This Week in the Markets

with Bryan Goligoski - Axxcess Editor at Large

Been gone, but not too long. This has been a noise filled market so far this year, but we just got some decent signal. So back I am with market insights, economic observations, mixed with irreverence and humor. Because if you can’t laugh at yourself sometimes, then who can you laugh at?

“Beware the ides of March” is an ironically good theme for this weeks commentary as it warns of the pending settling of debts and probable misfortune. The quote was made famous in William Shakespeare’s Julius Caesar when a soothsayer warns the emperor of trouble on the way, only to be dismissed with the quote “He is a dreamer. Let us leave him. Pass.” Caesar would be dead a few hours later, stabbed by Brutus in the Roman Senate. Caesar’s last words would be “Et tu, Brute?”, or “You too, brother?”.

If that isn’t a fat proverbial pitch to wait on before I rip it it 420 over left center, I don’t know what is. In the here and now markets need to heed the warnings, beware of pending debts that are due by banks, and be cognizant of the probable misfortune in an economy that is as confused now as ever. So, let me be your dreamer. Allow me to pass. But heed what I’m going to say. The good news, is that it's not all bad news. But, my friends, it is indeed March and bank failures are never a bullish sign, unless of course you are a bear. Read on to make some sense of it all.

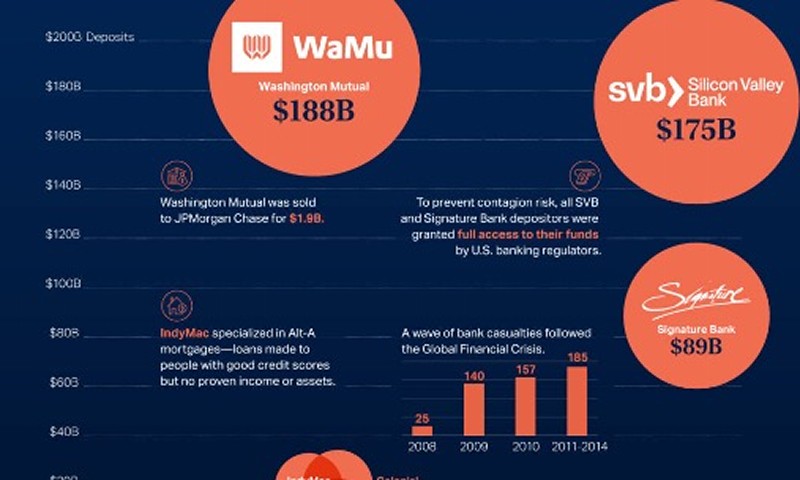

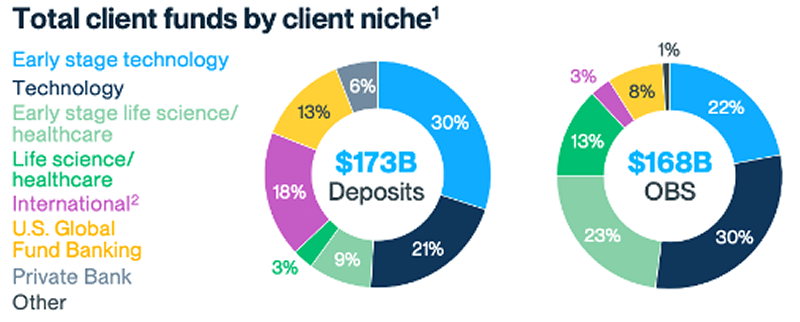

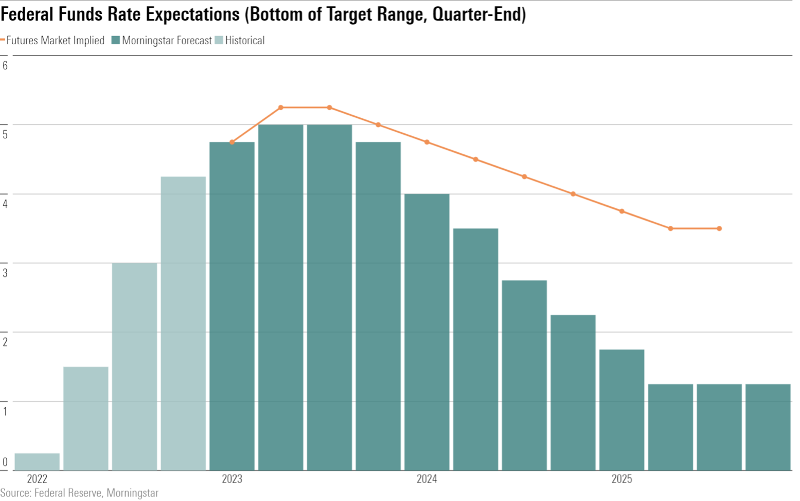

