This Month in the Markets

with Bryan Goligoski - Axxcess Editor at Large

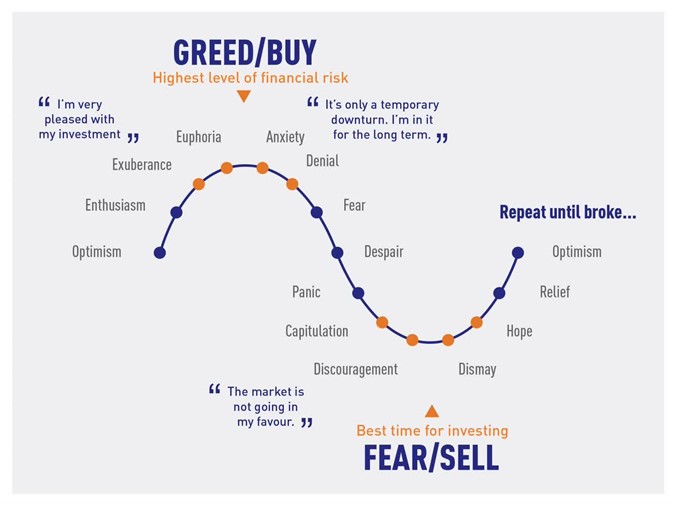

Welcome back, friends. It’s a crazy world out there right now, and a little time off the grid is totally responsible thing to do. There is an extreme level of noise in the markets, economy, politics, and even life right now. Because of that, it’s tough to see clear signal. And that signal can be even more elusive the harder you look.

Point being, chasing noise is for the sake of chasing noise isn’t going to get anyone to heaven. In fact, just the opposite. It forces you to live in some manic purgatory, reacting to every piece of news as if it really matters. They can argue all they want on CNBC, but to what end? It’s certainly not much watch TV.

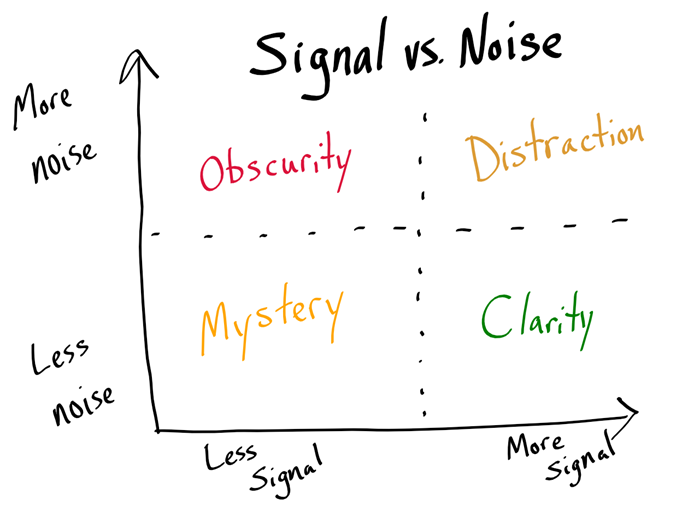

And to be clear as the day is long, not all the news that is out there truly doesn’t matter. Confused? This grid can help. Three of these quadrants are places where decision making gets clouded, oftentimes with negative consequences. One is not. Right now, it’s tougher than usual to get to the bottom right. Tough, but by no means impossible.

With that as backdrop, let’s travel down the rabbit hole and try to make sense of what is important, and discard some of the rest. The mind can be a crowded place, time to kick a few things out and focus. And if the fog of confusion is getting a little too thick, remember what Eckhart Tolle explained in the Power of Now. Ideas are just thoughts, nothing more. Be careful which ones you choose to give life to. Silent watcher? Sounds pretty Zen to me.

