Axxcess Wealth Annual 'Big Read' - 2024 Edition

By Bryan Goligoski - Axxcess Editor at Large

Welcome to the Stillwater Capital Big Read – 2024 Edition. Predictions, observations, stories or mirth and merriment, all combined with words, pictures, charts, and even cartoons. Word on the street is that it’s Joe Willie Namath’s number one read! Thanks, 'Broadway Joe', appreciate the look.

Scoreboard for 2023

Wins = 12 out of 20 = 60%

Pushes = 2 out of 20 = 10%

Loss Column = 6 out of 20 = 30%

First big call out of the gate for 2023 was: S&P 500 is going nowhere.

What happened in 2023: The range for the SPY was directionally accurate until November, and then it wasn’t. Like really wasn’t.

What happens in 2024: As a classically trained short seller, and skeptical bull, I would be inclined to say the best is over for stocks. But that would mean I fell trap to anchoring my brain bias that there is no way this shyte can go on forever. Will the last bear please turn out the lights?

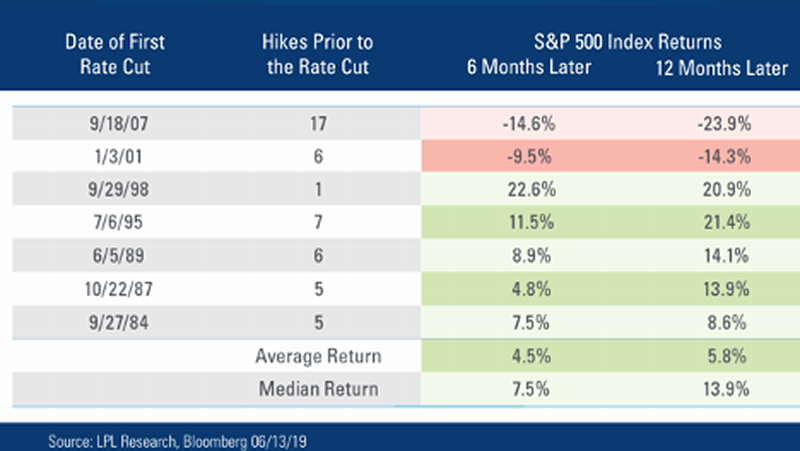

Bottom line, if the Federal Reserve is going to be cutting rates by summer, get yourself long. Keep in mind, the garbage performance for the S&P from late 2007 through the spring of 2009 correlates to the Global Financial Crisis, and the end of the great debt super cycle. No rate cut was going to save the market from that.

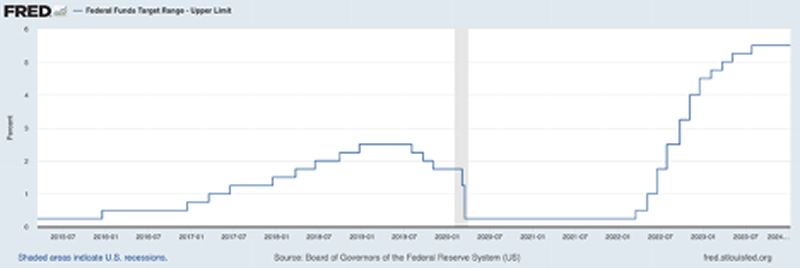

2) The Federal Reserve will overshoot in its effort to tighten liquidity.

What happened in 2023: Tough to say there was an overshoot at this point, but at the very least, the Fed stopped and holstered that monetary tightening sidearm.

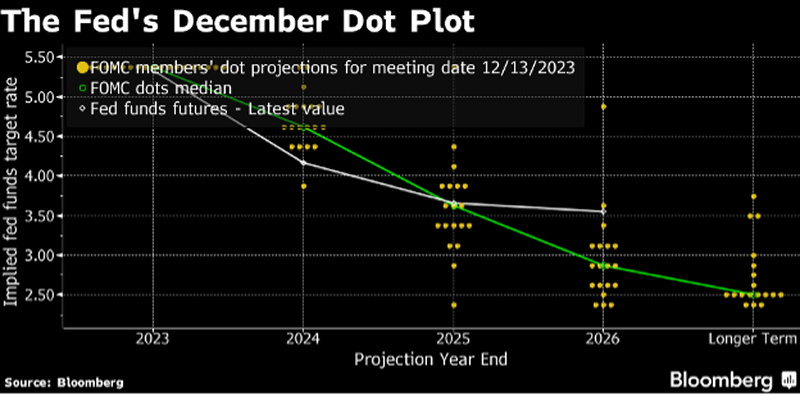

What happens in 2024: Jerry and the Powletts are dogs of the Pavlovian kind, and they love chasing hawks when the bell rings. CPI is going to stay in retreat, and by June the Fed Funds Rate is probably going to be toting a four handle.

