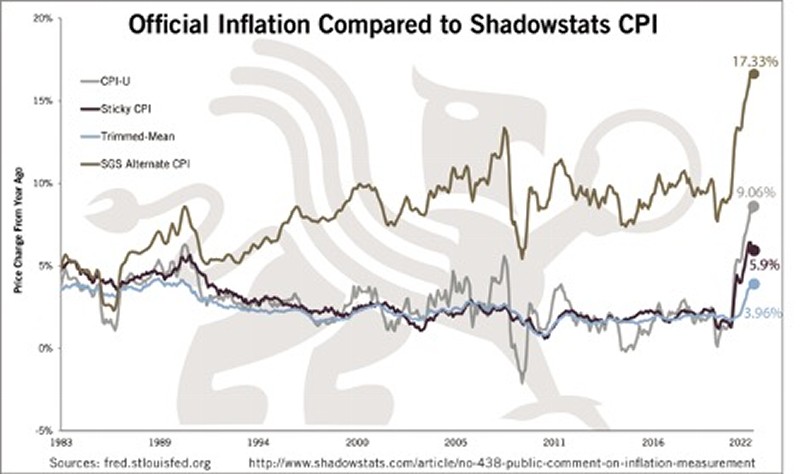

And to you, Chairman Powel, let me ask you this again, where are you seeing inflation moderate? It’s a fair question, because you aren’t aside from one squiggly number that doesn’t reflect the reality of the world most people are living in. Even if it does, 4% inflation after two years of 8% inflation is still a huge jump in inflation. While ShadowStats hasn’t updated their alternative CPI reading in a while, I believe they are directionally accurate in how prices should be estimated.

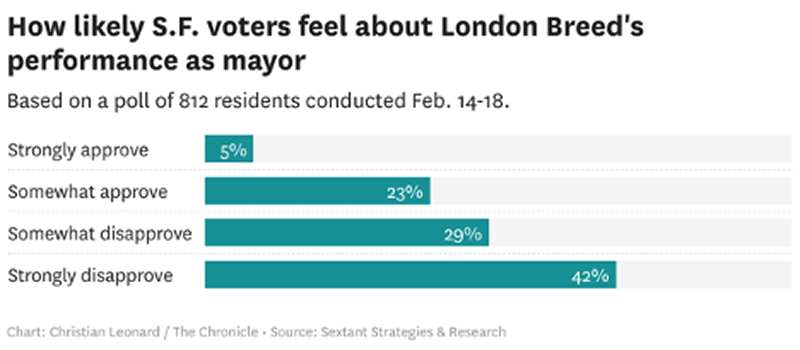

On a much brighter subject, me and another guy have declared ‘peak suck’ has passed for the downtown areas of some great American cities. Last weekend I took in Chinese New Year in San Francisco and wandered all around the city. While some areas were bleak in terms of stores that had closed, it was a far cleaner place with not nearly the homeless problem that has been advertised. That said, it’s probably too little, too late for Mayor London Breed to make the case that she is turning the tide.

But look who is now leading the race….

It’s Mark Farrell, who is straight out of central casting when looking for “preppy looking southern frat prick.” But the media likes his message, and I’m interested in seeing how this plays out. This headline is from the Daily Mail in the United Kingdom…

San Francisco Mayor London Breed is on course to LOSE election to no-nonsense rival who's vowed to adopt zero-tolerance policy on crime in violence-plagued city

I also spent time last week in both Portland and Seattle and they looked cleaner and more well put together than I have ever seen them. Full disclosure, this was late February in the Pacific Northwest, and the streets were quiet. But for those cities, the ‘end of days’ headlines did not match the reality. Of course, just like San Francisco’s Tenderloin, some areas are going to always be places you don’t want to find yourself. So do yourself a favor, know where they are, and don’t find yourself there. Then ‘Loin’ Has looked this way, or something like it, since I was a kid living in the Bay Area. I would counsel to buy your “American Style Levi Strauss” jeans someplace else.

And I will admit to not knowing the answer to the question as to which one is best, Seattle or Portland. But I do know first-hand that neither are as dirty, filthy, gross, and broken as people say.