Let’s start with what we all know, Silicon Valley Bank has failed. Also collapsing, Signature Bank. The former suffered a classic bank run at the wrong time; the latter looks like it might involve perp walks. The culprit for SVB? A balance sheet that held too much in government bonds, like 55% too much government bonds, that had been rising in rates and dropping in value. This time precipitously. It was that last move up in yield, and down in price at the far right that occurred at the same time there was a huge draw of cash from customers. As the hip kids like to say, “There was an asset v. liability mismatch”.

Why was there a run on the bank’s cash? We will never truly know. But to show you how fragile the system is, once it started, there was no way to stop it. Just like George Baily in It’s a Wonderful Life, when too many people show up at the window, there is simply no way everyone gets their cash out in an orderly fashion.

'

'

But of course, since there is no bank that is too big to fail, the good people in Washington at Treasury, the Fed, and FDIC have stepped in to backstop client losses. Maybe there is a little guilt on the side of Fed Chairman Powell that they were partially to blame. One of the most unsettling things about the actual business of SVB is the very small number of accounts that would have been protected with only the standard $250,000 the FDIC provides.

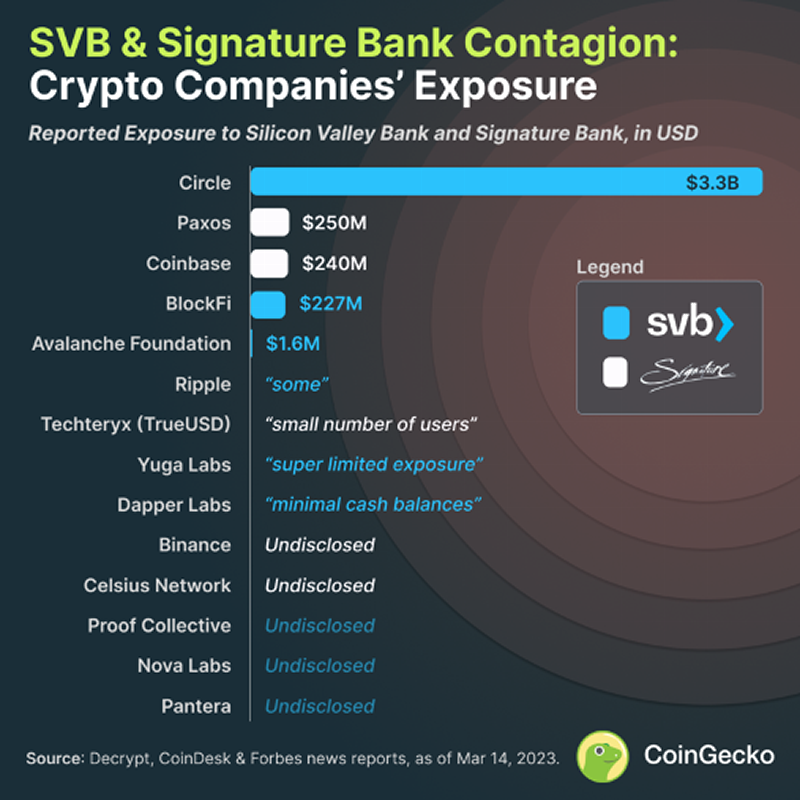

And the exposure crossed many technology and innovation lines, literally spreading across the Valley and up the Peninsula. And keep in mind, if a company’s cash is held up it can’t pay employee salaries and their vendors. If it can’t do that, they in turn can’t pay their bills. If they can’t pay their bills the guy doing brake jobs or serving tasty shawarma probably aren’t getting paid either. The ripple effect is huge. Though I do loves me a good shawarma, some things are sacred.

