This Month in the Markets - October

By Bryan Goligoski - Axxcess Editor at Large

October was not been kind to the markets, and it’s looking like the worst in 5 years. But we are still positive on two out of three, the S&P 500 and the NASDAQ. That being said, these charts show that the markets are looking a lot like they are rolling over.

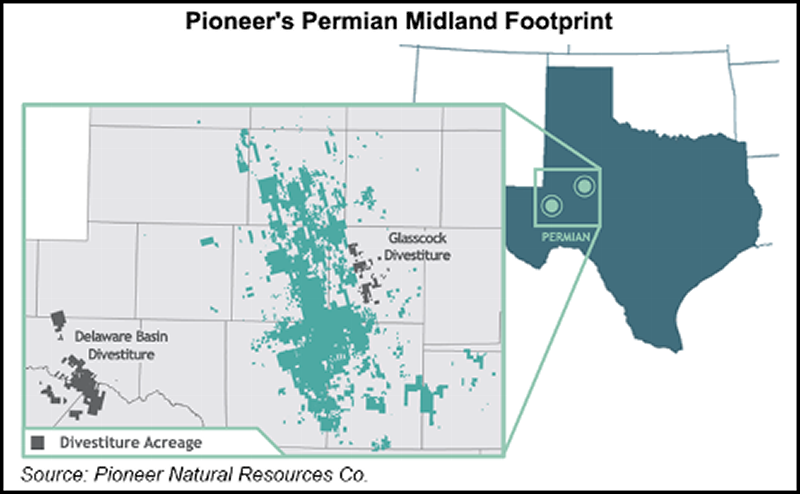

A huge deal went down in the oil & gas arena last week when supermajor Exxon bought shale pioneer, Pioneer Resources. Get it? The deal was valued at $60 billion and gave the former an even bigger footprint in the upstream side of the energy ecosystem. This is PXD’s Permian footprint. It isn’t small, and it’s as oily as Prince William Sound after Captain Tanqueray decided to hand the keys of the Exxon Valdez over to a junior officer.

Feeling guilty for missing out on the party, Chevon plunked down $53 billion for shale produce, refiner and retailer, Hess. While far more diversified than Pioneer, Hess provides a broader global footprint. Regardless, it’s party time for E&P bankers, looking to fill juniors stocking with GI Joe and his uber popular Kung-Fu grip before the holidays.

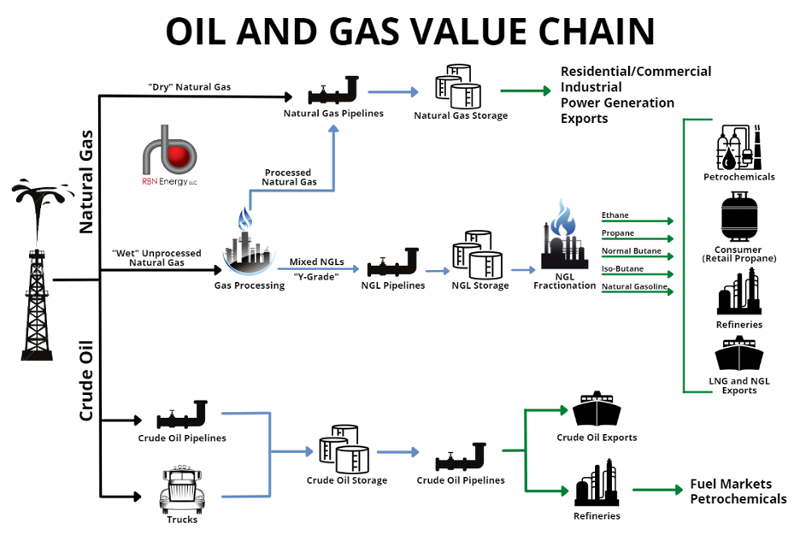

Quick digression, in a younger, but not that much younger life on Wall Street I was an oil and gas analyst for Nuveen’s satellite equity manager, Santa Barbara Asset Management. Maybe it’s the T. Boone in me, but dear God did I fall in love with the sector. It was one part the price of crude, and one part the upstream/downstream oil and gas value chain. This chart may not mean much to you, but ohhh dady, for a long/short specialist, this was manna.