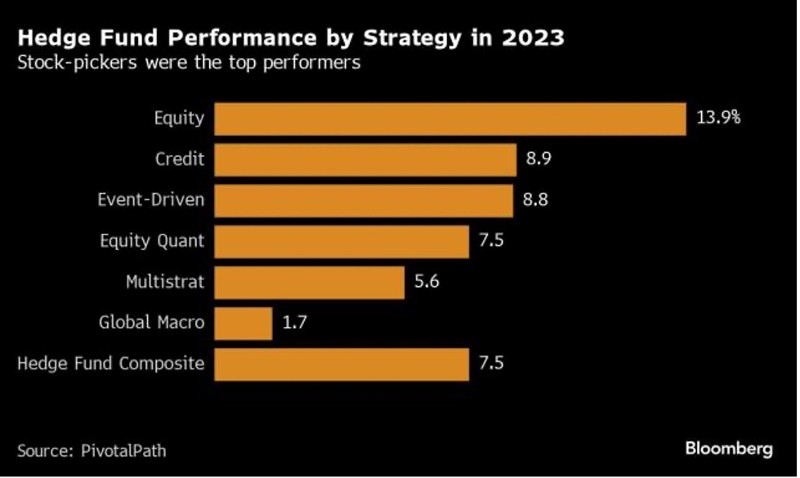

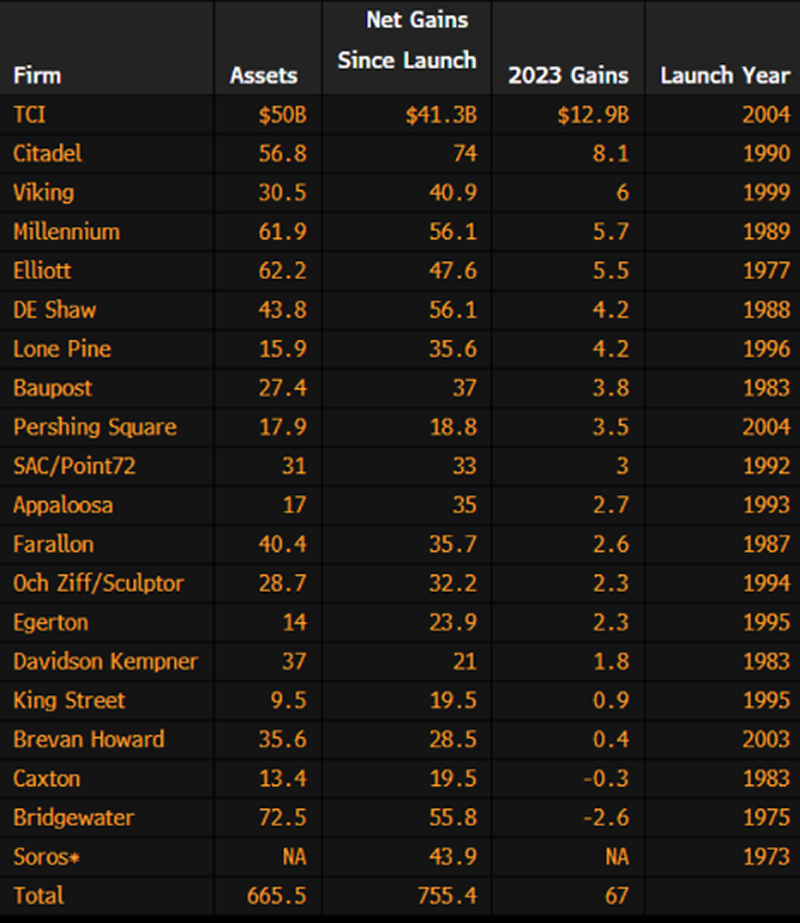

3) Hedge funds that truly hedge are going to do well in the upcoming world of going nowhere fast.

What happened in 2023: Stock pickers, at least those that leaned long, did great in 2023. The overall hedge fund composite return was pedestrian, and global macro managers had a year to forget.

What happens in 2024: It will be another good year for the hedge fund complex. There will be easy money made early, and then maybe managers will have to earn it come fall. But it’s going to be tough to put up a negative year given the tailwinds to the economy and markets.

