It’s here. It’s upon us. It will be ubiquitous within the financial media circles this week and next. For it is indeed time for the Kansas City Fed’s annual gathering of global bankers in the once noble, always beautiful, now fully corrupted, Jackson Hole, Wyoming. For it is indeed ‘Late August’ in the Teton Valley.

As transparency in part of my brand and telling the truth and suffering the consequences part of my schtick, I must be fully transparent. Ever since Fed Chair Ben Bernanke committed to a ‘by any means necessary’ zero interest rate policy regime at Jackson Hole in 2009, I’ve been drawn to the event and the monetary morphine that gets doled out. This was Ben with fellow dope dealer, Timothy Geithner.

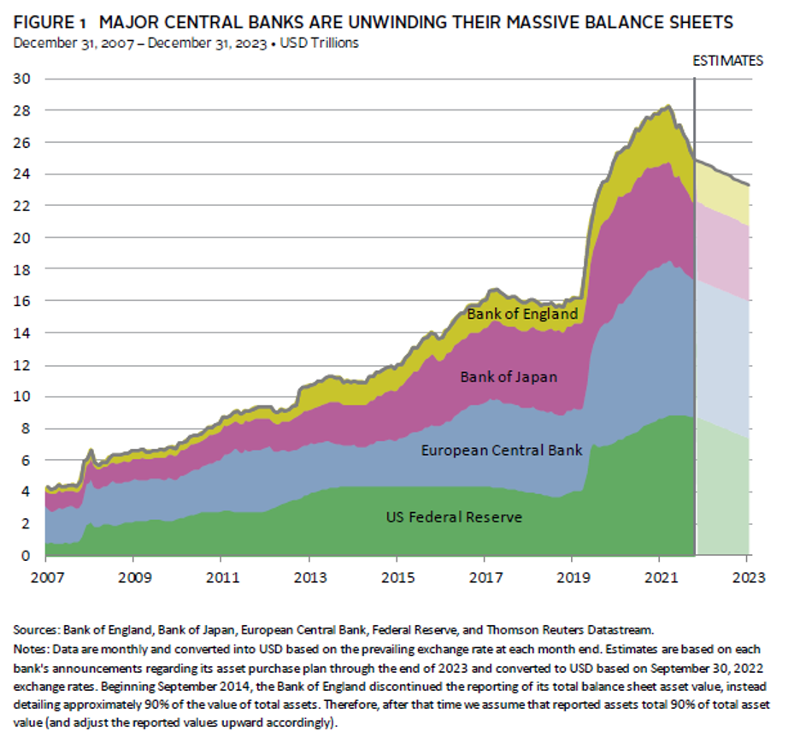

Think I’m wrong that 2008 & 2009 were the dawning of the great ZIRP (Zero Interest Rate) full throttle QE experiment, think again. At that time the balance sheets of all the relevant global central banks stood at $4 trillion. Today, that number stands at around $24 trillion, down from $28 trillion at the height of the pandemic. That’s right, six-fold larger than it was only fifteen years ago.

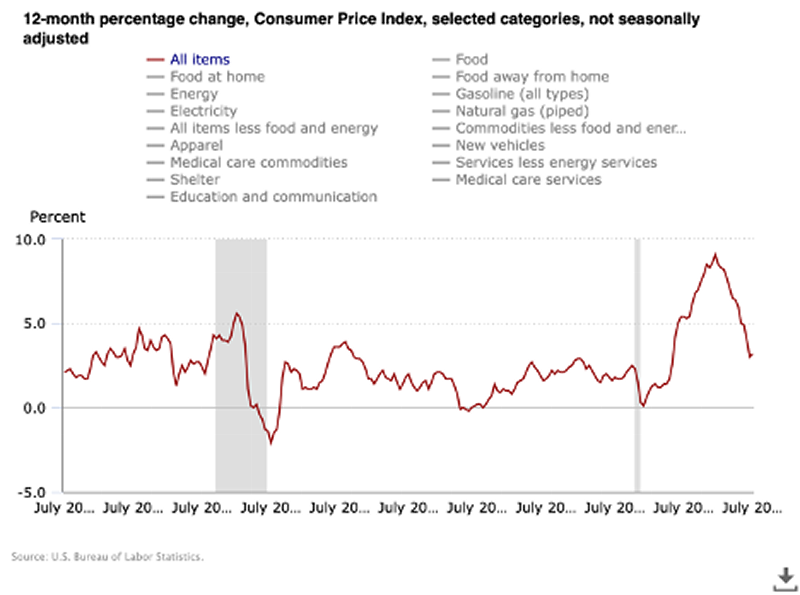

But get this, the experiment worked. It flipping, effing, arfing, yeffing, and iffing worked. From the time the monetary dispensary opened its doors, until two years ago, the experiment worked. This chart chopped off the start of the Consumer Price Inflation series when it hit ‘download’, but trust me on this one, it kicks off in 2003.