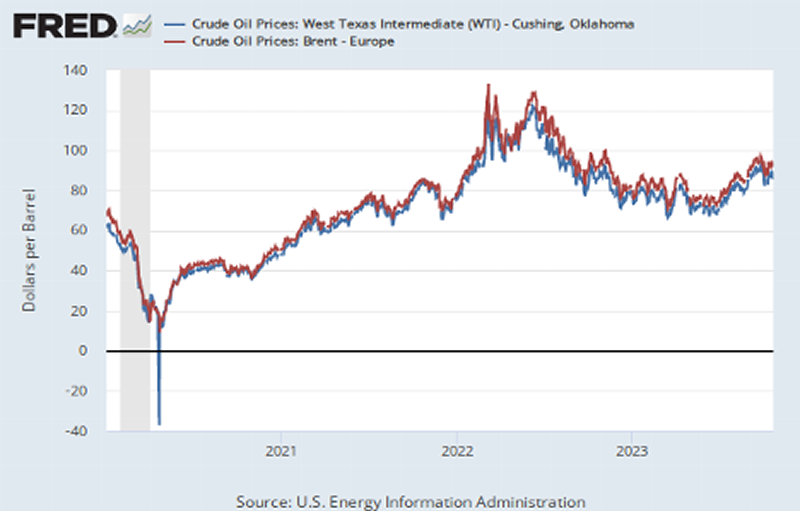

Now onto the economy, and what’s all the hub bub, bub? Well, it has a little something to do with a still reasonably strong economy, the excuse of inflation, and that God awful situation in the Middle East. And God awful it is. All of which leads you to a price knock, knock, knocking on $100’s door.

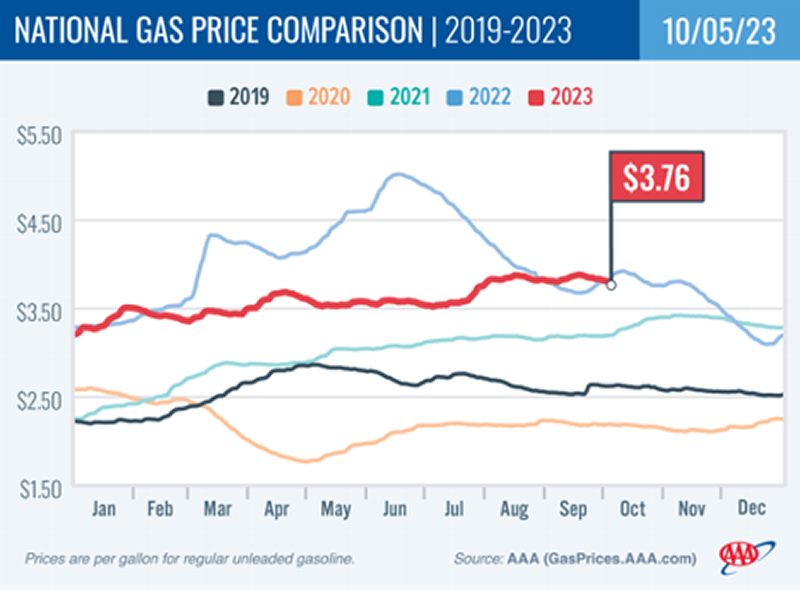

And that is what’s killing us all at the pump, and a killing we are getting. While dated by a month, this chart doesn’t lie. That’s a four year high, and a lot of people I know are throwing $40s in the tank, not $140s. And these aren’t particularly poor individuals.

Onward to things more real. My jaw was agape last week when Meta Facebook was sued by the attorney generals of several states over, you guessed it, the harmful effect of the platform has on the minds of kids. Hey guys, and most of you AGs are guys, this party has been going on for at least half a decade. Nice of you to join us.

And this was Meta’s pedestrian response, ironically shown here on Fox Business News. Which in and of itself, like other media outlets these days, its own form of a mental health bashing.

Digression, forget what social media and Facebook do to kids, look what it’s done to a reasonably well adjusted 50 years old father of three. While there are many a good aspect of firing up the iPhone and scrolling my feed of warships, fly fishing, world rugby, and a bunch of other respectable things, the platform still feeds me a brutal stream of things I can’t unsee. Like really can’t.