Signature Bank, an old-line lender that dipped its foot too far intro crypto, has failed as well. But these guys deserve the dirt nap because they drank the Kool-Aide, too much Kool-Aide.

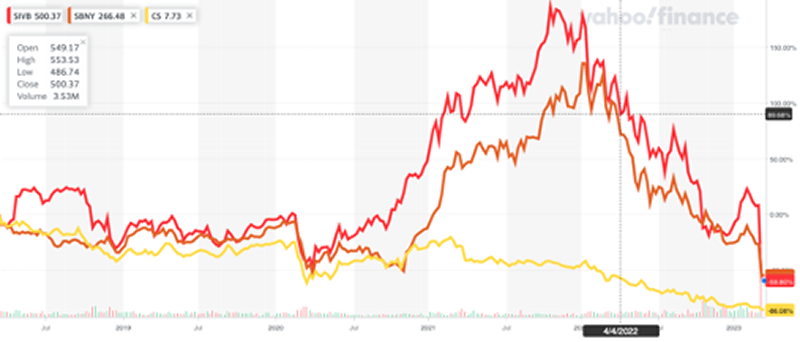

To wrap this up, let’s look at the ugly charts of Silicon Valley Bank, Signature Bank, and the beleaguered Credit Suisse. This is quite simply a massive blowup of value and capital, and it’s probably not done. Other banks will see some form of runs on cash, and more banks will fail. The investing public, as well as mom and pop on the corner, will lose their proverbial shit. It’s not going to be pretty, but the government has backstopped it so the actual financial pain will be cauterized.

I have to say one last word about the failure of Silicon Valley Bank. Having grown up there the news that the bank is gone had the feeling of a death in the family. I knew SVB since its birth in October 1987, ironically the month of the ’87 crash. As a portfolio manager I’ve invested in the shares and sold them short many times over my twenty-year tenure. It was always seen by me as a call or put option on the overall health of the tech sector. And it mostly worked

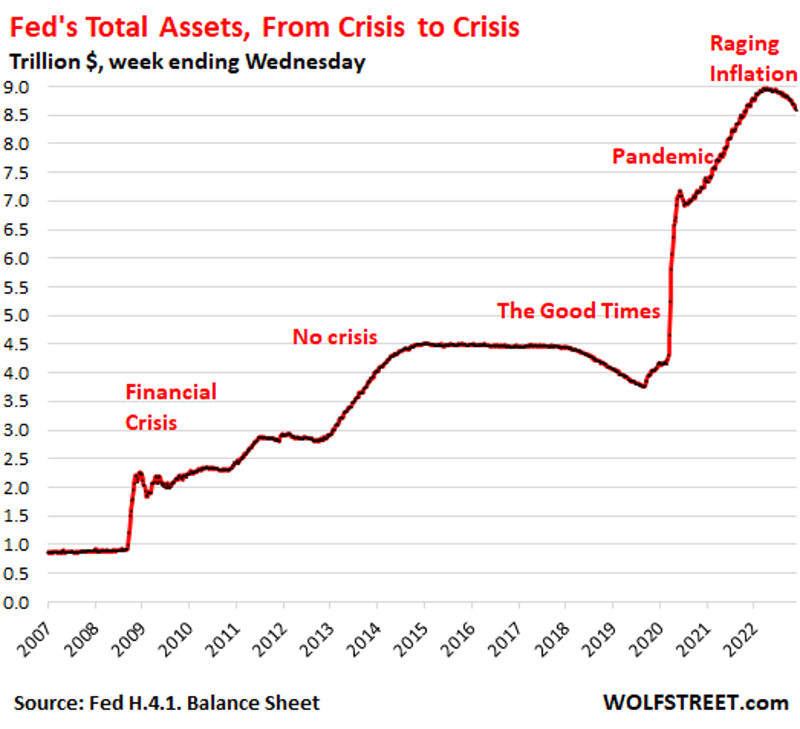

So here we are, back to the ongoing problem with markets. What is it? They are manipulated by the ‘Fed Put”. It’s been there for decades now, and there is no real chance it’s going to change. As much of a prudent bear as I’ve been for the better part two decades, I’ve got to give it to them, at the end of the day if you can stay long and strong, you are going to be just fine.

