This Month in the Markets

with Bryan Goligoski - Axxcess Editor at Large

To know me, is to love me. And to also know that I can get really excited about things. Full disclosure, I’m pretty excited right now. For a (recovering) market junkie like myself, these are incredible times. Like the best in a while. The Fed is getting off the throttle, layoffs are coming, Chuck Munger is telling it like it is, bank credit is tightening, and on top of it, the Surgeon General just told us that loneliness is like smoking half a pack a day. How about being happy and still getting to take down just a few Marlboro Reds? Next level, win, win.

Full disclosure, cigs are nasty, and the few times a year I’m in a Vegas casino I’m still shocked that people can suck down these burning sticks of nastiness. But I digress, this is a great moment for markets as it is rare to get this many cross currents pushing against each other. And the effect? Stocks likley won’t go down. Not that they are going up a lot, but they simply won’t really go down. That 8.6% return for the S&P 500 through yesterday, is a pretty good result. Further juiced if you factor in dividends.

Now let’s step back and get a little bigger perspective. Reminder, we live on a giant space rock, floating with other space rocks. There are so many space rocks in the universe, floating with other space rocks, that some incredibly bright physicists believe that everything that has happened on earth, has also happened on another space rock. Now that, my friends, is truly big picture.

Back to the subject at hand. Since the pandemic broke out in the early months of 2020, markets have put up some good gains, even when giving back the monster upside experienced from mid-2020 to year end 2021. With tensions building on many fronts, it’s my reasonable observation that this chart shows the range in stocks for the next couple of years. Not great for outsized right tail returns, but by no means a Global Financial Crisis style ‘bid wanted’ scenario.

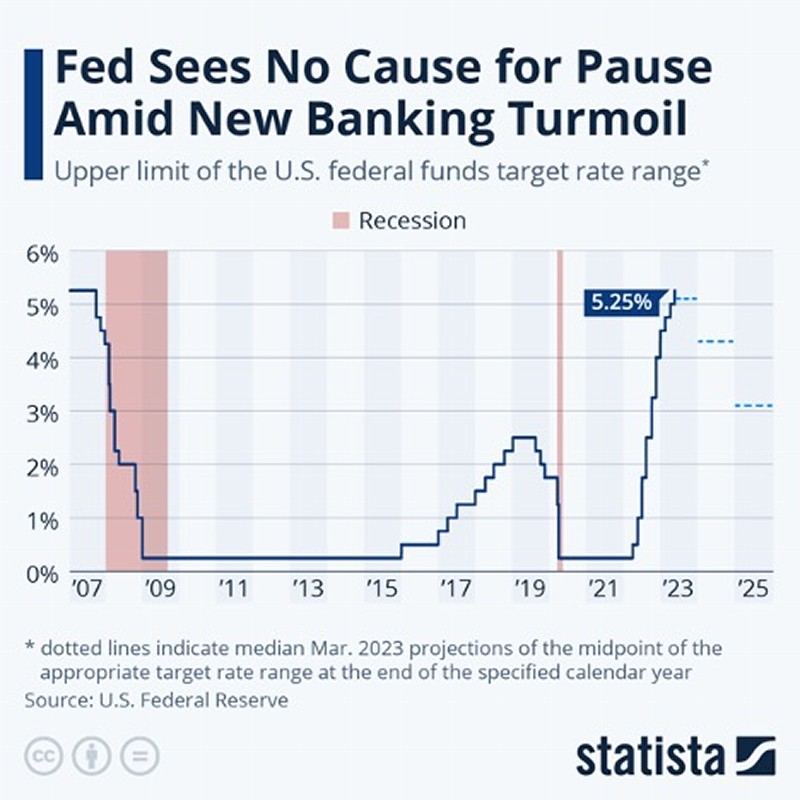

Biggest news recently from the macro perspective was the Fed tightening two weeks ago, taking the target rate to 5.25%. As has been well documented, this is the highest its been in 16 years. It is also the rate that was hit right before the housing crash and global financial crisis of 2008. Take that one step further, this was the prelude to when the Fed’s ZIRP (Zero Interest Rate Policy) started.

Following this tenth rate hike since the inflation jihad was declared, Powell, the Fed Chairman did the unthinkable during his press conference that followed. The crazy fool said….

“It’s possible that this time is really different.”

No, flat out no! It’s never ‘different’. And every time that type of thinking starts to kick in, bad things happen. I’ve been doing this for 26 years, and that phrase has a 100% success rate for portending a smack of reality. And as my main man Iron Mike said prophetically, ‘everyone has a plan until they get punched in the face.’ Love you, Champ(s).