My loathe for Facebook runs deep. So much so that I penned one of my all time greatest pieces every entitled “The Big Facebook Short” in 2021. A big piece of why I did was to do my own little job of shining the light through the darkness. And just like every squirrel, I too found an acorn and caught the $350 to $90 short sale. Aside from the fraud that was Centennial Technologies, this was my single best short sale call of my life. Crazy to think that since the summer of 2017, the stock has traded in a range of $85 to $378.

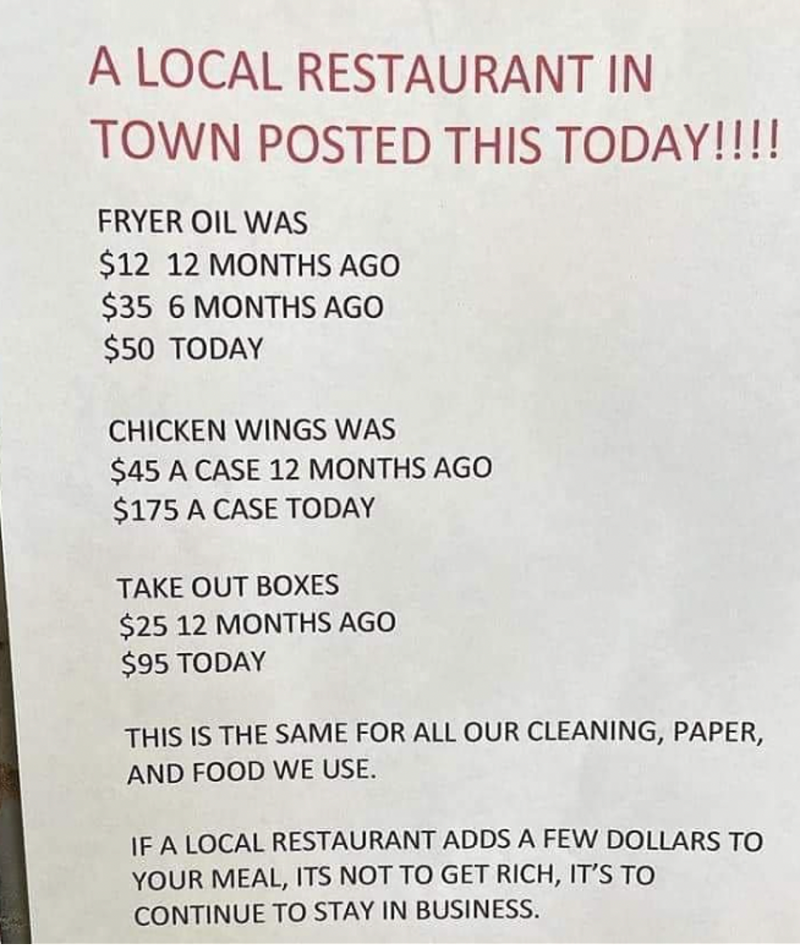

It continues to be a brutal world out there for those of us trying to avoid the creep of inflation. Maybe I’m just sensitive, but it seems like everything I touch, see, and feel these days is selling for 20% to 30% more than it was two years ago. Like everything! While Delmonico’s it is not, this is directionally accurate for everywhere I go.

