This Month in the Markets - November

By Bryan Goligoski - Axxcess Editor at Large

It’s out there, and it’s pervasive. Cross asset rallies, sure. Best bond market move since the 1980s according to Bloomberg, that too. Stocks in line to have a strong year, at least according to the big indexes, Bingo & Yahtzee. The antiquated phrase ‘Santa Clause rally’ is going to have to take a back seat to a potential mindset shift in the markets going on right now. One that says monetary tightening is over. The lean calf has been brought to market and slaughtered, bring the fatted one back. Markets love the fatted one.

Moments like this, when you start to see a change at the margin, are special for those of us who have been around markets for a while. It’s the change, and the intrigue of who can detach from their anchor with charm and humility. It isn’t easy, especially in a world of apex feeding master of the universe who stand at the podium and sell you their oil of the reptilian kind.

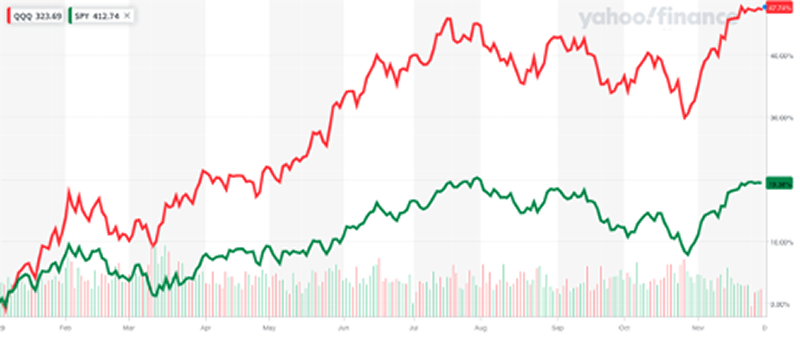

Too much? Maybe. But we shall see what happens when well pedigreed guys and gals need to start chasing the indexes to be able to keep up and afford those jewels around their girlfriend’s neck and that G.I. Joe with the Kung Fu grip for the kid. The NASAQ is knocking on the door of a 50% return on the year while the S&P is up almost a ‘paltry’ 20%. Not bad, not bad at all.

Source: Yahoo Finance

Digression, jewels around girlfriend’s necks and Kung Fu gripping G.I. Joe for the kid are references to “Trading Places”, the second-best Christmas movie ever behind “It’s a Wonderful Life” by my reasonable estimation. “Looking good Billy Ray, feeling good Louis”

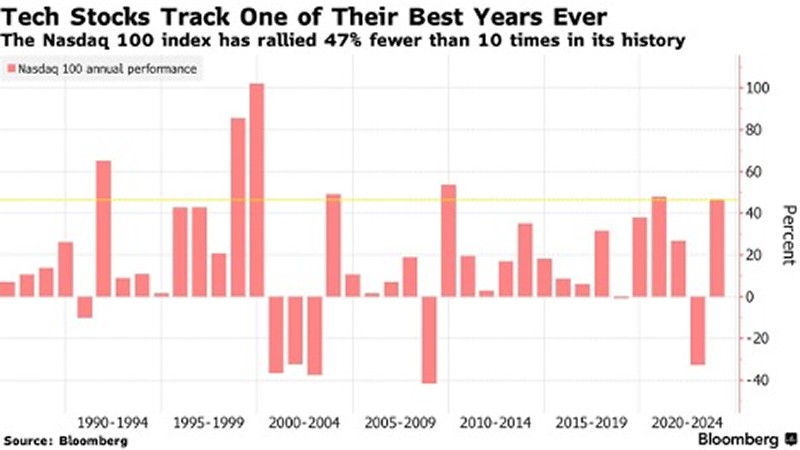

This monster of a rally in technology, better than 45%, has only happened seven times in the history of NASDAQ. And aside from the popping of the dot.com bubble, the year following such big moves has been pretty good as well. This has indeed been a profitable party to be hanging around at.

