This Month in the Markets - November 2024

with Bryan Goligoski - Axxcess Editor at Large

As was evidenced by last weekend’s fiasco of finishes in college football, it’s ‘flag planting’ season…

What do we mean by that? It’s the annual Wall Street right of taking victory laps of everything the professional observer called right, with no mention of how many ‘personal fouls’ they piled up.

But if they are going to go through the exercise, then so am I. In three weeks, when everyone is cozied up between Christmas and New Year expect to see and read a recap of what observation made right, made wrong, and somewhere in between. Good news, I wrote it all down a year ago…’telling the truth, and suffering consequences!’ along the way.

And I promise not to keep you holding your breath for the 2025 edition of the same observations. Goal is to keep my win percentage above .500 once again. I got up to .750 in 2023, so it’s worth taking note. Keep in mind, these are not stock picks or direct advice on any one thing. Simply a look into the future by a guy who has been trying to do it for 28 years now. Some big wins, and some badly played losses along the way. But always with a high level of honesty and transparency. But onward we charge!

Here is a quick whip around the subject matter, and I welcome any and all readers to contact me if there is subject you care for me to opine on, bryan@stillcap.com For as I like to say, ‘always confident, and sometimes right’. Still lifetime undefeated in tailgating. Go Bruins!

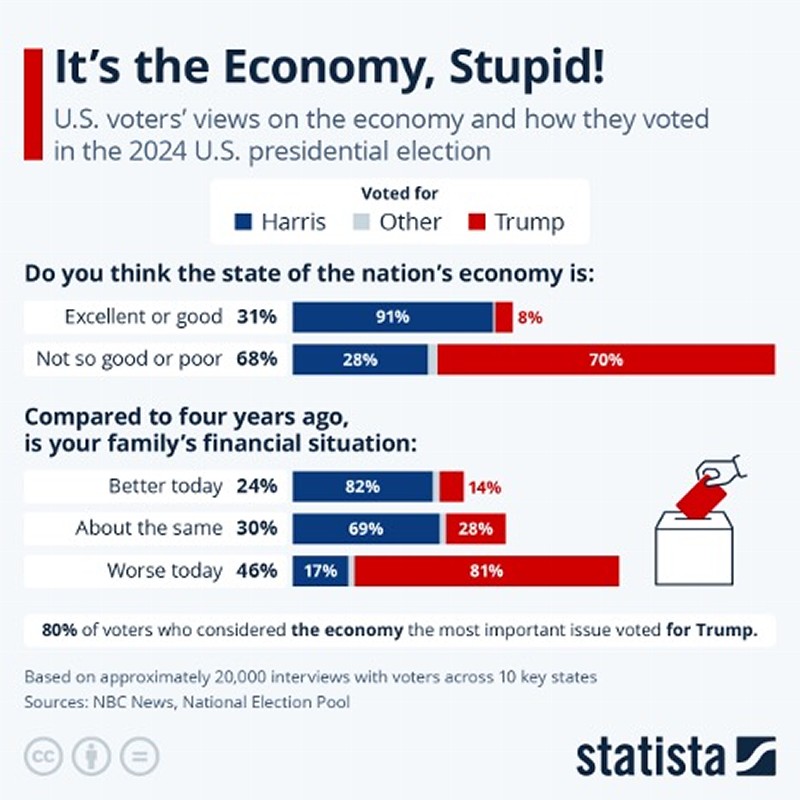

Big subject, though I want no part in political debate, is what the next Trump presidency could mean for the economy. It’s clear that a lot of people voted for him to maintain a strong standard of living and raise their very own. Never easy, but always worth fighting for.

So far, his cabinet picks are non-consensus thinkers, with a sidecar of controversy. Proud to see Jerome Powell stand up and say ‘Negative, I won’t be resigning until my term is up’. For all the bashing I’ve doled out for providing excessive liquidity in the system, it has somehow seemed to work, assuming of course that you had assets to inflate. These are incredible comparisons of wealth to GDP.

1952 to 2000 = Average of 350% to 400%. A 15% increase over 50 years.

2000 to 2020 = average of 400% to 500%. A 25% increase over 20 years.

2020 to 2024 = average of 500% to 600%. A 20% increase over 4 years.

Bubbles, bubbles everywhere, but not a one to prick. This subject is a hot one right now as gains in indexes, individual stocks, and alternatives are into the two sigmas right tail of the Gaussian bell curve variety. Everything is going up, somethings a lot more than others. Which of course works, until it doesn’t. This chart has been around for as long as I can remember. While it’s showing its age a bit, the concept is still the same.

Occasionally, I get the chance to rub elbows with the extreme apex feeders of the financial markets. Like way way way up the totem pole from everyone else. I did so again this past weekend. It was a short conversation, but the punchline was clear. The equity market, it’s incredible strength and narrow band of leaders, wouldn’t last forever. And when it was over, and the law of big numbers catches up, the emperor will once again have no clothes. And that which is good and important now, will no longer be.

Goldman Sachs shocked the investing world last month when they produced a very contrarian view that the decade ahead will not look like the decade behind. Equities barely keeping pace with inflation? Is that even a real thought? ‘Oooohhh Lucy, you have some splaining to do!’

As it relates to ‘alternative’ investments, unless you were long commercial real estate bonds, chances are very good you’ve done well. Gold went up big, crypto currencies as well. Residential real estate, as we are all aware, has gone parabolic. Inventory is incredibly tight, and rates are now sky high to where they had been. In a lot of places ‘Home Not for Sale’ is the new ‘Home For Sale’. I’m taking this guy’s advice and avoiding the ‘sassy mouthed owner’.

The bond market also appears to have taken the train to Crazy Town. Spreads, the difference between what someone would accept as a yield for a high quality bond, versus that which they would pay for one with a higher risk is at levels a reasonable observer might call ‘non existent’. Back in a day, a long long time ago, a spread could be 4%, even higher. Today, we are sub 1%.

Important note, this esteemed group of readers that have been well curated over time, can always ask that a subject be dived more deeply on. Call it ‘dealers’ choice, but I want to keep this piece real and relevant. Fed bashing and lamenting not levering up on NVIDIA stock can only be enjoyable for so long. Step on up, new shooter coming in!

I’ll leave you with this, it’s been an incredible year. From two sigmas on the right tail, to two sigmas on the left, it’s been a thing of extremes. And we saw a lot of flag planting this weekend. An extreme reaction to a win, that then caused another extreme reaction. It was ugly, and it left this longtime lover of the college game in a bit of a foul mood.

The lesson there, and for all of 2025, beware of where you plant your flag. Know the risk, know the reward, and don’t step into something when you can’t figure out the two. Discipline wins the day, even if Ohio State didn’t. See you in three weeks. I’ll be bringing the gifts. Don’t worry, they won’t be biblical in nature.

The contents of this commentary: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, and (ii) may not be relied upon in making an investment decision related to any investment offering by Axxcess Wealth Management, LLC (“AWM”), an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure.

Market data, articles and other content in this commentary are based on generally available information and are believed to be reliable. AWM does not warrant the accuracy or completeness of the information contained herein. Opinions are the author’s current opinions and are subject to change without notice. The views expressed in this commentary are subject to change based on market and other conditions. This commentary may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information contained above is for illustrative purposes only.