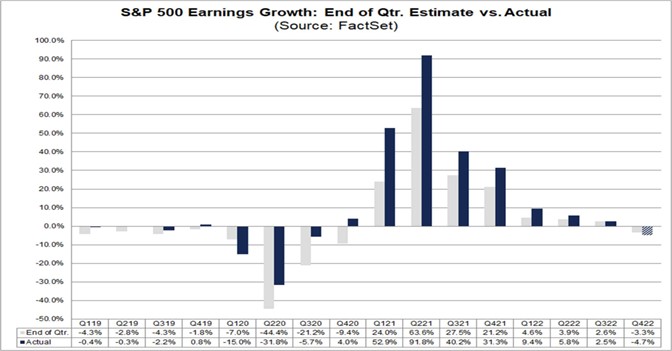

Now onto the signals we can see, and a look at what they mean. Earnings have been in contraction since the massive rebound following the onset of the pandemic. But is this truly cause for alarm? It would be tough to say it is given the fact that we are likely headed back to the baseline that existed in late 2019. Not an incredibly robust time for the economy, but also not one that was falling off the page.

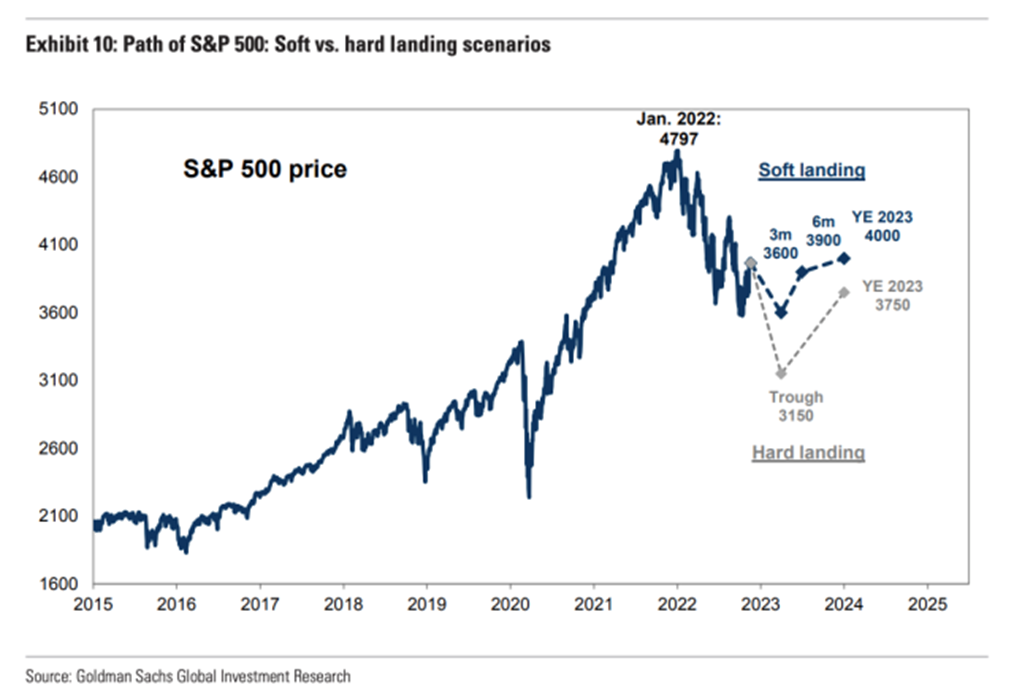

I found this really good chart from Goldman Sachs while searching the inter-web and it shows their view of what happens in a couple of scenarios, hard landing versus soft landing. No great shakes on the upside, but a decent sized contraction in the markets if the economy hits a liquidity bust wall.