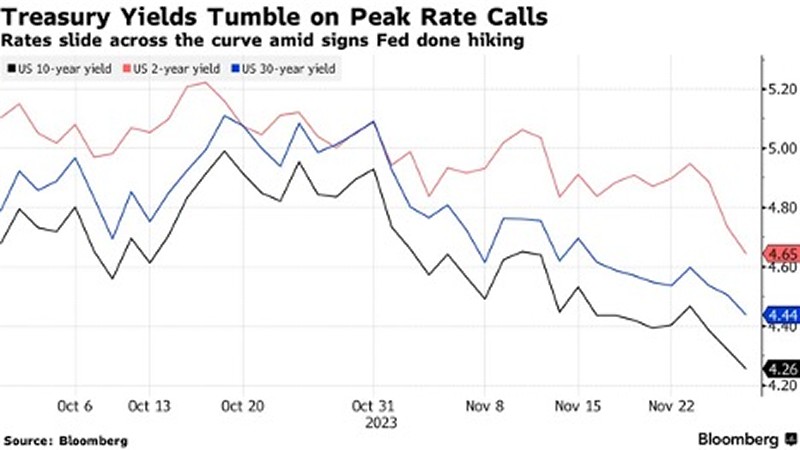

Did the economy get that much stronger in the last month? Negative. Did employment spike as the jobs-o-plenty trend continue? Not Really. But did the core measure of inflation the Fed looks at, the Consumer Price Index, finally mellow? Yes, it did. And that changed everything…in a hurry. In this chart somewhere is the 10-year Treasury Note and it went from almost a 5% yield to 4.26% in the last two months.

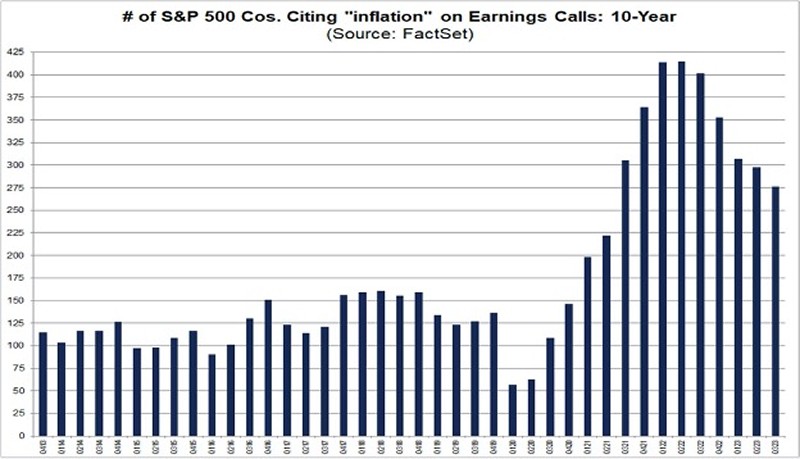

Related to that is this interesting chart I found from FactSet’s Earning Monitor, and it shows how references to inflation peaked a few quarters back, and that further confirms what the bond market is telling us.

Source: FactSet

Before we all get too carried away with this moment in time, there are still smart people out there who think that inflation is pervasive and will be here for years to come. Biggest name that comes to mind is Citadel founder Ken Griffin who earlier in November said the ‘drunken sailor’ spending behaviors exhibited during Covid could have impacts that last decades, and not all of them are good ones. And Ken has $35 billion in his back pocket that says he knows something about something.

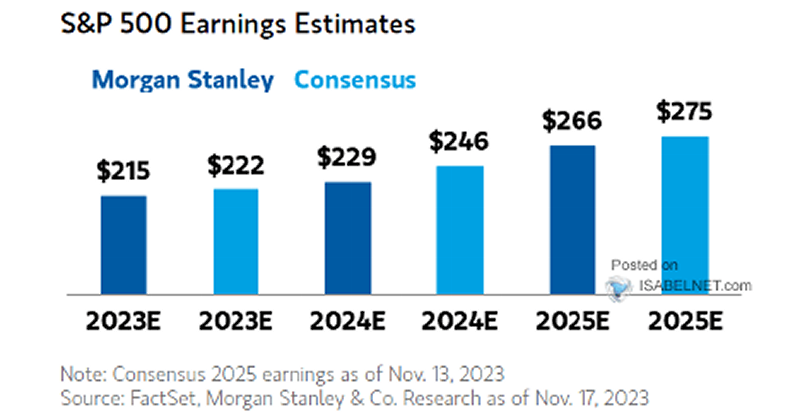

To counter Ken’s big picture, let’s look at a not so smaller one, earnings. As the economy has returned to some sort of normal, so have earnings. Whether it be Morgan Stanley, or consensus, the next three years could be showing the kind of trajectory that supports stock valuations at these levels.