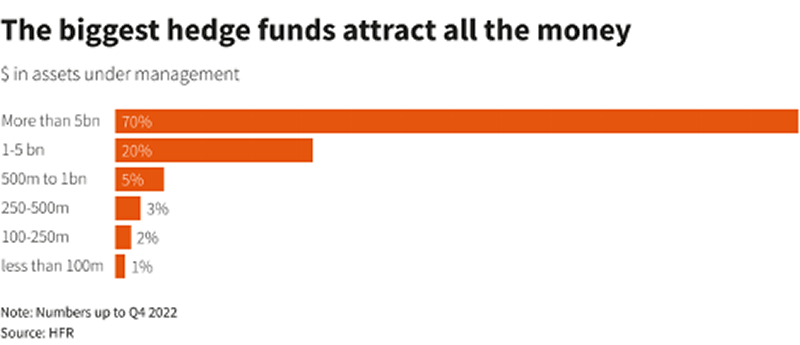

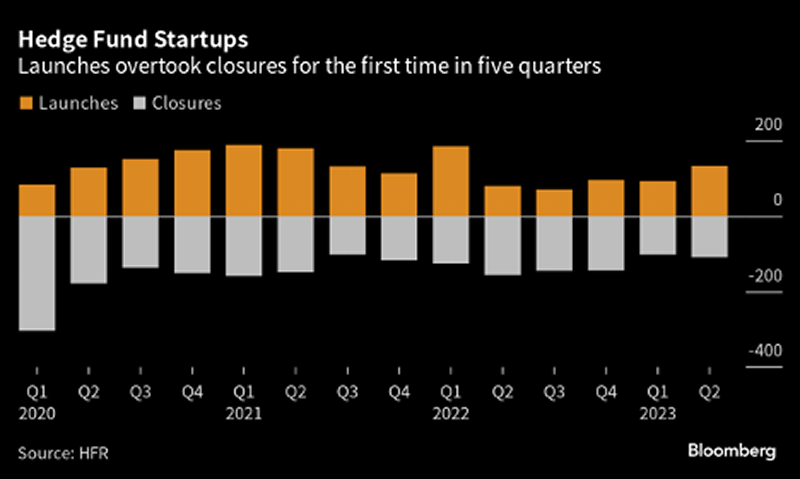

4) While there is still money to be made by those that have sticky assets, the hedge fund business will continue to suck for most!

What happened in 2023: Winner, winner, give me my chicken dinner! Ninety percent of all inflows went to funds with $1 billion in AUM. A full 70% went to managers with $5 billion in AUM.

And they got paid for last year’s efforts…

What happens in 2024: Guys in yellow, unless you walked off the SAC desk with a $1 backer, don’t bother. The only ones making money will be the attorneys at Skadden Arps who put your filings together. For those not in the know, Skadden is the law firm you hire if you want to impress people in the world of hedge funds and private equity.