The one problem with this scenario, if we are going to say there is a problem, is that while real assets in the form of homes, stocks, private investments will be fine. But most of the small business and the average Joe and Joette are staring down the specter of higher inflation lasting longer and cutting into many aspects of their lives.

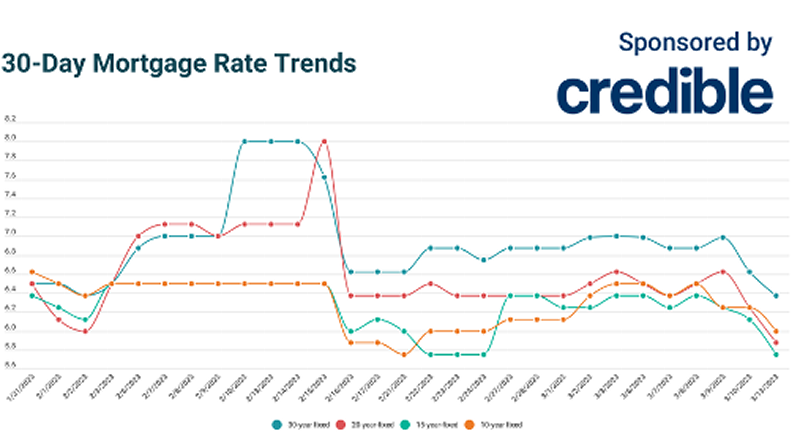

Finally, before we move onto to the corporate bottoms up, I want to make clear that there is upside to what’s happening. First off, mortgage rates have dropped big in the past week.

The other positive is that while the Fed will probably raise rates next week, we are much closer to being done with this cycle now than we were about 30 days ago, and that is indeed a big deal.

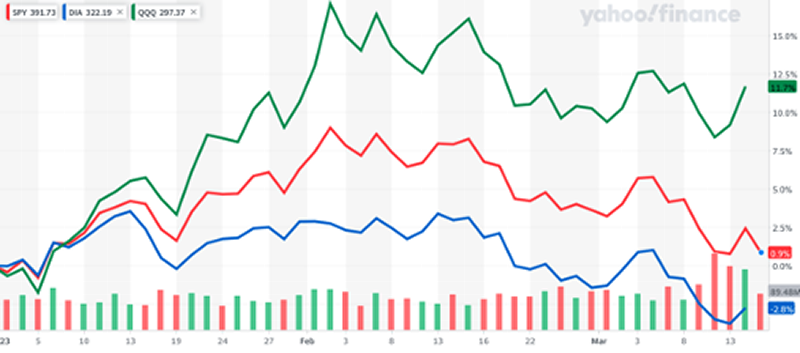

Now the good news. Even with rising rates, stubborn inflation, challenging earnings, recession fear everywhere, and now a live (mini) banking crisis, the markets are not fazed. You’ve got the NASDAQ up over 10%. The S&P is flat for all intents and purposes. And the DJIA is down a pedestrian 3%. That’s telling you something. And what it’s telling you is that there is a lot of discounting the negative already. So, while it may not be a gangbuster year for stocks, it’s probably not going to be a disaster either.

If you need one last reminder to keep your mind about you, remember the words from the robber to his wife in the final scene of Pulp Fiction, “be cool honey bunny”. We got a lot of guns pulled right now, so just be cool. From Capra to Tarantino in one market commentary, that’s what they call range, honey bunny.

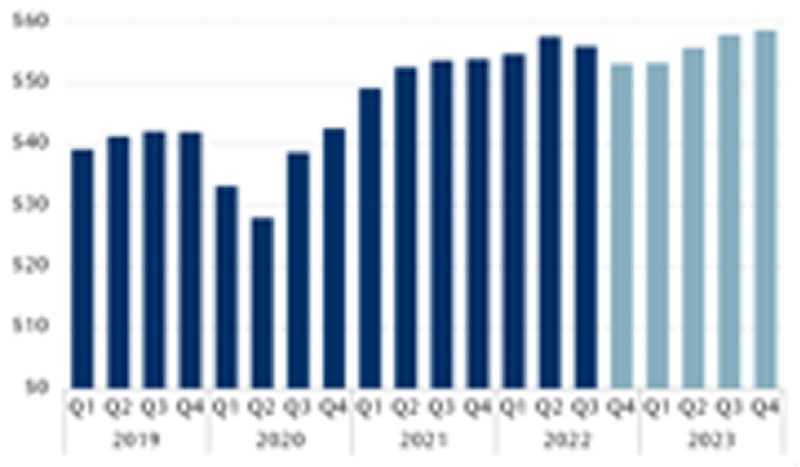

Speaking of staying cool, even with risk to the economy, earnings aren’t showing signs of cratering in 2023. These were RBC’s estimates at the end of January, and while they might have come in some, they are not materially different than they had been. This will mark the third year of pedestrian growth for S&P 500 companies. While that’s boring, it’s not the stuff of market crashes.