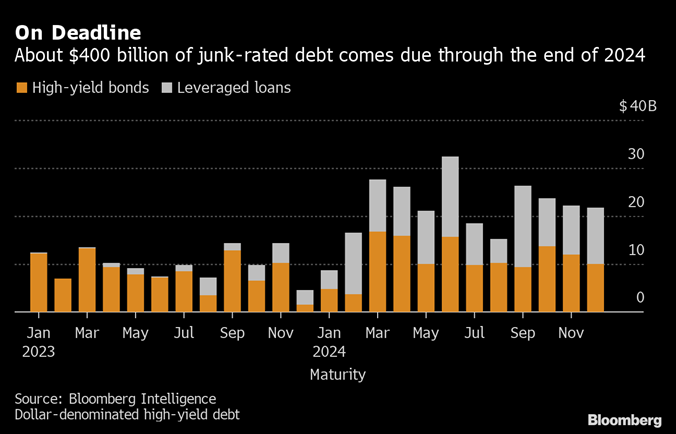

If you want to feed a bear a fat bone, show him a chart that looks something like this. If the Fed doesn’t tame inflation, and rates are going to stay higher for longer, then any company or individual carrying a distressed debt load is going to be forced to refinance in a rising rate environment. And this will be the first time since 1981 that will be the case. That’s a record going back forty years. I was ten when that happened last. Ten!

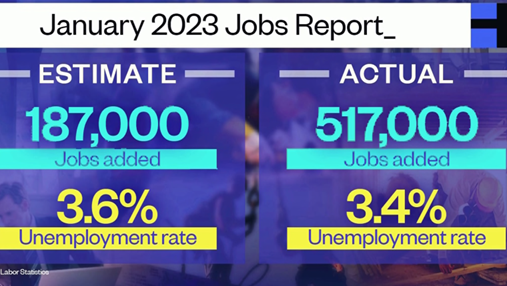

Now, let’s focus on the conundrum of conundrums right now. The thing that is throwing off the most noise of them all. And the question is this, how can it be that the economy is slowing down, and we see big headline numbers that talk about layoffs, but we still added more than 500,000 employees to the payrolls last month. That’s a huge number, by anyone’s standards.

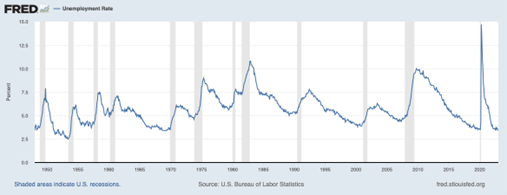

I look at charts like the following and say that we are near the end of this trend. But if I’m right, I’m not right yet. Maybe it shows up by summer. But if not, all bets that the Fed can holster that tightening pistol are off.

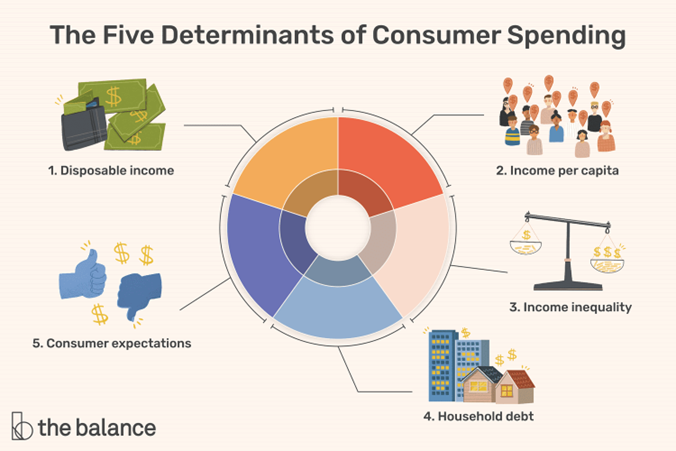

Want to throw some more noise and obscurity into the mix? There is frightful propaganda like this out there…everywhere.

You want to scare mom, pop, sister, brother, cousin, best friend, college sweetheart, and the chick you met at the bar whose name you can’t remember into sitting on their wallet, start talking about the coming recession and disposable income taking a hit.