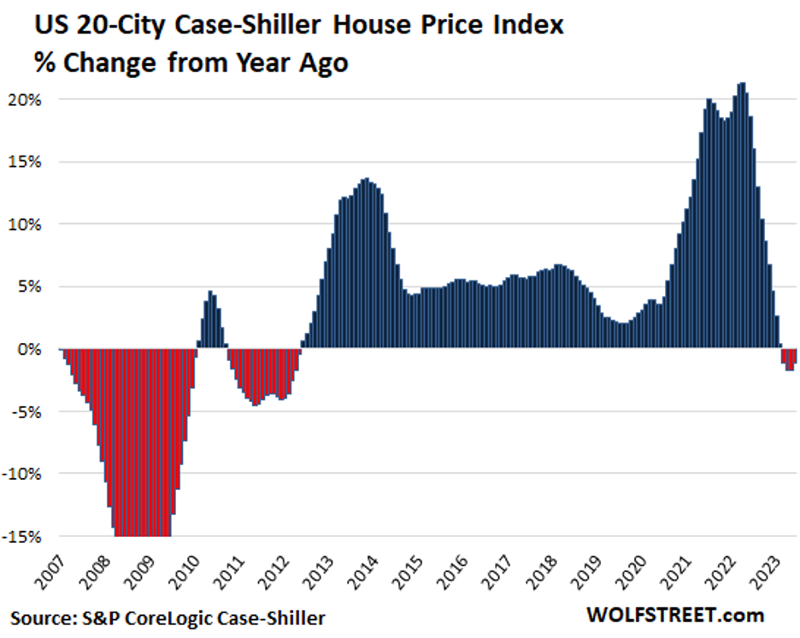

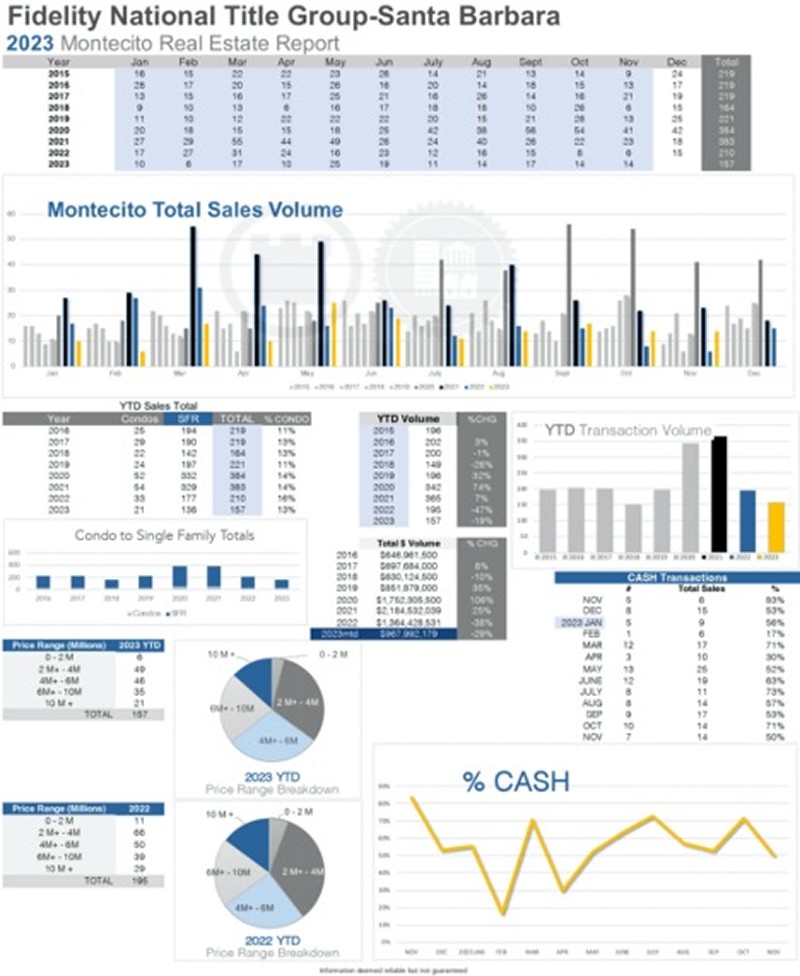

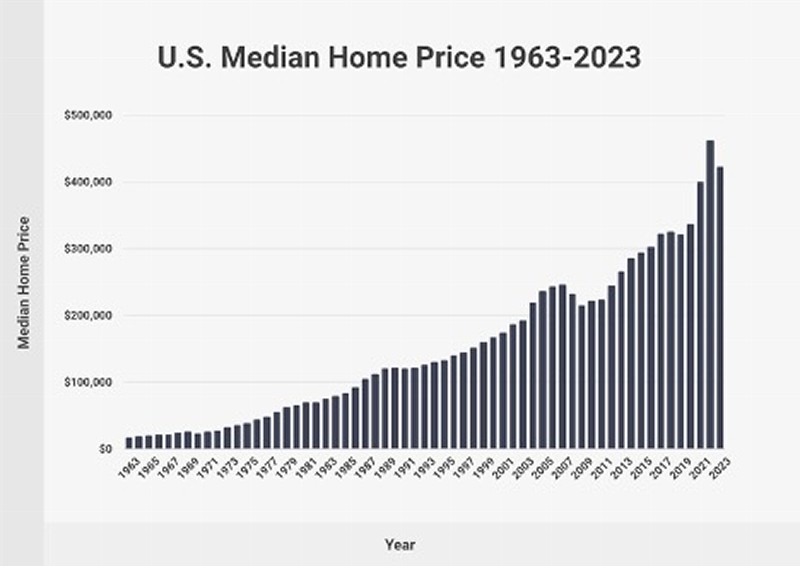

5) I’ve seen a lot of asset bubbles over twenty-five years of doing this, the one we were in is up there…It’s going to be a tough year for residential real estate prices, maybe even a tough decade.

What happened in 2023: Score one for the kid!

What happens in 2024: Residential real estate, and the bubble that ZIRP (Zero Interest Rate Policy) created, is living rent free in my head right now. And will probably be there until the day I take my very own dirt nap.I sold a place that I couldn’t sell in the hills of Montecito for $2.1 million in 2018, listed thrice. It sold for $4.5 million in 2022…sight unseen from a cash buyer who lived in Minnesota. Half the trades going down are done with cash. Doesn’t matter what interest rates are. Good job guys and gals at the Fed, way to fail to ‘read the room’ as they say.

Everything I’ve seen and heard says this is insanity, and now the majority of inventory is locked in at 2% mortgages. If this chart doesn’t mean revert…

…I’ll never get back in, and will be living off the grid. My own yurt life dream! Not bad, they say.