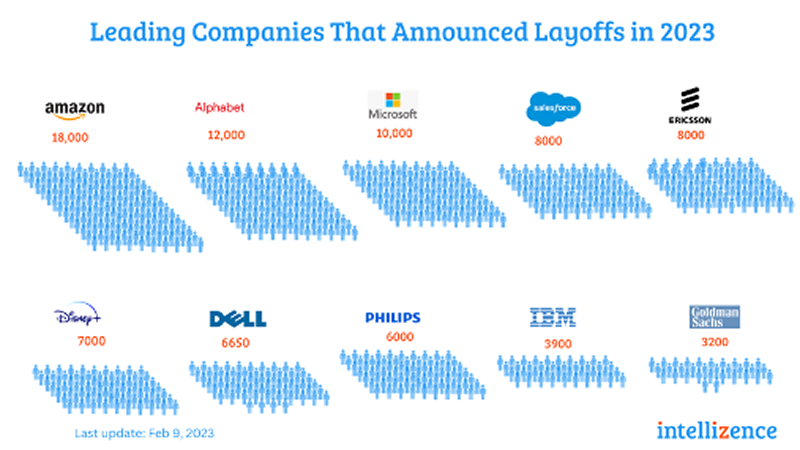

Also beware the drumbeat of corporate layoffs. This chart is updated as of a week ago and while it looks bad, add them up and you get a number less than 100,000. That’s a drop in the bucket.

Looking at financials again, aside from the torching that some regionals with technology exposure are feeling, it’s been a sideways twelve months. For all their challenges, Goldman Sachs is barely down, same with JP Morgan and Citigroup. The banking ETF, the XHB, is flat’ish. That’s said, Schwab and Bank of America are now heavily in the loss column after the wheels came off SVB earlier this week, and investors are looking for the next possible run.

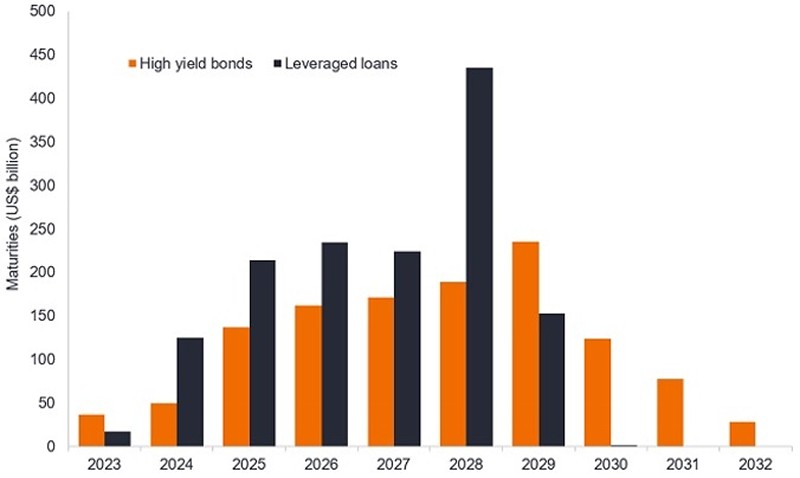

One of the reasons why there is health in the banking sector though is because there is a light amount of high yielding bonds coming due this year, so there is a limited amount of debt that needs to get refinanced. The out years could prove problematic, but by that point, interest rates will have likely peaked out. Point being the default risk is lower than it has been in a while.