Here is one reasonable piece of reality that is going to smack hard, in my reasonable and humble opinion, inflation is not going back to where it was. Barring a hard landing and severe demand destruction, it likely isn’t going to happen. Producers of goods and services probably aren’t going to give back that much cherished, and hard to come by pricing power. They will come down in price, but not back to pre-pandemic levels.

You all know that I lamented hitting the bid at $2.1 million for my house in Santa Barbara late in 2018, only to watch it trade for $4.5 million last month. Part of the reason to sell was that ‘the giving house’ had done its job being in the right school district. But I also followed the trendline at the time thinking mortgage rates were going to go higher, making it less easy to pick up and move. Doesn’t matter that these are Freddie Mac rates, it’s the same picture for all mortgages.

Good news, bad news, at least for me. Last year I claimed residency in the great state of Montana, making me a now 5th generation in my family. With that comes a far lower cost of living, and home prices. The bad news, I’ve been out of the market waiting on better prices that never came. In fact, they doubled, and I wasn’t interested in chasing them. Sour grapes? 100%. But I’m doing better at lamenting life’s missed opportunities. ‘Being present’ is what I think the hip kids are calling it.

Couple of more items from the top down before we get to some of the real nitty gritty good stuff. Ed Hyman, Chairman of Evercore, and a guy who has seen a lot in his days, is calling for a recession starting right about now. One that he has ‘never seen this far out’. Same story as everywhere else, too much liquidity was provided, and now it’s being drained faster than Dave Robert’s can suck down a Dodger bullpen. Well played, Ed, not only a power backdrop there, but you were not afraid to wear white before Memorial Day.

Another story that has been making the rounds, and as I have found to be true myself, is bank lending has gotten tight in a hurry. And let me also point out that this bi-polar monetary policy has created manic markets. Just look at how stable things were from 2010 to 2020. That’s what a healthy lending environment should look like. The volatility we’ve seen in the last two years is like nothing on record. Slow your roll, Mr. Fed Chairman. Slow yo’ roll.

An aspect of this condition, which has also been flogged by seemingly everyone that has been brought out on CNBC, is that smaller banks have gotten crushed this year, and for good reason. They had extremely levered balance sheets, got sideways in treasuries, and clients pulled the rip cord. Tough to have a healthy lending environment when failures could come at any time. Literally, any time.

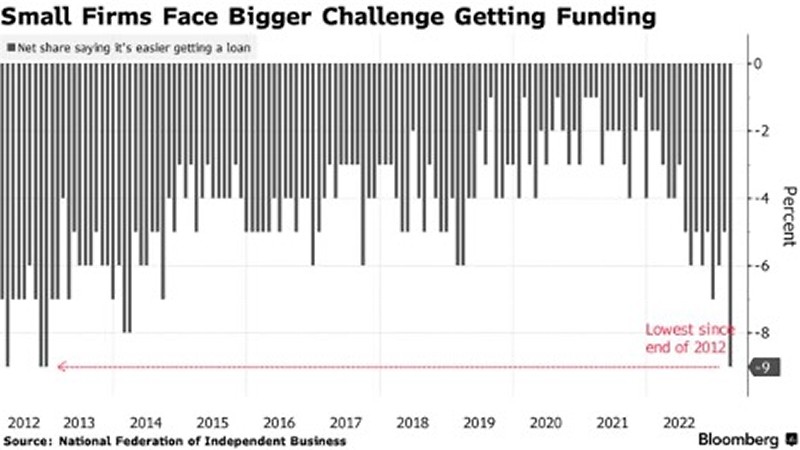

All this leads into the exasperating experience for the owners of Skinny Dips & Salsa, myself included, have had to live through in our quest to build a $100,000 revolving line of credit. Before I tell you our tale, look at this chart. It paints a scary picture. That’s a doubling of the delta between what small borrowers were thinking when it comes to the availability of credit to them.