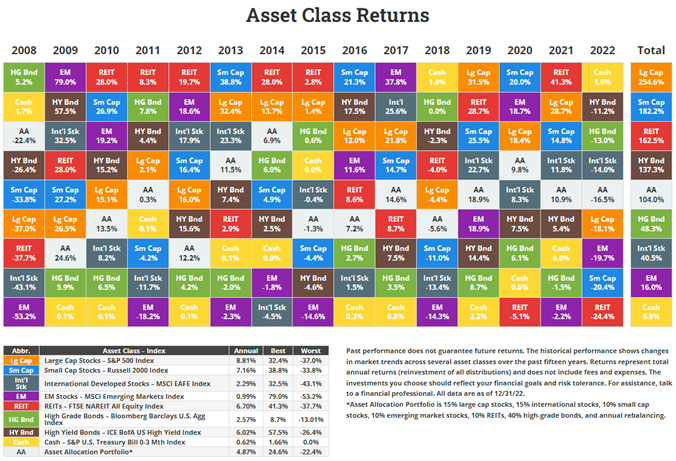

The problem for the prudent bears, self included, is that asset prices reflect recessions well in advance of them showing up. So, who cares that one might be coming, or not. Asset prices are discounting mechanisms, and a boat load of risk was taken out o in 2022. It was simply a shitty year. Period. Full stop.

Back up to that chart for a second. If you wonder why there is room for optimism, it’s because things like high yield have not had two down years in a row in forever. And in fact, in every down year they came back with a vengeance the following. Be as scared as you want of a recession. But don’t think for a minute that it might not be baked in.

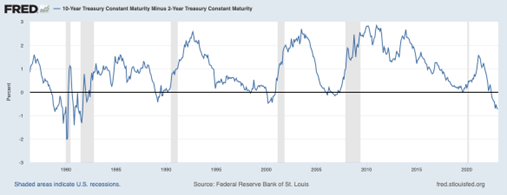

Yield curve, long rates minus short rates, has gone negative and as you can see by this, there has never been an instance when it did that and there wasn’t an associated recession. And if you listen to the talking heads, they repeat this fact ad nauseum. But who really cares? By the time we get to this point, much of what you should be afraid of is already baked into the markets. The time to be afraid was a year ago, not now.

Let’s wrap this up with a look at the outliers. Things that could happen wrong which would change the narrative and introduce new risks into the market. The monster under the bed that keeps you up at night, if you will.

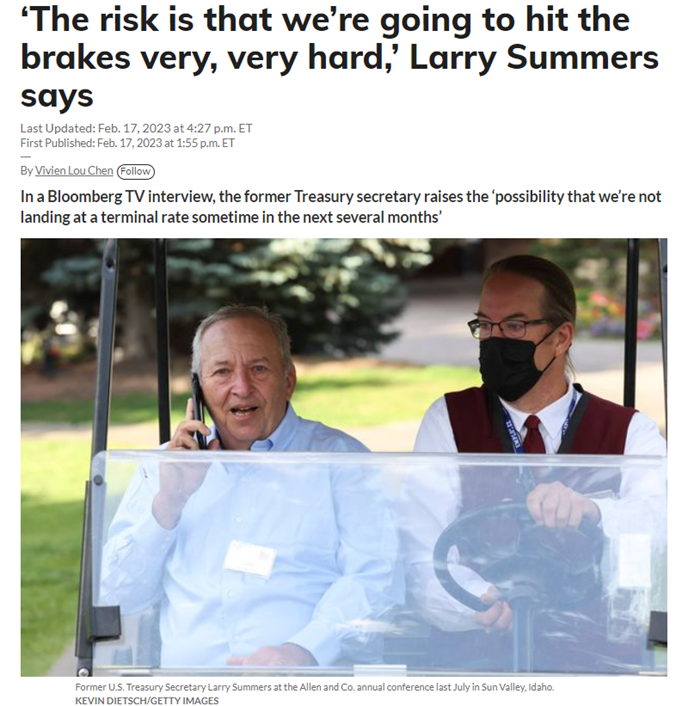

The boogie man is named ‘hard landing’, and as the economy fails to soften the way it should be, the risk of it is increasing. Ironic you say? Yes, very. This is the argument that former Treasury Secretary Larry Summers has been making. But now he is doubling, nay tripling down, on the that trade.

