This Month in the Markets - April

May 2024

If you are on the Insta, and most all of you are, it’s become clear that graduation season is upon. This one being even more dramatic than usual as ceremonies across this land of freedom are being cancelled. That’s a lot of time, money, and effort to not get the chance to celebrate with your classmates. And maybe you would have gotten, or get this year, inspiration from what the commencement speaker has to say. This guy knew a thing or two and twenty years ago brought down the house at Stanford with the ‘stay hungry, stay foolish’ speech.

But I digress. Importantly, summer travel is right around the corner which fits perfectly with our theme that the economy, interest rates, and markets are now some versions of ‘Planes’ Trains, and Automobiles’. Buckle up, buttercup!

Just when everything looked like it was playing out to a dovish monetary travel plan, the script got flipped. Finally, those who work for the Federal Reserve and punch the clock at the Marriner S. Eccles building in Washington D.C. might be seeing the light at the end of the tunnel. Only now it could be this….

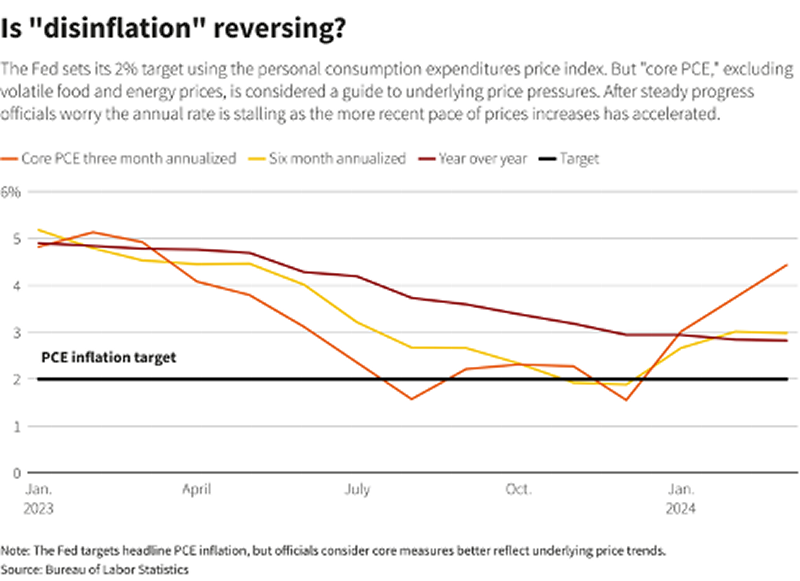

What’s fueling the train of policy change? That thing that we all know keeps hanging on, at what seems like ‘stubbornly higher levels’. Forget CPI for a moment. Those In the know will tell you that the Federal Reserve prefers to use core PCE (personal consumption spending) to guide its path. And if that’s the case, the path forward just got a lot tougher for those who need lower rates to survive a late cycle economy. .

How do we know we have an expectation problem? Because Fed Chairman Powell just told us we do, but not overtly. After the announcement last week that the body he chairs made the decision to hold off on a rate cut, Powell took to the microphone at the post decisions presser and said,

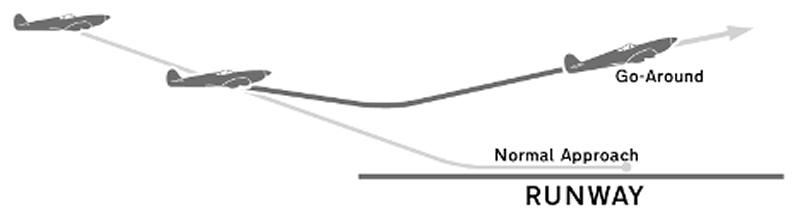

You know what persuasive evidence is that inflation isn’t going down to 2%, sustainably? It’s the fact that it stopped going down at 3% and is now headed higher. Keep in mind, the Fed was able to build the ‘lower sooner’ case beginning in the middle of last year when PCE was feathering in a landing from 5%, and then 4%, down to 3%. For the aviation enthusiasts out there, it now looks like the pilot just called a monetary ‘go-around’ and will wait for better condition to put this bird down.