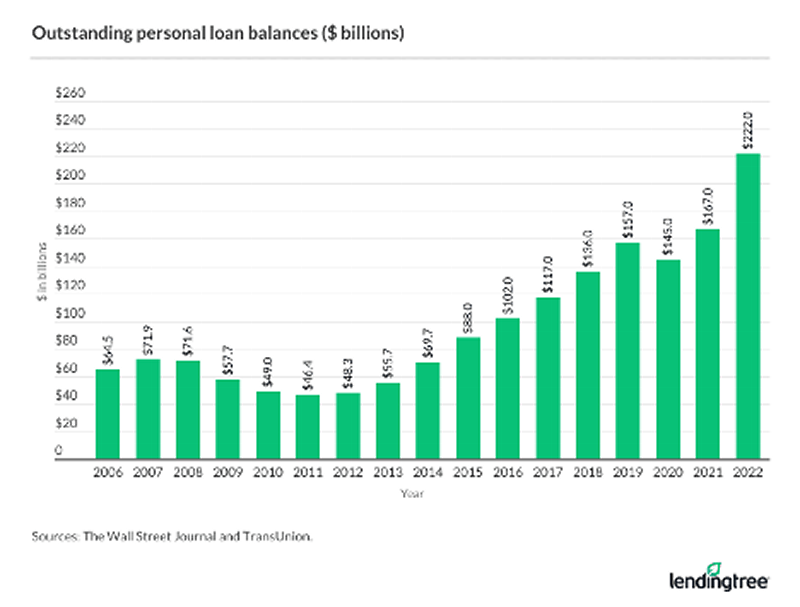

We aren’t alone in going out to the market and trying to get our hands on some unsecured private debt. Turns out a boatload of other people are out there doing the same, clearly with some success. Personal loan balances have gone up 50% in the past two years. Even while it’s a small part of the overall debt market, this is going to be a problem when we enter recession.

Like I said, we’ve been out beating all the bushes we can in a search for dough. Earlier this week, my co-founder and I, went down the path with a loan broker focused on smaller lenders. Turns out our 12% offer on the revolver is half of where the market is. That’s right, the borrowing rate for a young company, with respectable prospects, is a whopping 18% to 24%. That’s a low chance of survival lend. The source on this chart is Zippia.

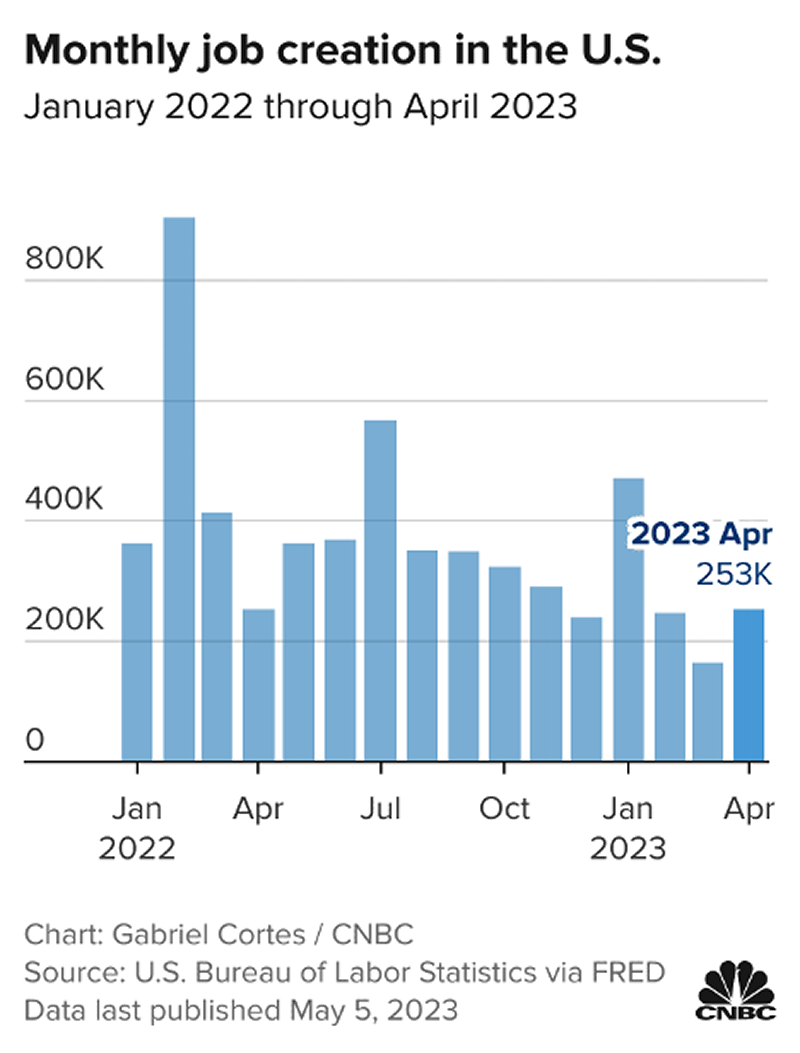

A couple of weeks back, the BLS released the April jobs report and it continued to defy observers who think that we are going to see an uptick soon. So far, no such luck. But it feels very much like there could be a change at the margin headed our way. But in this bizzarro world, fewer people entering the labor market would probably be applauded by the markets.