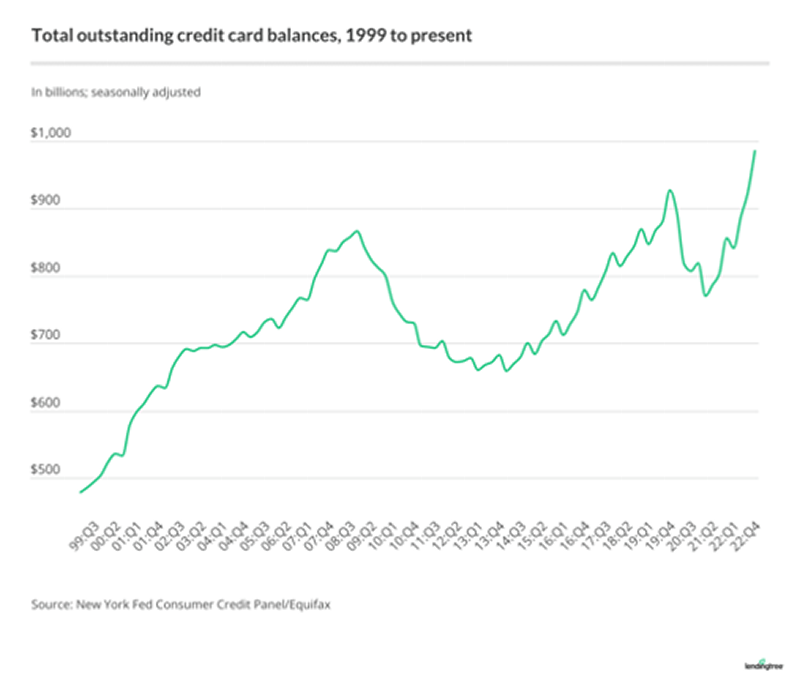

One chart of concern is the rise in consumer credit card debt in the past few years. Not something you want to see going into a recession.

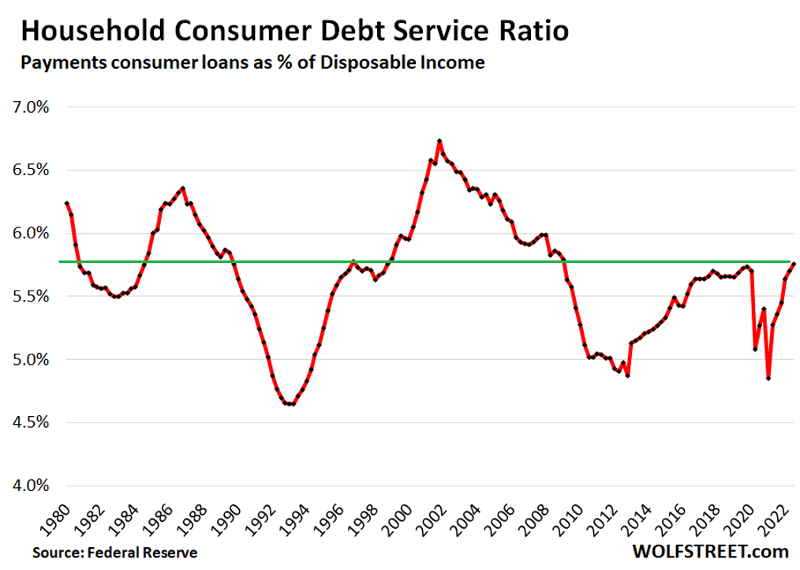

The counter to that is that the ratio of debt service to disposable income, or the ability to service rising debt levels is at an average rate over forty years. This means that the risk of consumer debt crisis is lower than the headlines are saying. So be careful of what certain charts show because they need to be taken in their entirety.