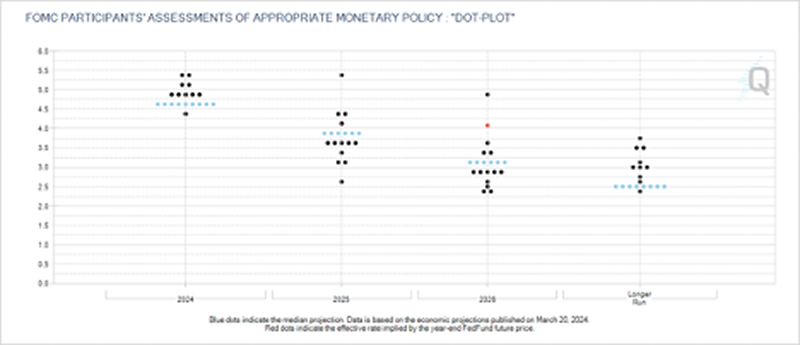

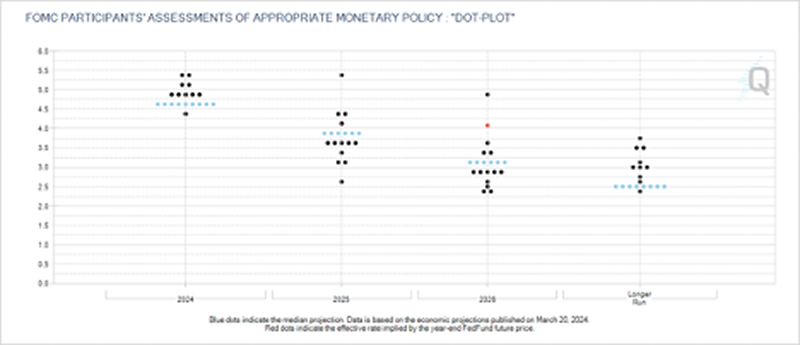

Where does that leave us? First off, the Fed is still anchored to the belief that what has happened for the past quarter century will happen again and inflation has a home at a consistent 2%. That is TBD. Second, they will have the tools available to confront inflation, if it doesn’t mellow out. Again, TBD. But for now, consensus among members of the Board of Governors is that we have about two to three rate cuts in store for 2024. Blue Horseshoe likes the other side of that.

Source: CME Group As part of the view that inflation is here to stay, is that home prices have come untethered from mortgage rates, which have more than doubled in the past 24 months. While this chart doesn’t go back far enough, take my word for it that the last time we saw the price of home buying money this high was two years into George W’s first term. That’s twenty two years ago for you kids at home.

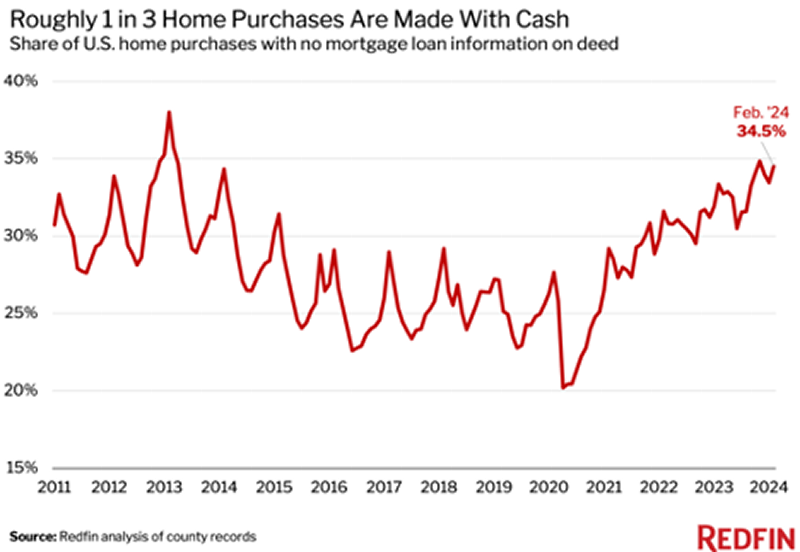

But why then can’t we get more inventory on the market or softening in sky high prices? Because one out of three homes are paid in straight cash. Dollah bills, moolah, jack, green backs, clams…and that’s a lot of them.

Rounding out our cinematic theme, let’s talk automobiles. Most importantly the ones you are hoping to take on a trip soon. Turns out, don’t let prices of gas on the coasts fool you. Nationally, we are running at par with last year, and right in between the highs and lows of the past three.

I’ve logged more road miles thank most anyone I know in the last two years, a lot of them in California. With that experience I can attest to the fact that once you get out of the Golden State, life on the highway gets a whole lot less expensive. This is what I paid in Paradise Valley, Montana on Friday of last week….