Source: Morgan Stanley

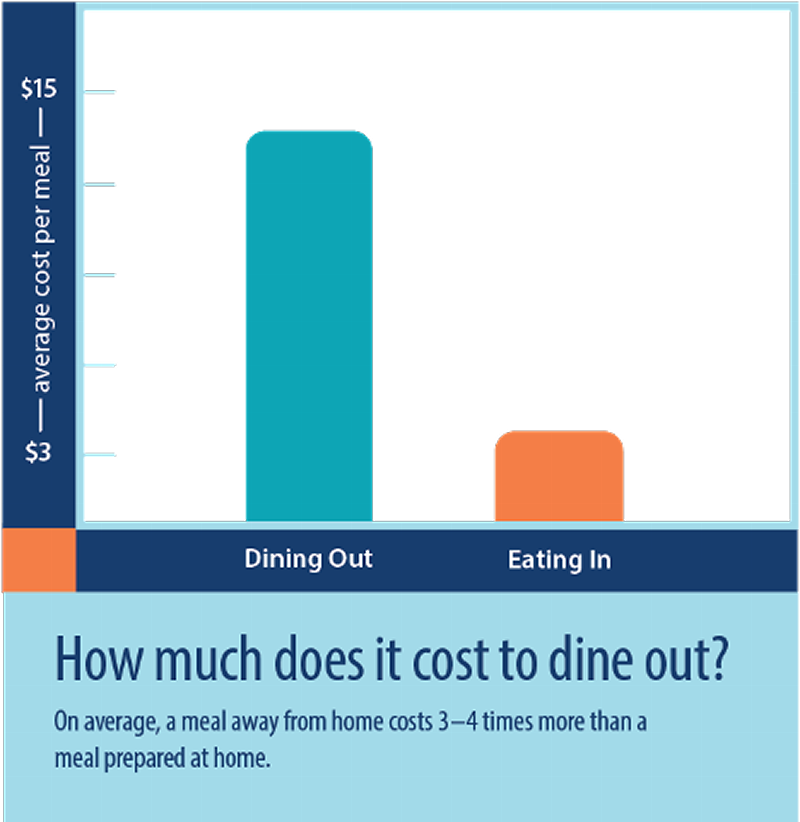

Digression still, as everyone and their brother, mother, sister, and friends appear to be making money hand over fist these days, I’ve decided that I too need to take advantage of this newfound wealth amongst rising prices. Don’t laugh, but I plan on exploring the idea of creating some form of a cookbook and line of culinary products that bring haute cuisine to the mainstream and do so at a fraction of the price of going out. Like real restaurant quality ideas, not the faux marketing kind.

Source: Money Management International

A plate of six ravioli and a glass of fermented grape in San Mateo, California earlier this year that cost me $70, has me hell bent on seeing this become a reality. Stay tuned, your personal “Sous Chef” is going to make an appearance in 2024, I hope.

The world lost some big names this past month. Among them were Henry Kissinger, Charlie Munger, and The Little Pro, Eddie Merrins. The only tie in I have to Henry is he lied to my long since passed grandfather-in-law, Franklin Murphy, about the United States going over the border and bombing into Laos. Ooops, probably shouldn’t have done that to the National Security Council, Hank.

Charlie Munger, Warren Buffet’s longtime partner in creating Berkshire Hathaway, passed away at the tender age of 99 this week. For those of us who knew the Los Angeles private club scene, Charlie was a bit of a fixture. At the venerable Los Angeles Country Club, he held court in the card room with a dominant Bridge game. After another pedestrian round of 18 at LACC I would walk by where the gentlemen of an older generation were solving things over a deck of cards. And almost every time, there would be Charlie Munger in his perfect WASP uniform of grey slacks, a blue blazer, and rep tie. Whether he knew it or not doesn’t matter, but he intimidated the living hell out of all of us.

