Our resources provide you with specialists in portfolio management, real estate, private equity, and investment advisory services.

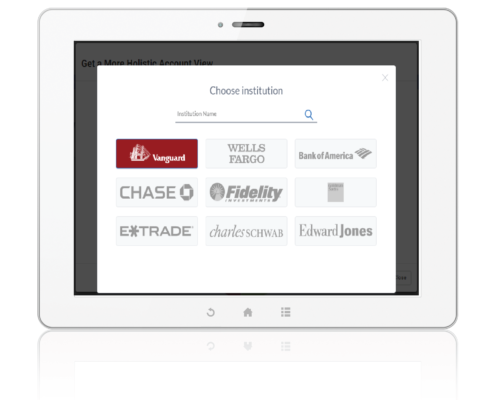

Your high net worth clients have made directed investments. They own LPs, Real Estate, and shares of private companies. Axxcess has a solution to help your client track, report and bill on their total wealth. Having built our firm running family offices, we understand this challenge.

Work with us on an account by account basis, or accross your entire practice.

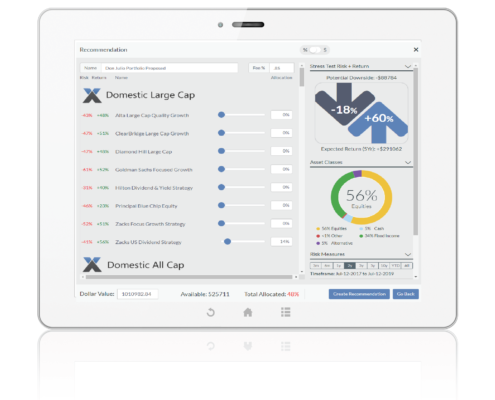

We have found that if you can help your client track and report on their inefficient assets, their liquid assets will come under management. Track, bill, and report on directed investments in the same account that houses traditional SMA, Fixed Income, Mutual Fund, and ETF strategies. Report, monitor, and analyze hedge fund, private equity, private credit and real estate within the same Advisor branded report portal.

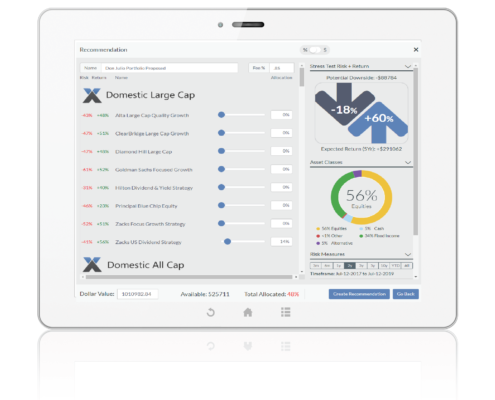

Our integrated technology creates a seamless solution. Build meaningful proposals after on-boarding your clients through your white labeled prospect portal. Create a paperless environment that generates client engagement.

Engagement, Client Profiling, and IPS workflow management automate and increase efficiency in your practice.

CPA’s and Attorneys can partner with Axxcess to deliver our platform to their clients. Our transparent fee-only relationship can be structured to support your firms unique business model. Deploy our resources to support your firms pooled retirement accounts, the Partners own personal accounts, and provide differentiated services to your clients.

Advisory services provided by Axxcess Wealth Management, LLC (AWM), an Investment Adviser registered with the SEC. Advisory services are only offered to clients or prospective clients where Axxcess Wealth Management, LLC and its Investment Advisor Representatives are properly licensed or exempt from registration.