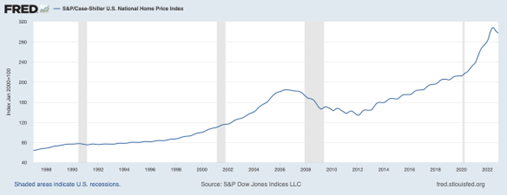

But like I said earlier, a hard landing for the economy doesn’t necessarily mean a hard landing for asset prices. The only one those that really seems to be at risk is residential real estate. Stocks are down. The innovation trade has been eviscerated. But home prices, they have barely corrected. Keep in mind though, up until recently, the only way you lost money in houses is if you sold. It’s one of the greatest levered trades in the history of the world.

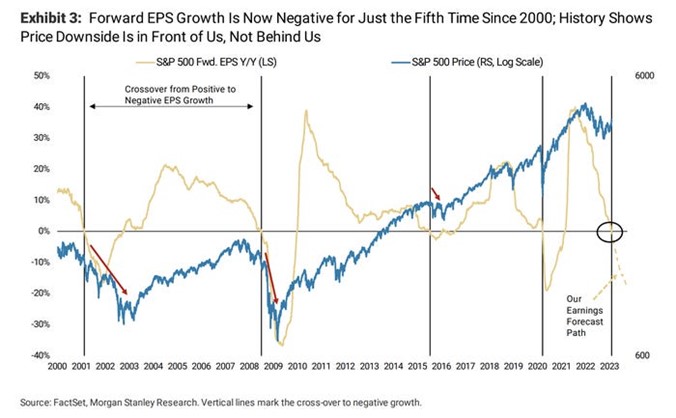

Last piece of proverbial meat to throw at the boogieman, big fancy firms like Morgan Stanley are now raising the risk of a disjointed unwind that is accompanied by 20% to 25% market corrections. The generally uber bullish Mike Wilson, of said white shoe firm, points to earnings growth going negative as the biggest reason for concern. And truth be told, he makes a good point. In every instance this century where this happened, stocks have hit a wall. Simply something to consider.

The one outlier that wasn’t on the radar, topical metaphor intended, was the risk of a geopolitical bump in the night. Everyone knew that Ukraine was on the table, but that was rung fence to Europe. What wasn’t out there is this completely bizarre situation with China floating spy balloons over American soil. In an ironic twist, the first one appeared to naked eye high above the town I call home in the Treasure State. Note to China, if you are going to mess with the United States, pick a softer place to start. Maybe Florida…

Enough with all of this, let’s now end on a high note and focus on what could go right…

First off, the pandemic is largely behind us, and this is for sure to be celebrated. And the further into the rearview mirror it goes, the less we need to think about unprecedented measures needed to keep the economy going. Getting the markets off the junk as they say would go a long way in ensuring better long term health.

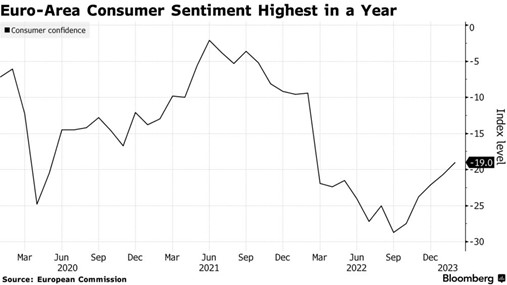

Second, as we’ve mentioned before, much of the froth in the markets was taken out last year. In so doing, prices have therefore been de-risked to a certain extent. And if prices are de-risked, when and if the recession comes, there is less of a likelihood ugly unwind. Even with all that has happened, the Europeans are already feeling better about things.

Lastly, above all else, we American’s lead the world by example in the ‘resilient’ department. And this is indeed important. For me personally, after a pretty rough period in my life, a close friend who I trust deeply, said to me that I survived due to my resilience. I didn’t know it at the time, but it turns out I did. And I by no means have that market cornered. Be bold at times, be foolish even, but always be resilient.

Disclosures

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.