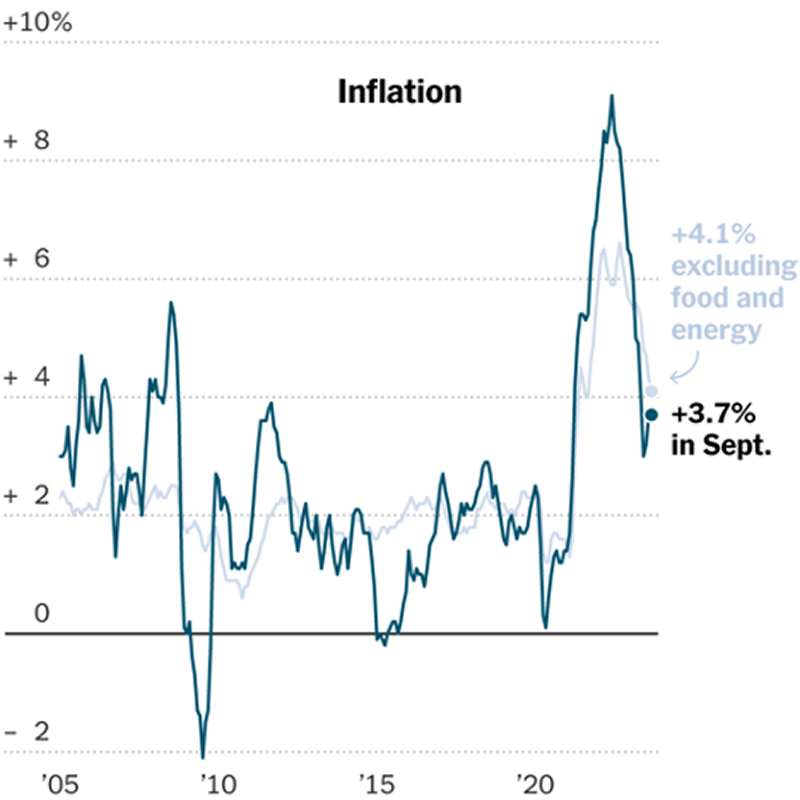

And while I don’t believe the government reporting of consumer prices, let’s assume inflation settles in at 4% for a while, which it could. That would mean prices overall will be roughly 25% higher in 5 years, and 50% higher in 10. Think the Fed can get off the throttle with that as backdrop? Think again. This is going to be a tough slog for a long time, in my opinion of course.

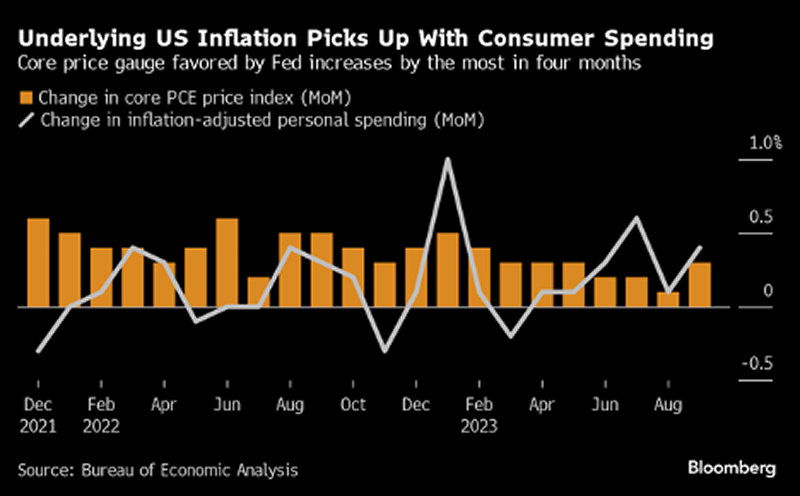

Regarding inflation, last week we got the Fed’s favorite inflation gauge, personal consumption expenditures (PCE) which basically measures how the consumer does in terms of buying in the face of rising inflation. And they are still buying, even in said face. And if that keeps happening, the Fed is going to keep rates at an elevated level. Higher for longer, baby.

In an unfortunate incident, that could have become really unfortunate, an off-duty Horizon Air pilot turned a macro dose of mushrooms and turned it into a macro dose, losing his mind in the process. Why am I pointing this out? Because you can mark me in the column of those who think psylocibin is going to be developed into a very important, and very commercial, drug for treating all kinds of mental health issues. All that said, magic mushrooms cannot be considered legitimate alternatives unless you get the dosing right. Otherwise, you are going to have more Joe Emersons on your hands, and nobody wants or needs that. But he looks happy in these pictures.

In a sad note, but one that was for sure on final approach, Wall Street legend Byron Wein has passed away at the age of 90. While Byron finished his professional life at Blackstone, it was Morgan Stanley where he made a name for himself. Back in the day he, Steven Roach and Barton Biggs would publish their musings and observations. And I ate it up like the finest filet I’ve ever been served. He made me dream big dreams during the early years of my career, and for that I will be forever grateful. Stay golden, Byron.

Concentrate on finding a big idea. Treat everyone you meet as a friend. Every year, do something you’ve never done – and more lessons from a lifetime of hard-won wisdom. Here are Byron Wein’s 20 lessons he learned in life, and I’m sure there are more.

