This Week in the Markets

by Bryan Goligoski - Axxcess Editor at Large

We heard recently that June is to summer what Friday is to a week. That July is to summer what Saturday is, and August is the Sunday of summer. That’s an interesting way to look at things, except to those who get cases of the Sunday blues, which would make from here on out about as fun as watching the Detroit Lions suffer through another year of broken dreams and busted records. But never fear, Matthew Stafford is here, to remind us that we are just one trade away from going zero to hero. The best of times is now. What’s left of summer is but a faded rose.

If July was indeed summer’s Saturday, then it’s been a pretty good weekend so far, as stocks found stronger footing and the bond market took some time off from scaring the living hell out of economists and marketeers globally. And for all the talk about the shape of this recession, and the perils of inflation, the S&P 500 is about as normal a correction as they get. And we are still way higher from where we were in the early spring of 2020 when the Fed started handing out gift horses that were not to be looked at in the mouth.

Source: Yahoo!Finance

Back to bonds quickly, the spike in yields that somehow caught the market off guard since the start of the year, stopped spiking. That too has taken the pressure off equities, and the Fed to some extent. With the short end of the curve almost guaranteed to be going up, and the long end taking a breather, the resulting flattening will setup a steepening environment later this year. That would be a big win for those in the bull camp, though there is still a way to go before we get there.

Source: Yahoo!Finance

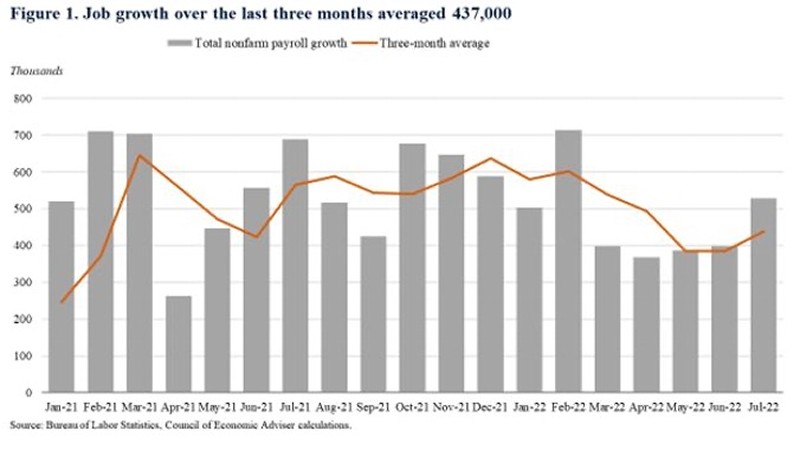

We held off a few days to write before the July jobs report was posted, and pretty much any way you look at it, the hard economic numbers are not letting the narrative of the economy being in a recession take complete hold. There is for sure still some strength out there.

Source: The White House

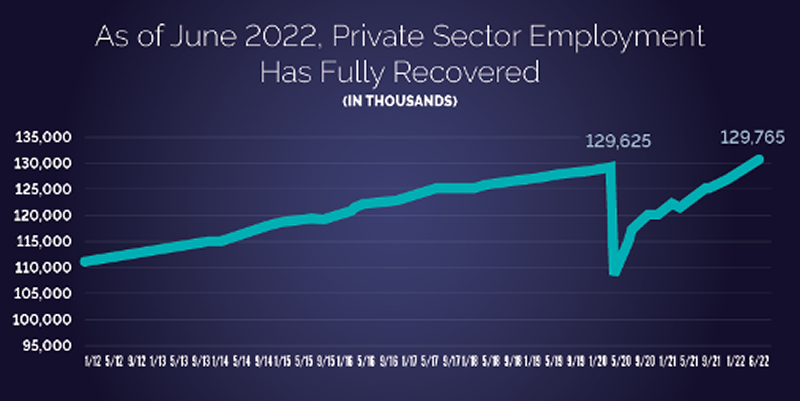

Which leads us to the last top-down chart of the week, and one that we put up there with the best evidence we have that the Fed for sure kept their foot down on the liquidity hammer for too long as we are back to pre-pandemic levels in terms of private sector employment.

Source: BLS

While there is strong temptation at this point in the story to go on another rant that says markets simply need to be left alone to their own pricing devices, our ice cubes aren’t marinated enough yet this week to take off the governor and let it rip. That said, we look forward to the day when there is no QE, and no QT, and pricing is no longer in the crosshairs of policy makers, but instead the true makers of markets. As always, there are to be no crybabies in the casino!