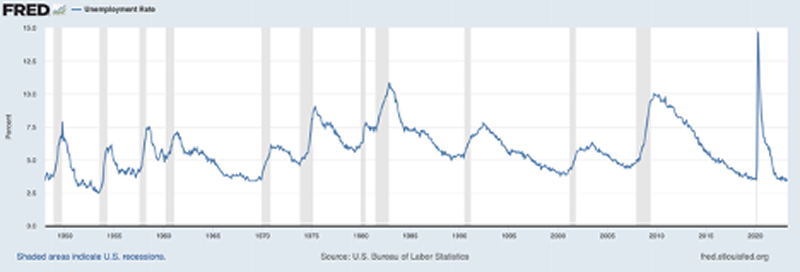

And the unemployment rate keeps ticking lower, ever so slightly. But notice, just as everyone else has, for this data series, it’s usually brightest before the dusk, not darkest before the dawn. And 3.5% has been just about where it bottomed right before each of the last three recessions.

Last week Microsoft announced that they were putting a freeze on wage increases for the full year. This was based partly on concerns over where the global economy was headed, more importantly, there was mention of spending money to gear up for a year of spending on artificial intelligence initiatives.

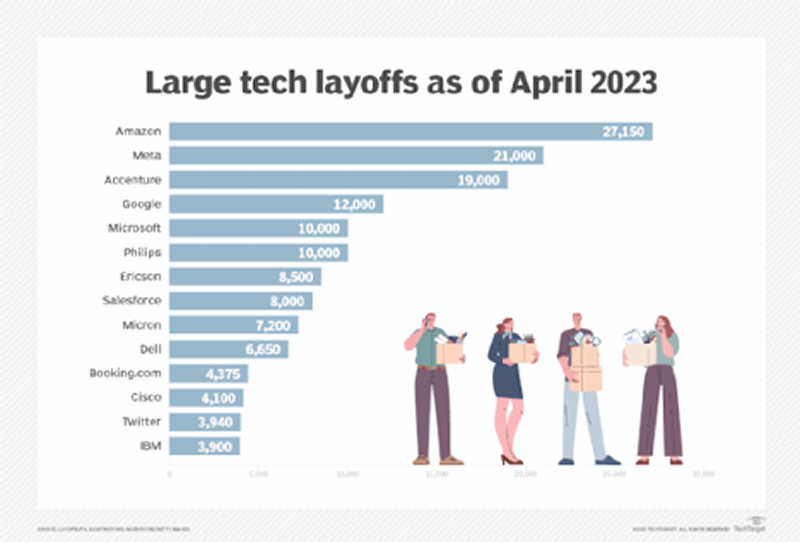

And since I’ve run this image in the past, or one like it, might as well stay consistent. While these may look like big numbers, all in they are less than 150,000 live bodies working. IBM at 3,900 layoffs isn’t even a number worth passing on. I mean, come on, there are 300,000 working for Big Blue worldwide. This chart is courtesy of TechTarget.

The annual Buffett/Munger fest came and went last week and once again, Chuck let loose. For those of us in the investment management business, we must process his quip that we are in aggregate, ‘fortune tellers or astrologers who are dragging money out of their clients’ accounts’. But he also offered up his own self-deprecating comments that he lived in a perfect time to be a common stock picker. Further adding ‘Our success was by and large the result of low interest rates, low equity values, and ample opportunities’. Ahh, to be born at the right time.

There has been much speculation about what impact the runoff from this year’s record snowfall out west is going to have. We’ve seen a decent amount of agricultural damage in California, and this year 90% of the State was under a flood watch, while only 2% of the state’s population had flood insurance, as reported by the Los Angeles Times.

Now it’s Chevron’s turn to deal with it. The company’s Bakersfield heavy oil facility is being shut in and levees are being built up ahead of the pending rise in the Kern River. There is too little production to make a difference in crude prices, but it’s an interesting situation, nonetheless. The discovery well where oil was first found lies in the upper left portion of the photo and is about 20 feet from the water. I went looking for it on my 45th birthday. True story.

Back to where I started this week’s piece, the epidemic of loneliness, and how it’s impacting the mental health of a whole host of people, present company included at times. I lost a dad to the mental pounding isolation caused during Covid, and he called his own exit at the end. But he was a good man, a kind man. ‘Stay gold’…..

This week the Surgeon General, Dr. Vivek Murthy released 70 pages on the cause, effects, and ideas for getting out of this malaise, the subtitle of which is ‘the healing effects of social connection and community.’ Read it, just as I plan to, ‘The Epidemic of Loneliness and Isolation’. With a high degree of certainty, laying out sandbags with my fellow Red Lodgians, and doing our best to keep the town safe, should fill my need for social connection and do the community some good.

“Take care of yourself. You’re the only one of you you’ve got.”

Disclosure:

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Axxcess Wealth Management, LLC (“AWM”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure. The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. The information contained above is for illustrative purposes only.