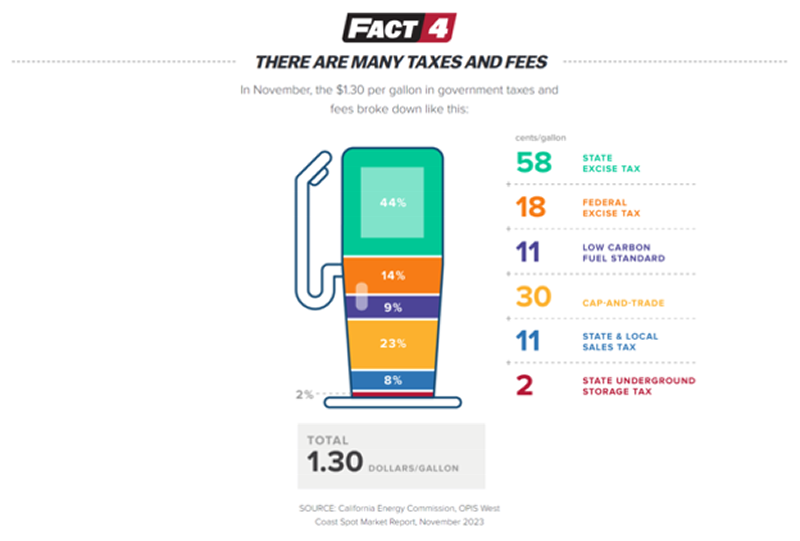

While I can’t claim it was ‘half price’ from California where I had been the day before, it was for sure a lot less than the petrol I was pumping with the $6 handle on it. But my former home state, and its governing bodies rightfully elected, have mostly themselves to blame. While $1.30 is baseline for what Golden Staters pay extra, that number is supposed to double in the next half decade. I believe old timers call that ‘pain at the pump’.

Quick flash back to last week’s Employment Situation (Jobs) Report. There was a little cooling of the white-hot job creation coming into April, but not much to change an otherwise strong trend. That said, if this keeps up and job adds stay below 100k a month, look for the drumbeat to get loud for the Fed Funds Rate to come down.

While I’m not an ‘all in’ believer that stagflation has arrived, a slowing in average hourly earnings growth, coupled with inflation above 3% would be evidence that could sway many to that camp. I can see the case more clearly now with rates where they are, and liquidity being drained, that we will wind up in some sort of recession, mild or otherwise, in the next 12 to 24 months. It’s been said it’s just math at this point, but I’m also not so sure it is.

That’s it for this chart heavy May look at the top down. Next month we return to the bottom up with a review of which sectors have been leading, and which ones are lagging, and why.

Source: ThirtyNorth Investments But before I leave you, a reminder. It’s a struggle out there, always will be. And oft times it’s real. May is Mental Health Awareness month, which was so introduced way back in 1949. Which makes sense given that we had just wrapped up a second world war. But today, If there are four people in a room, chances are good one of them is facing some sort of challenge. If it’s 40 million, then 10 million are suffering.

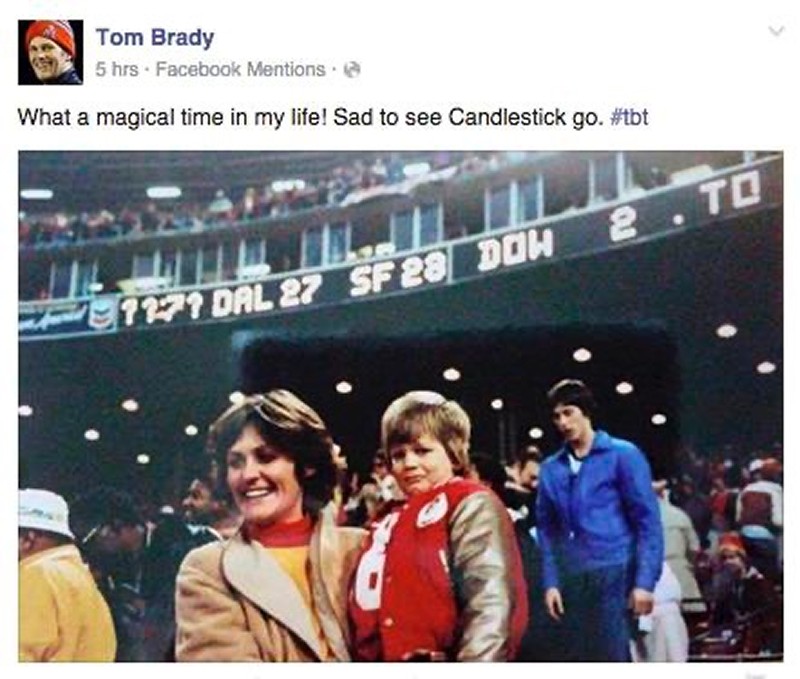

As part of a paid promotion for BetterHelp, Tom Brady is out offering one month free of the direct online therapy service. In the ad running on social media, he mentions being in some form of it for the last 25 years. Even the G.O.A.T. feels it, probably more than most. But if a quarter century of figuring out how to manage stress, doubt, fear and even loathing winds up getting you seven Super Bowl rings, then I’m for sure in.

And don’t worry, I’m cool with the idea that growing up all he wanted to do was play for the Niners. Which of course I’m not. But let’s add that to next week’s therapy session. And hey Dallas, to remind you, Joe wasn’t throwing it away!

Be good to yourself out there. You are the only one of you you’ve got.

The contents of this commentary: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, and (ii) may not be relied upon in making an investment decision related to any investment offering by Axxcess Wealth Management, LLC (“AWM”), an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure.

Market data, articles and other content in this commentary are based on generally available information and are believed to be reliable. AWM does not warrant the accuracy or completeness of the information contained herein. Opinions are the author’s current opinions and are subject to change without notice. The views expressed in this commentary are subject to change based on market and other conditions. This commentary may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information contained above is for illustrative purposes only.