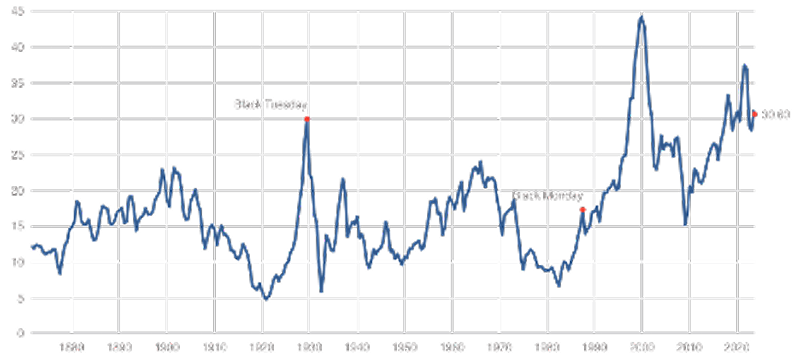

And here is the Schiller P/E ratio, a reasonably well-regarded measure of public equity valuation. While it’s elevated, it’s been so for nearly thirty years. So that’s means it’s no long elevated, it’s the norm. At the current 30, it’s almost perfectly balanced between 25 and 35, the new range.

Source: Case/Schiller

So where does that leave me, the well patinaed skeptical bull? Well, to be honest, it leaved me feeling a lot like Phil Michelson after he melted down on 18 at Winged Foot in 2006 to blow his chance to win the US Open. The guy had a one stroke lead and only needed par to win. Three wood off the tee to almost guarantee it? God no, let it rip with driver. And the rest is major golf history.

After Phil did his best impression of a shankapotomus off 18, he proceeded to card a double bogey and lost the championship. Afterward, he let loose with one of the all time greatest and most honest quotes in golf history

"I still am in shock that I did that, I just can't believe I did that. I'm such an idiot."

The lesson to all of this is that the Federal Reserve, and any other private company, or public agency and politician have been begging you to take it three wood off the tee, for a very long time in fact. Literally saying, ‘You get the financial ball in the fairway, and we will take it from there. No gripping and ripping. No overthinking in your backswing. Just get long assets and put your financial ball in play. And even if you don’t win a major, there is still a lot of prize money out there. Like a lot…a lot.’

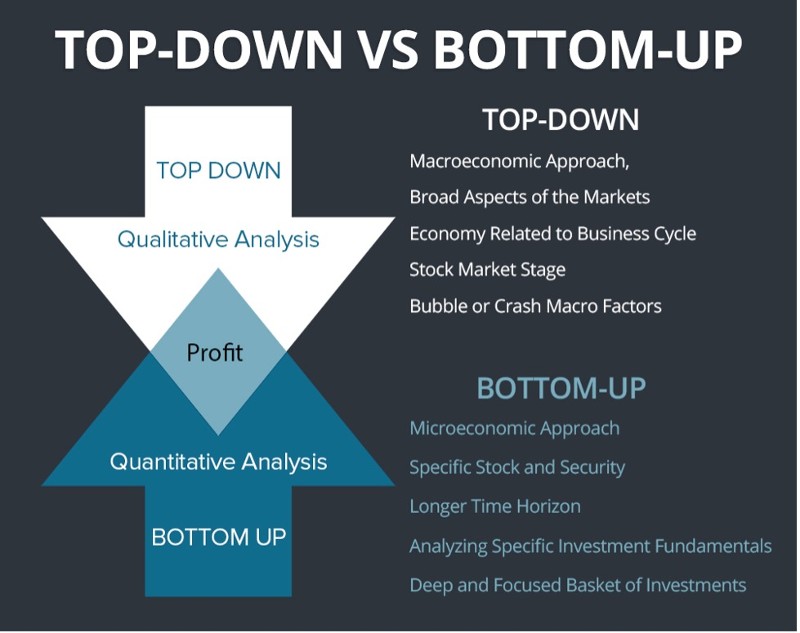

Every picture tells a story, don’t it? Sure does. And because of that, let’s take a quick whip around the markets to see what’s working, and what’s not, and what it tells us about secular trends, and what’s happening with the top down.