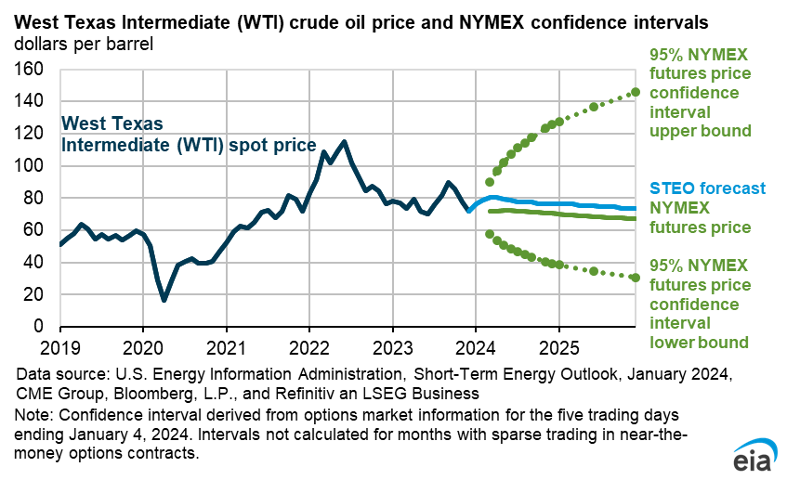

6) Good news for some, bad news for most others, recession or no recession, crude oil prices of between $80 and $100 are here to stay.

What happened in 2023: Score one more for the kid!

What happens in 2024: Long terms average of $90 stays intact. This year’s range for West Texas Intermediate (WTI) is going to be slightly lower at $70 to $85. “Mr. Valentine, has set the price…”

7) Cathie Wood’s ARK Innovation Fund (ARKK) is done going down.

What happened in 2023: Another good call as 2023, particularly late 2023, was a year for getting paid taking risk. And innovation is indeed where risk lives.

What happens in 2024: I’m having a tough time seeing risk going on an all year bender, but what does that even mean these days? What I do know however, is that Cathie parlayed the self-appointed “Queen of Innovation” crown into a brand of material consequence. Sorry about ‘your’ Bucs, Cath.

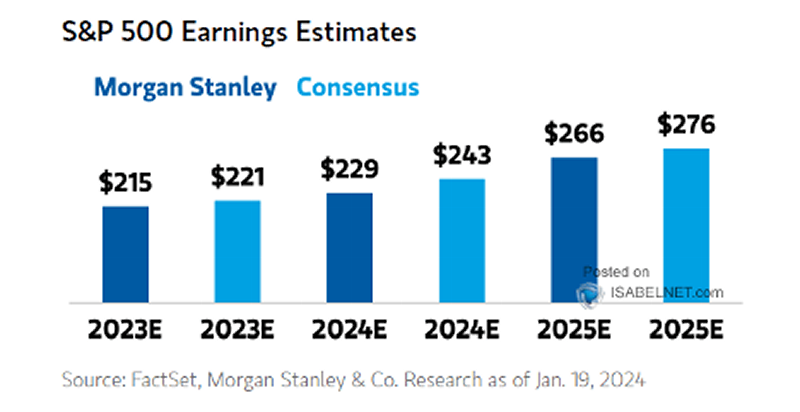

8) Equites are no longer as expensive as they were.

What happened in 2023: I looked long and hard to find a CAPE type ratio to show this was the case and couldn’t. So, I’m going with market cap to GDP, and it tells a story that indeed stocks are no longer as expensive as they were.

What happens in 2024: I don’t get the sense, and most others on Wall Street don’t either these days, that a big economic contraction is on the way. If it comes through that way, earnings are most likely going to see a modest rise in 2024, and a rather robust jump in 2025. At some point soon, maybe even now, the market will start looking out 12 to 18 months and the P/E on the S&P 500 is going to start looking reasonable. Beware those that say we are in a valuation bubble.

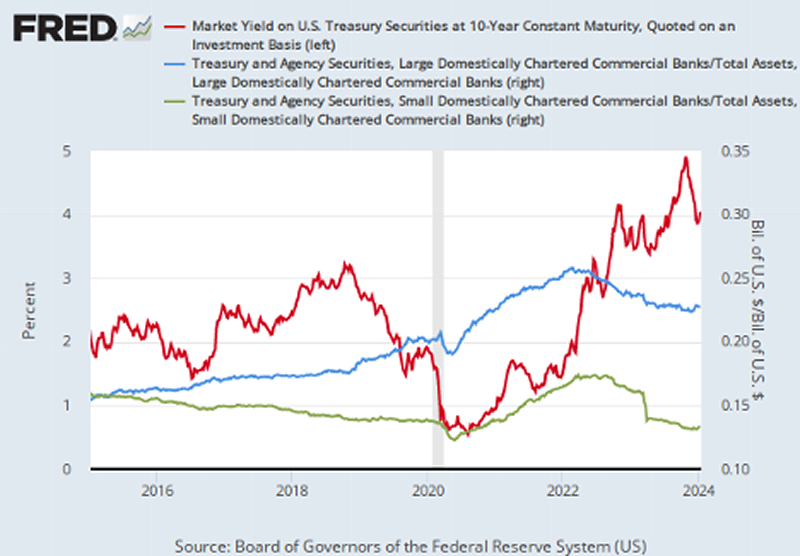

9) The 4.25% we saw on the 10-Year in October of last year is the high for this rate cycle.