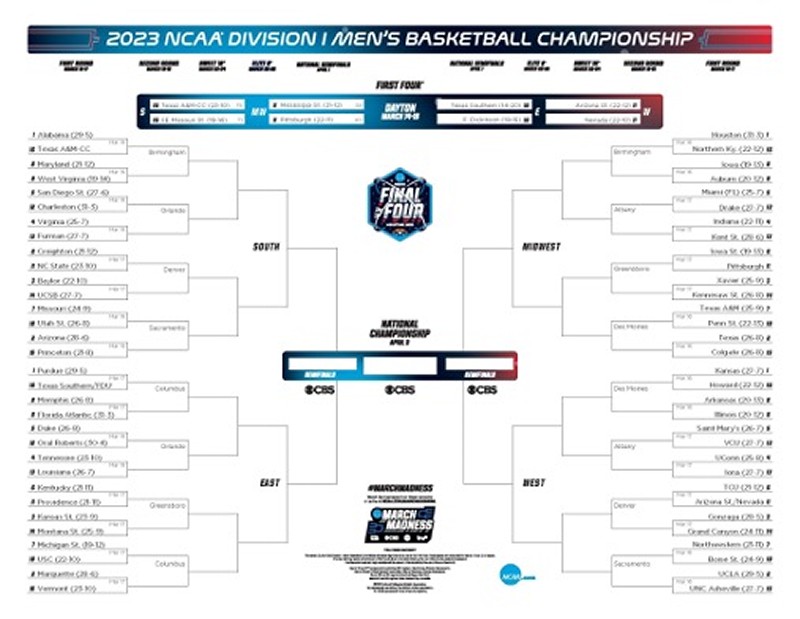

Now onto the fun stuff, nay, the best stuff. And this time of year, with the country gripped in some crap weather, that best stuff is “The Tournament”. And if you don’t know what it is, that’s a you problem, not a me problem.

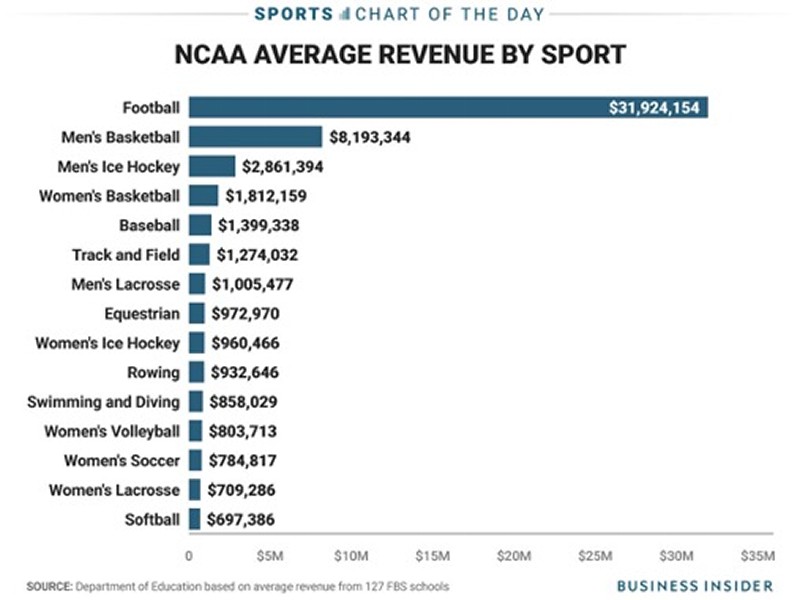

Last year I penned a pretty good piece titled The Big Money Game of College Game. It was a deeper dive into how the money comes in, and how it goes out. While the hoops tournament is big, college basketball is still small compared to football. Like three times the size. What isn’t always advertised is that after those two sports, everything else is run at a loss.

The giving part by donors is its own special animal. Some schools rake in hundreds of millions of dollars annually, while other are just getting by. At my peak, and not that long ago, I was in debt to Ucla Athletics a $12,000 Bruin Legends annual donation. Ironically, to then get access to another $12,000 in tickets to football and basketball. And lord knows I loved it all, and I have zero regrets. It used to be easier when you got to deduct it off your taxes, but alas, Donald J. Trump took it away. But when you have good old Uncle Phil (Knight) who the eff cares. Quack…quack.

Back to the tournament, I’m loving this year’s high seeds. Aside from Kansas, there is parity in them. Purdue is more old school, with a freak of a center. Alabama has some ethical issues, so I want them to lose early. The Houston Cougars are interesting from the perspective that the National Championship game is going to be held there.

But I don’t think the overall winner comes from pole position. I think there is a two in there that has the right chemistry, right coach, right point guard, and right big man, and right pedigree. I’m also very superstitious about the subject, so I’m not going to utter the name. Here is a hint, the school starts with a U and ends with an A, with two letters in between. They play in a legendary “Pavilion”. Their mascot is ursine. And if they pull it off, it will be the 12th national championship banner hanging from the rafters. Let’s go boys. Do something special.

Disclosures

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.