Some of the many words of wisdom from Charlie Munger…

On investing in tech:

“We were not ideally located to be high-tech wizards. How many people of our age quickly mastered Google? I’ve been to Google headquarters. It looked to me like a kindergarten.” - Berkshire Hathaway meeting, 2018

On algorithmic trading:

“We have computers with algorithms trading against other computers. We’ve got people who know nothing about stocks, being advised by stockbrokers who know even less.” - Berkshire Hathaway 2022 meeting

On learning:

“I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than when they got up and boy does that help—particularly when you have a long run ahead of you.” - 2007 USC Law School Commencement Address

On sitting tight:

“There are huge advantages for an individual to get into a position where you make a few great investments and just sit on your a**: You are paying less to brokers. You are listening to less nonsense. And if it works, the governmental tax system gives you an extra 1, 2 or 3 percentage points per annum compounded.” - Worldly Wisdom by Charlie Munger 1995 - 1998

On marriage:

“I think life is a whole series of opportunity costs. You know, you got to marry the best person who is convenient to find who will have you. Investment is much the same sort of a process.” - 1997 Berkshire Hathaway Annual Meeting

On the government deficit:

“A man who jumps out of a building is OK until he hits the ground.” - 2023 Berkshire Hathaway annual meeting

On mastering our emotions:

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success.” - Kiplinger interview, 2005

On problem solving:

“Invert, always invert: Turn a situation or problem upside down. Look at it backward.” - Poor Charlie’s Almanack

On passion:

“You’ll do better if you have passion for something in which you have aptitude. If Warren Buffett had gone into ballet, no one would have heard of him.” – Berkshire Hathaway annual meeting, 2008

On mismanagement:

“Invest in a business any fool can run, because someday a fool will. If it won’t stand a little mismanagement, it’s not much of a business.” - Poor Charlie’s Almanack

On inflation:

“If I can be optimistic when I’m nearly dead, surely the rest of you can handle a little inflation” – 2010 annual Berkshire Hathaway meeting.

On success:

“It’s so simple. You spend less than you earn. Invest shrewdly, and avoid toxic people and toxic activities, and try and keep learning all your life, etcetera etcetera. And do a lot of deferred gratification because you prefer life that way. And if you do all those things you are almost certain to succeed. And if you don’t, you’re gonna need a lot of luck.” - Poor Charlie’s Almanack

On old age:

“The best armor of old age is a well spent life preceding it.” – Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway’s Vice Chairman on Life, Business, and the Pursuit of Wealth With Commentary by David Clarkhis

And finally, the world said goodbye to one of the kindest men to grace God’s green earth, Eddie ‘The Little Pro’ Merrins, the true ‘Prince of Bel Air’. Eddie was the Head Pro at the Bel Air Country Club for longer than anyone can remember. He also turned a moribund Ucla golf team into a national title winner.

I’ve been around a few special places in this lifetime, one of them was Bel Air Country Club where Eddie truly was the place. It didn’t matter your state in life, the size of your bank account, or your golf handicap, the Little Pro was kind to everyone.

I was lucky enough to have a few encounters with Eddie over the years, and like everyone else, he was good to me. Not good enough to turn me into the golfer I wanted to be, no that’s near impossible. But he always took the time to connect, to check in, to ask how you were doing in a very genuine manner.

My best story comes from 26 years ago today. It was the day after my wedding reception at BACC and they were still tallying the record bar bill when I got a call looking for a missing golf cart. It took me one call to a fellow jackass fraternity brother of mine to find out it had made its way to Brentwood from the night before.

Upon retrieving it, and driving said cart down Sunset Boulevard in the pounding rain, I pulled into the porta cochere at Bel Air where Eddies’ wife Lisa was dropping him off for work that day. He congratulated me on finding the cart and bringing it back to where it had regularly started its day.

When I told him the guilty party was the son of Dennis Moriarty, the then President of the Olympic Club in San Francisco, he responded in that sweet slow southern drawl and said, ‘Well, I do believe that entitles us to some reciprocal privileges, now doesn’t it’. Stay golden, Eddie. See you on the first tee again someday.

The contents of this commentary: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, and (ii) may not be relied upon in making an investment decision related to any investment offering by Axxcess Wealth Management, LLC (“AWM”), an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure.

Market data, articles and other content in this commentary are based on generally available information and are believed to be reliable. AWM does not warrant the accuracy or completeness of the information contained herein. Opinions are the author’s current opinions and are subject to change without notice. The views expressed in this commentary are subject to change based on market and other conditions. This commentary may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information contained above is for illustrative purposes only.