As a classically trained short seller and hedge funder, I’m going to double down on my long urban areas trade by putting out a short on rural with a levered bet against my sometime hometown of Montecito, California. The 93108 as it were. Why? On Monday, Montecito jumped the shark with this headline and story in the SF Gate online…

The newest hangout for celebrities and billionaires? This California liquor store…

My first reaction when I saw this was something that even I can’t put down on paper. The Bottle Shop was a go to for inexpensive single malt scotch, cheap Herradura Silver, beef sticks, and Pepto…as seen in this picture. I’ve been there many times and if anything, it’s a throwback to less bougie era in that nice little seaside town. A time before Rick Caruso came and built the Miramar Hotel, where rooms start at $2,000 a night.

Rick is a very smart man, shrewd business operator, cleanup artist as Board Chairman at USC and should probably be the mayor of Los Angeles right now. Caruso builds exclusivity not for those who have it, but for those who want it. And he does it well. It’s not lost on those who know that the Miramar, and the venerable Los Angeles Country Club look like they could be ‘separated at birth’.

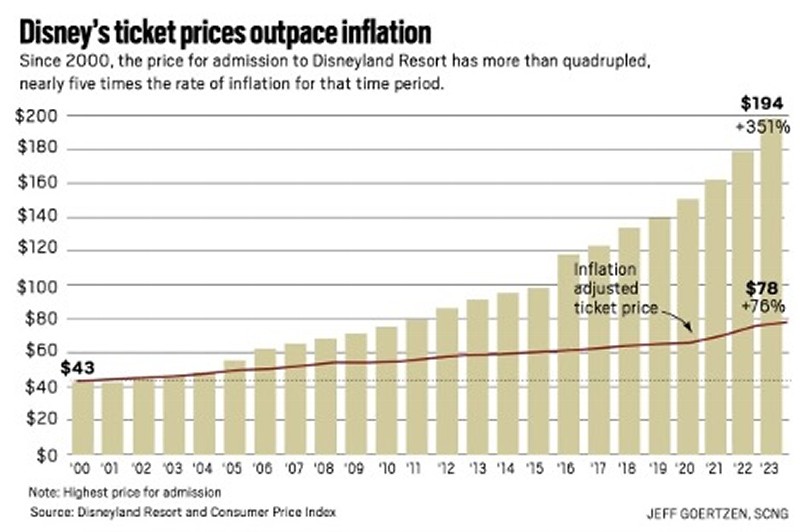

Part of the reason for this is that LACC is an incredibly exclusive club, with two very enviable golf courses on property. The North Course, of which the US Open was played last year, is spectacular. But like I said, few mortals can get in. Even rich mortals.There is similar psychology and desire to belong when you cross the velvet ropes of the Miramar and then belong to the exclusivity on an ‘ability to pay’ basis. It really is fascinating when you think of it. A make-believe Disneyland for adults, with a ticket price to match.

All that said, from about 2000 to 2020 we were lucky enough to enjoy this little cove on Miramar Beach with family and friends, raising three boys who charged it hard. No dues, no application process, no ‘hits’, no politics. Just one of the best beaches on the California coast, and great people enjoying it. It was a beautiful time, and a special place.

Last headline I’m going to give you, fully understanding that you may be getting tired of me beating the psilocybin drum, is from last weekend’s Wall Street Journal’s Magazine. If a publication of its stature, reputation and distribution is writing about it, there is probably something there to think about.

The Working Woman’s Newest Life Hack: Magic Mushrooms

Like the Gonzo Capitalist said in the video short I did from Portland last week, the genie is out of the bottle. The world of treating mental health naturally with psilocybin has been let loose, and you are not putting it back. Let go of the psychedelic stigma, though one can get there as well, against my better recommendation. Listen carefully to those who are on the front edge of this, there is indeed a huge trade in here somewhere. This, from the WSJ article…

'Marketing Executive Kina Anvaripour says she has been microdosing mushrooms for two years now, four days a week. She started after struggling with postpartum depression and menstrual mood swings. Back in her 20s, she’d had a terrible experience with shrooms, but now many of her friends and peers seemed to be doing them. The vibe felt different to her—not trippy but focused and productive. “It was like an attitude adjustment, where things that would infuriate me, like missing a call, or whatever was going on in your busy day as a CEO, just wouldn’t,” Anvaripour says. “It’s mental clarity.”'