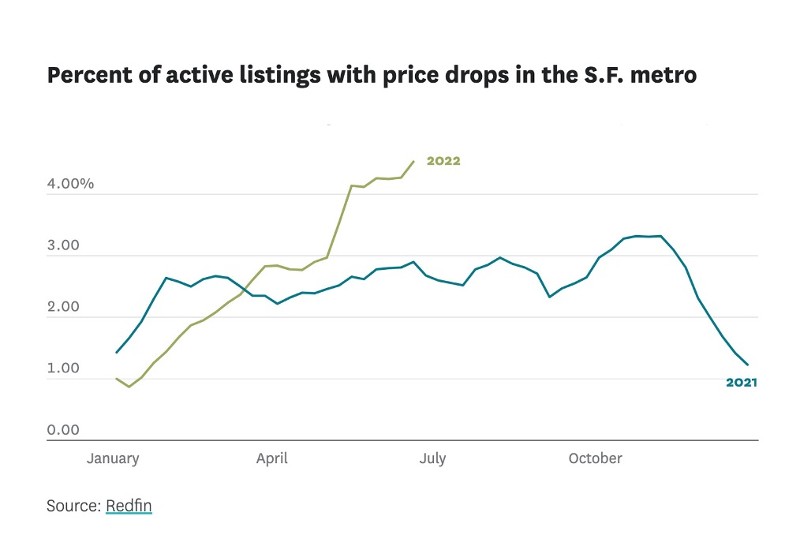

On the subject of crybabies and casinos, San Francisco sellers of real estate might be making the list if June’s price pullback becomes a true slump. For the first time, in a very long time, what it costs to buy a home in Baghdad by the Bay, longtime columnist Herb Caen’s term not ours, went down by a whopping 0.50%. That’s right, half a percent and suddenly the great one way trade is off. But a change in trend is indeed a change in trend.

Throw that into the short side of the levered pair trade with Dallas, where home prices that are up 20% year over year, and suddenly you are talking about real money. A true reversal of fortune from the last several times the Niners have taken over Jerry World while laying the wood to the Cowboys again. Way to travel, Faithful.

On the subject of San Francisco and the greater Bay Area, the author of this fine prose (myself) will be posted up here in the 408 for the remainder of the month. A lot of business, but also a lot of time spent with old friends in many of the places we called home in 70s and 80s.

Come later this month I’ll publish a retrospective Silicon Valley ‘then and now’ piece laced with firsthand stories of cherry orchards that are now prime real estate in the race to advance the world economy by expanding the infinite number of ones and zeros that run it. That too shall be explained. Those that know the story love the simplicity of it all.

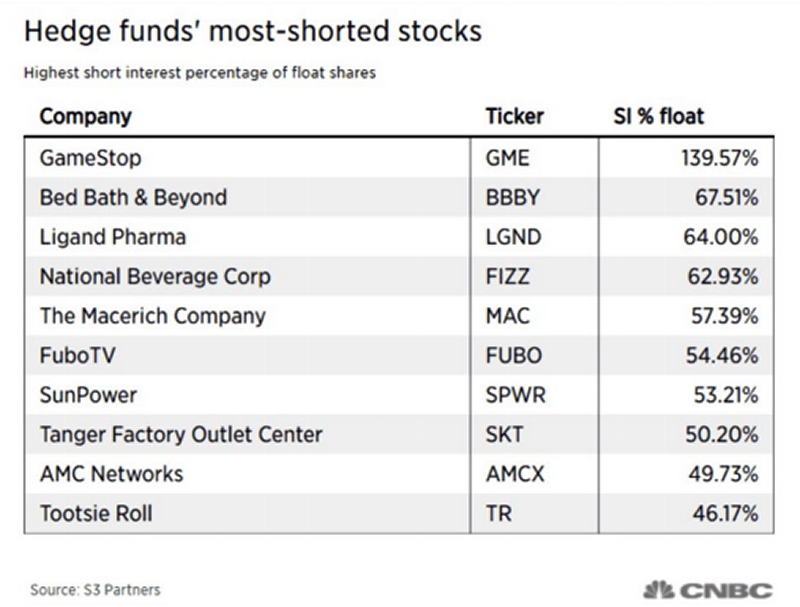

Not that we traffic in them on either side of the long/short ledger, but ‘meme stocks’ are showing life again. This is worth noting from a risk on/risk off perspective. When the animal spirits start to wake up, they tend to gravitate to the junkiest parts of the market. And there is nothing more junky than this list of Star Wars bar characters masquerading as quality companies with good fundamentals. Except of course, Tootsie Roll. I mean come on, what’s not to like?

With that, we are signing off for now. If this is indeed the Sunday of your summer, enjoy wherever it finds you. Whether it’s at the lake, in the mountains, on the beach, or still stuck in your home office, make it a good one. Nobody here is getting any younger, so enjoy it while it lasts. Happy 16th Birthday, RonDog, you earned it big man.