This Week in the Markets

with Bryan Goligosky - Axxcess Editor at Large

Oh, yeah baby! Better be ready for some football this weekend, the divisional playoffs are here. And because we like to be full service at Stillwater, here are our picks to click for the action. Full disclosure: I am notoriously bad at this, and I haven’t gambled since my Ucla days. Feel free to take the other side and make some money!

Kansas City over the Jag = Nobody has that good of luck two weeks in a row.

Bills take down the Bungles = Buffalo is too good a story, and they play good ball.

New York Football Giants over the Eggles = Birds are looking wobbly, Gints the opposite.

Niner beat down the Cowboys = Because if they don’t one of the best defenses in NFL history, and the most loaded offenses since Rice, Montana, Craig, and Taylor will have been assembled of not. Let’s goooo….

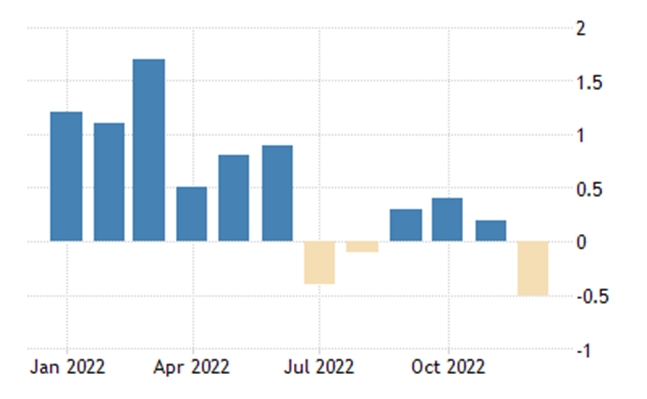

It’s happening. It’s happening right now, and it’s not going to stop. This week we received another important reading that inflation has probably peaked out when the Producer Price Index came in at a drop of half a percent. This was helped by a decent sized decrease in energy prices, but why would you factor that out? Everyone uses energy. Nothing scary about this PPI chart, in fact it’s quite bullish for the markets.

Source: Bureau of Labor Statistics

This slowing down of the economy, and drops in inflation, have really helped the mortgage market. While it stop the Wile E. Coyote action in home prices? Negative. But it’s one less thing for the bears to point to and say ‘see, everything is crashing’. For those who bought homes in the last twelve months, we hope you like them as you are probably already underwater.

Speaking of underwater, Goldman Sachs is looking like it’s in the same boat in its consumer banking division which has racked up $3.8 billion in losses in the last three years. Even by Goldman’s standards, that’s a lot of money to be coughing up to get into the game of consumer credit and spending. Biggest factor was the more than $1 billion lost via Apple Card, where the company handles all the back end and Apple sits as the smooth veneer.*

*Source: CNBC

While the stock of Goldman Sachs was down on the news, looking back, GS and the rest of the banking sector have held up remarkably well over the past two years. Trading sideways in an overall market that has been doing the same thing. Which beats the pounding that has been taking place in all things speculative.

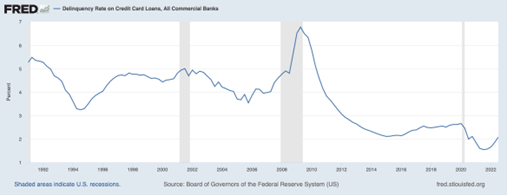

A big reason for the resilience is that when rates go up, banks tend to make more money as the business of borrowing short and lending long has been a good one for the past 100 years. And beware the carnival barkers that warn of a pending eruption in credit card defaults. For more than four years the trend has been flat to down. So even if it doubles from 1.5% to 3.0%, it’s still a low number historically. And this coming from a guy who makes lots of money when the consumer gets out over his or her Rossignols.

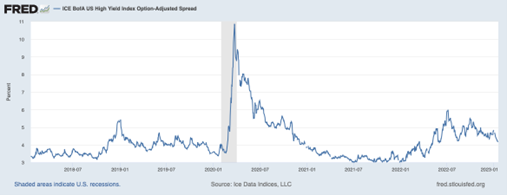

Think the consumer is the only one in better shape? Better think again. This is what corporate bond spreads have done for the past five years. Aside from the ‘oh shit’ moment at the start of the pandemic, they’ve traded between 3% and 5%. For any of us old timers, that ain’t a rate that screams risk. And you have the Fed to thank for imbedding ‘lower forever’ into the psyche of the markets.

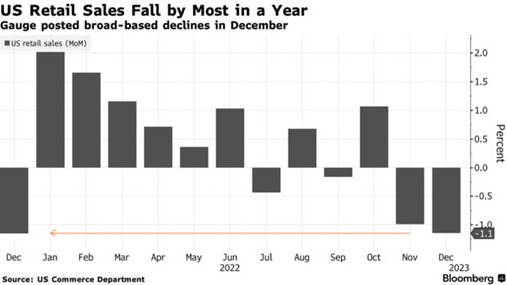

In a further sign of the times that the inflation trade might be over, retail sales in December declined by the most in a year. Why is this a big deal? Real simple. If goods at the market are slower to get off the shelf, the guy or gal looking to unload that inventory has two choices. Keep prices where they are and deal with less ringing of the register or start marking things down to get product to move. The latter is what will happen, and that will start to take some of the sting out of what has been a front-page story for months now.

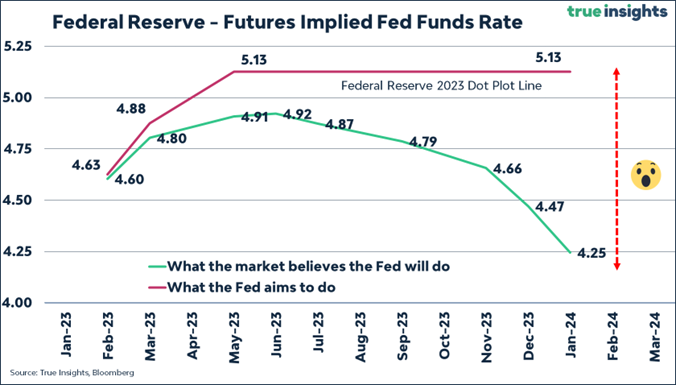

As we’ve been saying, stop following the Fed and start watching the bond market. The ball keeps bouncing, make sure you are keeping the eye on the right one. It’s telling you what you need to know.

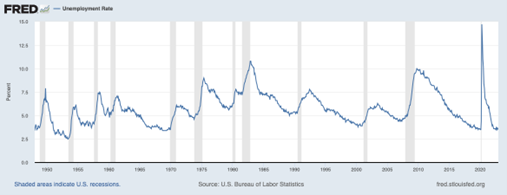

Last chart of the week in this chart heavy edition is that of unemployment. This is the 75 year chart of the data series and 3.5% to 4.0% on the unemployment has been the floor, and could be this time as well. Simply too many pink slips hitting the streets.