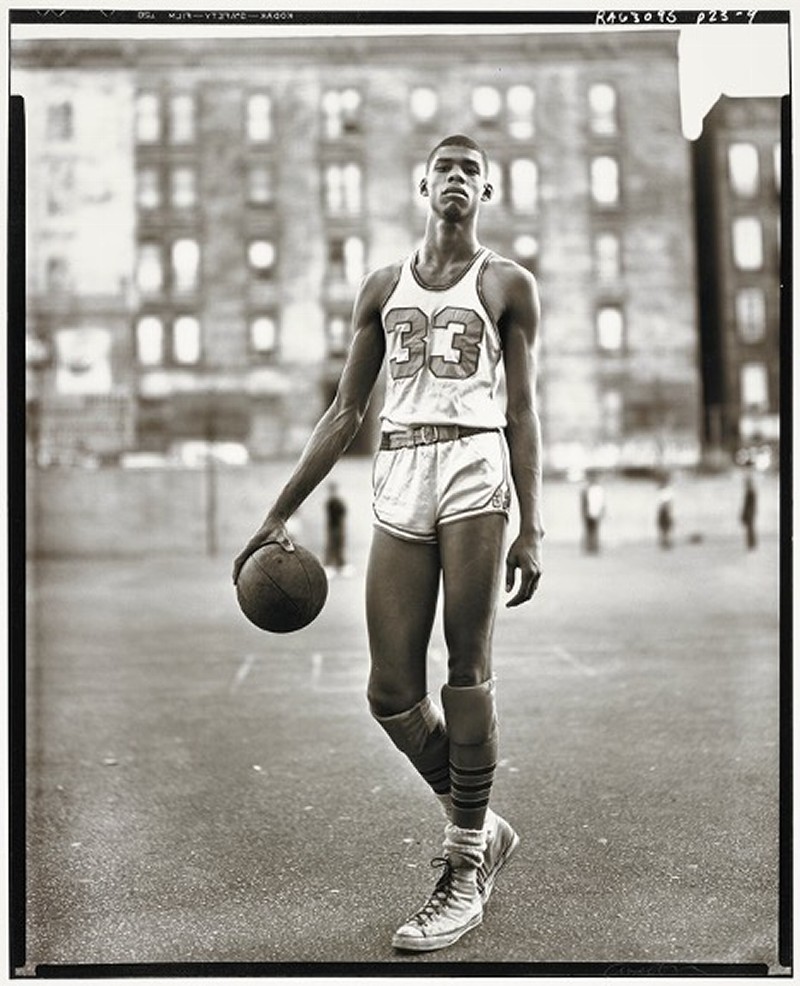

I’ll leave you readers with this. I’m now distributing content on Substack with about a total of 20 whole readers and still learning how to get more without asking my loyalists to pay up. That’s tough for anyone these days. But one who is doing it successfully is my man, Louis Alcindor, nay Kareem Abdul-Jabbar. This is one of my favorite pics from 1963 of Louis. as John Wooden called him, in New York City two years before heading west to Ucla.

In one of his most recent writings Kareem said this…

'Kobe once said something that has stuck with me ever since. He said, “I see the beauty in getting up in the morning and being in pain because I know all the hard work that it took to get to this point.” He was referring to the physical pain that all professional athletes learn to live with in pursuit of excellence.

But his statement is even more profound than that because we all arise from bed each day with some pain—the pain of lost loved ones, the pain of lost dreams, the pain of aging out of relevance. Yet, we endure that daily pain because it is the worthwhile cost of the daily joys and delights, we experience in loving, in dreaming, and in growing older among family and friends.'

That pain he talks about is real, and as I wrote earlier, it’s more pervasive than you think. It’s not easy in this world right now. But there is also more joy and happiness than you probably know is around you as well. It’s simply tough to see though the noise at times.

The only thing I can add to this which makes any sense is that as you age, it gets harder to find the pain from the joy. You get tired, you simply do. You get complacent as the joys are harder to track down. But find them you will, they probably just weren’t there where you put them down last. I’m going to go pick up some of that joy next year in lands far away.

The Tibet 2025 Tour!

Get ready, Dali. I’m coming, it’s going to be a Zen Buddhist party.

Until next time...

'if you don’t like the news, go out and make some of your own.'

DISCLOSURES

The contents of this commentary: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, and (ii) may not be relied upon in making an investment decision related to any investment offering by Axxcess Wealth Management, LLC (“AWM”), an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure.

Market data, articles and other content in this commentary are based on generally available information and are believed to be reliable. AWM does not warrant the accuracy or completeness of the information contained herein. Opinions are the author’s current opinions and are subject to change without notice. The views expressed in this commentary are subject to change based on market and other conditions. This commentary may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information contained above is for illustrative purposes only.