What happened in 2023: Close, but maybe only half a cigar on this one. Rates peaked out at 5% in November and are now just north of 4%. When rates came in at 20%, the S&P 500 took off and gained almost the same.

What happens in 2024: Right or wrong, and I believe the latter, the market is going to be pricing in an end to the great Covid inflation boom. If that’s the case, look for the new range to be 3% to 4%. Again, I don’t think this is what should be happening given my belief that inflation is now ‘in the bones’ of the economy. But I’m just one guy of many millions of guys and gals out there looking at this. Consensus seems to be the worst is over. And the Fed Governors see it the same way.

10) This year’s theme of “standing in the middle of nowhere, wondering where to begin, stuck between tomorrow and yesterday” is a perfect setup for the next call. Like it or not, mega cap technology is going to (continue) to have a good year.

What happened in 2023: Ummm, yes.

What happens in 2024: The stocks above: Amazon, Apple, Microsoft, and Google are so heavily weighted in the indexes that you can’t both say that it should be a good year for the S&P 500 and Nasdaq, and then say this mega cap tech rally is over. That simply doesn’t exist. As the late Charlie Munger said, don’t try to pick up nickels in front of a freight train.

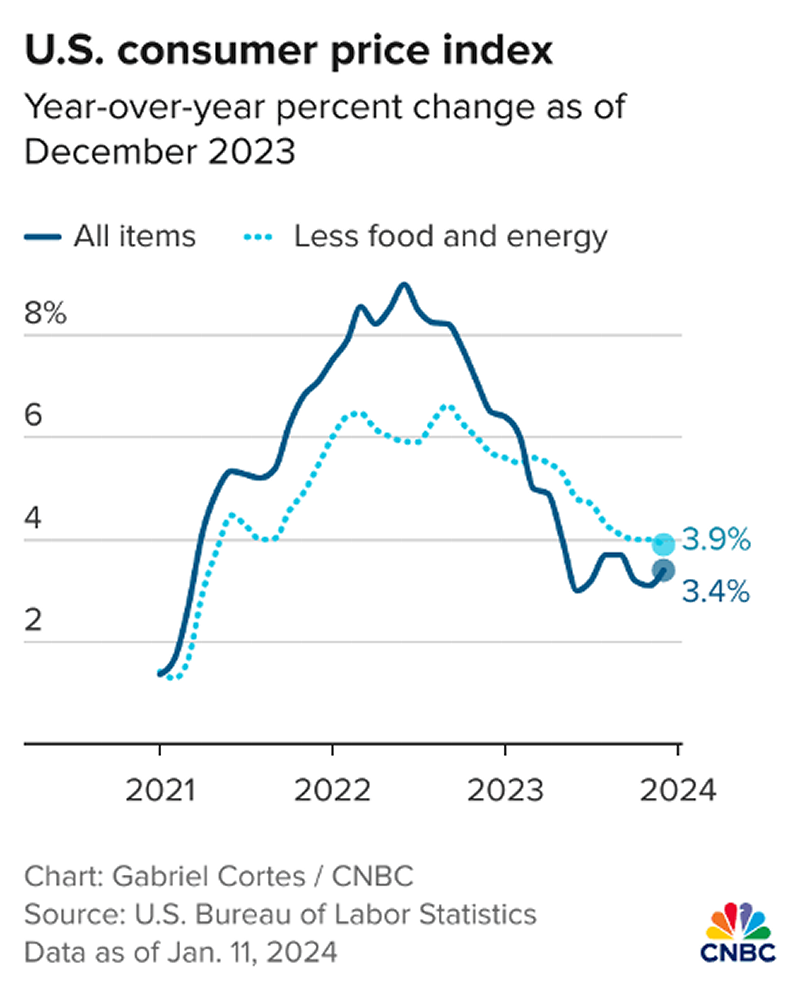

11) Consumer Price Inflation (CPI) will continue to come in, and that will keep a lid on interest rates, and put a risk bid in stocks.

What happened in 2023: Sure enough, CPI came in…and the risk bid lifted stocks.

What happens in 2024: You are going to continue to hear a tremendous amount about how inflation has been brought under control, and that all is good. The Federal Reserve will be given great credit for brining in the big fish, a la Ben Gardner in Jaws. But that ain’t nothing. Somebody is going to need to hire Quint to kill it. This sucker is too big, too old, and too smart. ‘Bad fish’, as the Captain said.

12) Reviving a call from last year that the great Covid inspired semiconductor super cycle of 2020 to 2022 is officially over.

What happened in 2023: This call kinda sucked for most of the year, and then REALLY sucked from November on…and still does. Thank Christ I’m not running money right now otherwise I would have doubled, nay tripled, down as I anchored to my position.