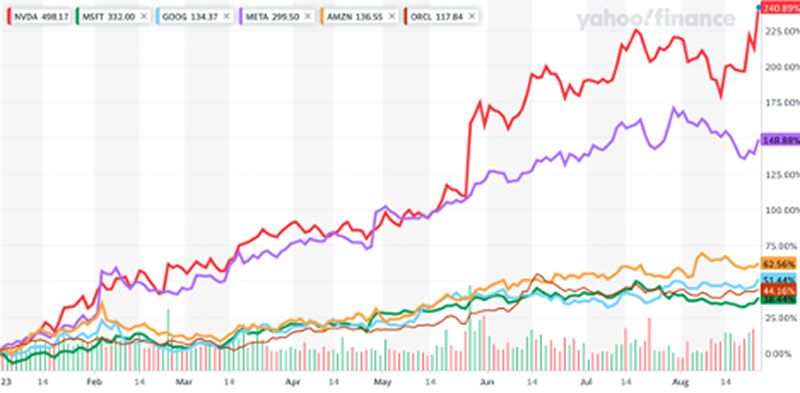

First up, artificial intelligence. We were due for another tech bubble, and it comes to us in the form of AI taking over the world. Which is kind of a bummer, because while it may not seem so at times, I like people. Green light on speculation and growth among technology mega capitalization companies who are perceived to be way out in front already. Of these beasts Microsoft is the laggard, up a paltry 38% on the year.

If the squiggly lines aren’t enough to make you sick, this list of private AI focused companies from Niris-Weis Blatt titled ‘All Aboard the Hype Train, The AI Train that Is” shows you how loaded up the venture capital pipe is. And trust me, these are just the ones we know. Whether the technology behind it lives up doesn’t matter, we are early innings on techs next big bubble.

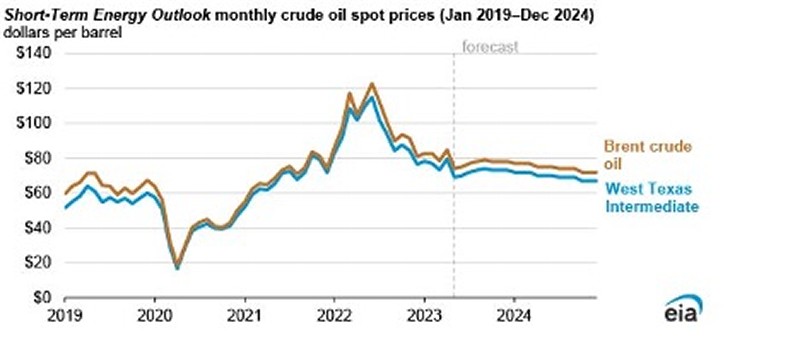

Onward to energy and the crude oil markets. These are the major players across the broad cross section of the energy value chain. No great shakes one way or the other, though I do think this chart just gave me a seizure. It pretty much tells the story of the economic top down debate. On any given day, half the people now think we are headed for recession, the other half don’t.

Same situation for crude prices going out into next year. They could do one of three things: go up, go down, or go sideways. Or it could do all three. For the record, upright functioning adults get paid big bucks to say things similar to that with a serious face. True story.

Last set of charts we are looking at this week is of big box and discount retailers. Right or wrong, what they are saying is that while the bourgeoise are having their day, the proletariat is struggling. I mean when Kohl’s, Target, and Best Buy are all down north of 30%, that is saying something. I guess they don’t sell anything AI related yet.

I’ll end things with this. Jackson Hole is truly an enigma for me, as it is with most people who have known it for 30 years. For the longest time it was a mountain town that you couldn’t mess up. A few good stores, a quaint square, some decent off the main drag dining options, and an epic ski mountain.

And say what you will about it being a western tourist mecca, but I still love the Million Dollar Cowboy bar and can drink myself back to 1989 pretty much every time I go there. Plus, I’m a sucker for the stories told in glass above the bars. There are lots of familiar names in there and you eastern interlopers could learn a thing or two.

At the end of the day, we should thank Paul Volcker, Fed Chairman when rates were nearly 20%. For he is the one who chose Jackson when he was trying to find a location to both talk monetary policy with his global contemporaries, and get a little fly-fishing in. The duality there is precious. A man not afraid to match a monetary 10 with an economic 10, while at the same time keeping his line tight and hook set at the ready.

Disclosures:

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Axxcess Wealth Management, LLC (“AWM”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure. The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. The information contained above is for illustrative purposes only.