- Concentrate on finding a big idea that will make an impact on the people you want to influence. The Ten Surprises, which I started doing in 1986, has been a defining product. People all over the world are aware of it and identify me with it. What they seem to like about it is that I put myself at risk by going on record with these events, which I believe are probable and hold myself accountable at year-end. If you want to be successful and live a long, stimulating life, keep yourself at risk intellectually all the time.

- Network intensely. Luck plays a big role in life, and there is no better way to increase your luck than by knowing as many people as possible. Nurture your network by sending articles, books and emails to people to show you’re thinking about them. Write op-eds and thought pieces for major publications. Organize discussion groups to bring your thoughtful friends together.

- When you meet someone new, treat that person as a friend. Assume he or she is a winner and will become a positive force in your life. Most people wait for others to prove their value. Give them the benefit of the doubt from the start. Occasionally you will be disappointed, but your network will broaden rapidly if you follow this path.

- Read all the time. Don’t just do it because you’re curious about something, read actively. Have a point of view before you start a book or article and see if what you think is confirmed or refuted by the author. If you do that, you will read faster and comprehend more.

- Get enough sleep. Seven hours will do until you’re sixty, eight from sixty to seventy, nine thereafter, which might include eight hours at night and a one-hour afternoon nap.

- Evolve. Try to think of your life in phases so you can avoid a burn-out. Do the numbers crunching in the early phase of your career. Try developing concepts later on. Stay at risk throughout the process.

- Travel extensively. Try to get everywhere before you wear out. Attempt to meet local interesting people where you travel and keep in contact with them throughout your life. See them when you return to a place.

- When meeting someone new, try to find out what formative experience occurred in their lives before they were 17. It is my belief that some important event in everyone’s youth has an influence on everything that occurs afterwards.

- On philanthropy, my approach is to try to relieve pain rather than spread joy. Music, theatre and art museums have many affluent supporters, give the best parties and can add to your social luster in a community. They don’t need you. Social service, hospitals and educational institutions can make the world a better place and help the disadvantaged make their way toward the American dream.

- Younger people are naturally insecure and tend to overplay their accomplishments. Most people don’t become comfortable with who they are until they’re in their 40’s. By that time, they can underplay their achievements and become a nicer, more likeable person. Try to get to that point as soon as you can

- Take the time to give those who work for you a pat on the back when they do good work. Most people are so focused on the next challenge that they fail to thank the people who support them. It is important to do this. It motivates and inspires people and encourages them to perform at a higher level.

- When someone extends a kindness to you write them a handwritten note, not an e-mail. Handwritten notes make an impact and are not quickly forgotten.

- At the beginning of every year think of ways you can do your job better than you have ever done it before. Write them down and look at what you have set out for yourself when the year is over.

- The hard way is always the right way. Never take shortcuts, except when driving home from the Hamptons. Shortcuts can be construed as sloppiness, a career killer.

- Don’t try to be better than your competitors, try to be different. There is always going to be someone smarter than you, but there may not be someone who is more imaginative.

- When seeking a career as you come out of school or making a job change, always take the job that looks like it will be the most enjoyable. If it pays the most, you’re lucky. If it doesn’t, take it anyway, I took a severe pay cut to accept each of the two best jobs I’ve ever had, and they both turned out to be exceptionally rewarding financially.

- There is a perfect job out there for everyone. Most people never find it. Keep looking. The goal of life is to be a happy person, and the right job is essential to that.

- When your children are grown or if you have no children, always find someone younger to mentor. It is very satisfying to help someone steer through life’s obstacles, and

- Every year, try doing something you have never done before that is totally out of your comfort zone. It could be running a marathon, attending a conference that interests you on an off-beat subject that will be populated by people very different from your usual circle of associates and friends, or traveling to an obscure destination alone. This will add to the essential process of self-discovery.

- Never retire. If you work forever, you can live forever. I know there is an abundance of biological evidence against this theory, but I’m going with it anyway.

DISCLOSURES

The contents of this commentary: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, and (ii) may not be relied upon in making an investment decision related to any investment offering by Axxcess Wealth Management, LLC (“AWM”), an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure.

Market data, articles and other content in this commentary are based on generally available information and are believed to be reliable. AWM does not warrant the accuracy or completeness of the information contained herein. Opinions are the author’s current opinions and are subject to change without notice. The views expressed in this commentary are subject to change based on market and other conditions. This commentary may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information contained above is for illustrative purposes only.