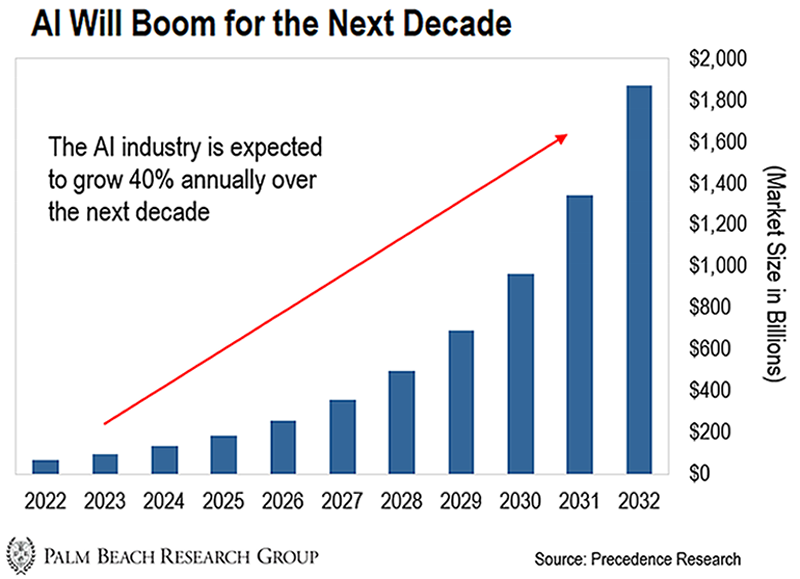

What happens in 2024: I officially give up. Semiconductors are the Teflon trade. With AI as the new hip kids’ theme and I can’t see any reason to not think this will again be their year. Trees grow to the sky, right?.

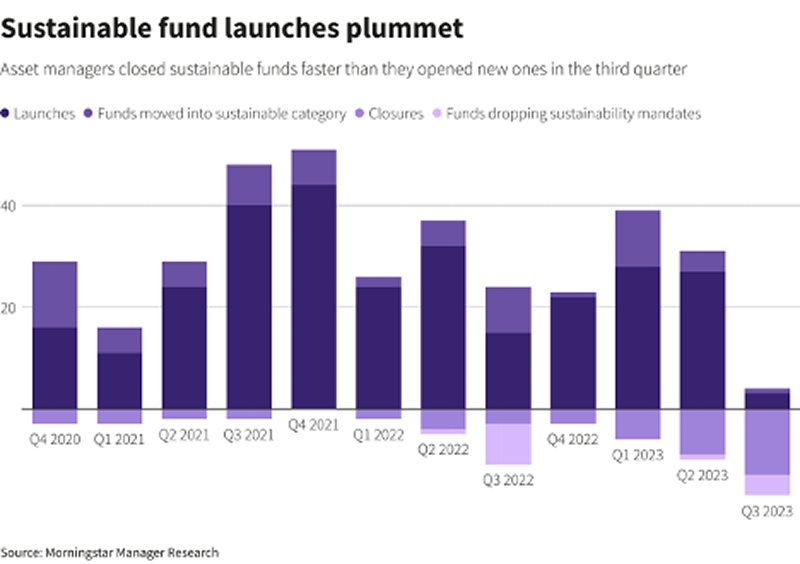

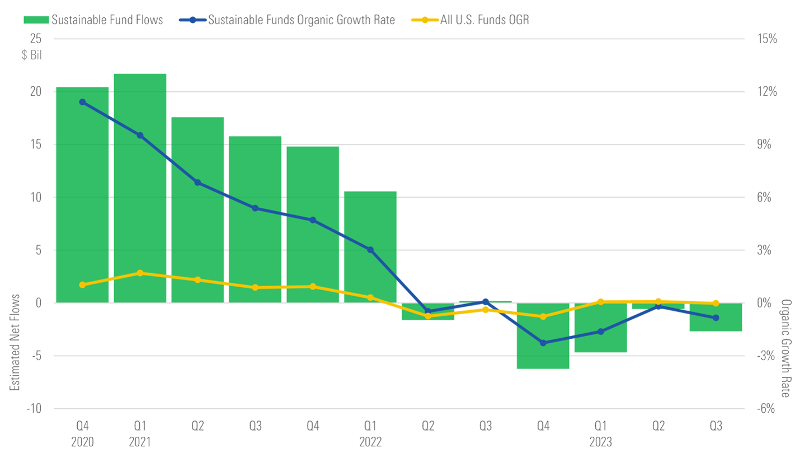

13) You want to know what wave has now run out of strength? Wokeism inspired ESG and impact investing has hit a wall.

What happened in 2023: Thought I’d be right, didn’t think this right. Then again, I’ve seen many a fad come and go over twenty-four years in the business. And it’s not that I don’t think ESG has strong merit, I do. So much so that I tried to float a fundamentally based ESG long/short strategy to the market. But alas, try as I might, I couldn’t get any big enough fish to bite.

What happens in 2024: Once these trends start, they are tough to stop. If that’s the case this time, looks like ESG is about to go through its very own long winter of discontent.

14) Unemployment is about to start to rise and will for sure become a trend during 2023.

What happened in 2023: Nothing like this. The economy has added jobs every month for the past two years. And there is nothing that says that’s going to end in January.

The call for 2023 was a bit of a flyer. I too bought into the idea that an inverted yield curve was the precursor to something that looked like a recession, shallow or otherwise. And it simply didn’t happen.

What happens in 2024: It’s tough to think that this time will be different, and we won’t slow into recession. But there simply isn’t anything out there that says it’s on the horizon. That said, I’m going to channel my young inner Luke Skywalker and try to feel the Force again.

At some point in the first half of the year, unemployment will start to rise. And when it does, the markets are probably going to do quite well. Because at that point, the Fed will be in full rate cut mode. And the next bubble will be born. Which one this time? Maybe AI, or perhaps real estate really gets out of hand. Regardless, we will have survived and been made whole again.

15) There are legions of Wall Street economists and strategist who are hanging their necks out saying the Federal Reserve is screwed and will pile us into a recession.

What happened in 2023: None of this, so far. Even though there are still guys out there like Peter Schiff * who see nothing but rocks ahead. Big ones! Keep in mind, this ‘end of days’ blast was a short six months ago. Also keep in mind, it came from ‘Dr. Doom’ himself. The same guy called the Global Financial Crisis a year before it arrived, so he still gets a seat at the adult table

* Peter is an Austrian School economist and did both his undergraduate and graduate work at Berkeley. If that doesn’t set you up in life to be the Mayor of Wingnut City, I don’t know what does.

What happens in 2024: To a certain extent I was with Peter not that long ago. But he and I also view inflation differently. So differently that much of the rest of the world doesn’t see it that way. There are inflationary problems all over the globe now. But unless high prices for everything can manifest themselves into behavioral change in how economic participants operate, then nothing will change, and the ‘soft landing’ will be upon us. Whatever that looks like.

Pause for a little self promotion: It looks like I will be back at my favorite business school, Marshall at the University of Southern California, in the spring to guest lecture on the history and practical application of long/short investing and a portion of the subject matter will be dedicated to the ‘theory of reflexivity’ or ‘myth becoming realty’, and how it impacts asset prices. Should be one for the ages, and I will be posting the lecture materials on these pages.

Fight on, my friends. Fight on!

And now, to the more esoteric...

16) This is going to be the year that psilocybin legalization truly emerges from the shadows and becomes a mainstream conversation

What happened in 2023: Of all the things I was right about in 2023, this one was probably most spot on. In two instances, the cause for advancement in legalizing psilocybin took major steps forward. First, Governor Gavin Newsom vetoed a bill providing large scale decriminalization of magic mushroom. And second, a ballot measure movement to get the same thing on the 2024 ballot failed to get enough signatures to make it happen. And I call this progress? Yes. Yes I do. And the idea that I stand side by side with San Francisco State Representative Scott Wiener on something is proof that there is no Rubicon too wide.

What happens in 2024: The Genie is now out of the bottle, and there is no putting it back in. And I really like the more measured approach California is taking on legalization of psylocibin. This is the chance to put some guardrails up and make sure that when it does become legal, it’s credible. You open the floodgates now, the unwashed masses are going to be chomping down psychedelic fungi like you can’t imagine, and that will dilute down the genuine medical benefits that will change lives.

The main benefits commonly attributed to micro-dosing psilocybin.

1. Increased productivity

2. Greater access to flow states

3. More creativity & curiosity

4. Higher sense of empathy & communication

5. Improved focus & concentration

6. Increased self-efficacy

7. Better emotional wellbeing & connection

8. More energy & coordination

9. Greater sense of self-awareness

10. May reduce addictive behaviors

11.May help alleviate cluster headaches

12.Offers protective action on the brain & neurological system

13.Reduced anxiety levels (especially existential anxiety at the end-of-life stage)

14.Better rational awareness & problem solving

Full Disclosure: I’m a center right, 'Never Trump', independent who these days would wind up in a fetal state after one rip off a joint. A legal joint, mind you. I’ve also been diagnosed, rightly and wrongly, around several different forms of depression, anxiety, and bipolarism. And until they got the diagnosis right (bipolarism), and the meds right, it was an awful rollercoaster of meds that did more harm than good. Properly dosed, in mild form, psilocybin works. And it works a shit ton better than everything sold in the corner liquor or vape store. And last time I checked, much of that is for self-medication and escape. To those who are in charge, wake up. MLK Liquor and Vape isn’t Chuck E Cheese.

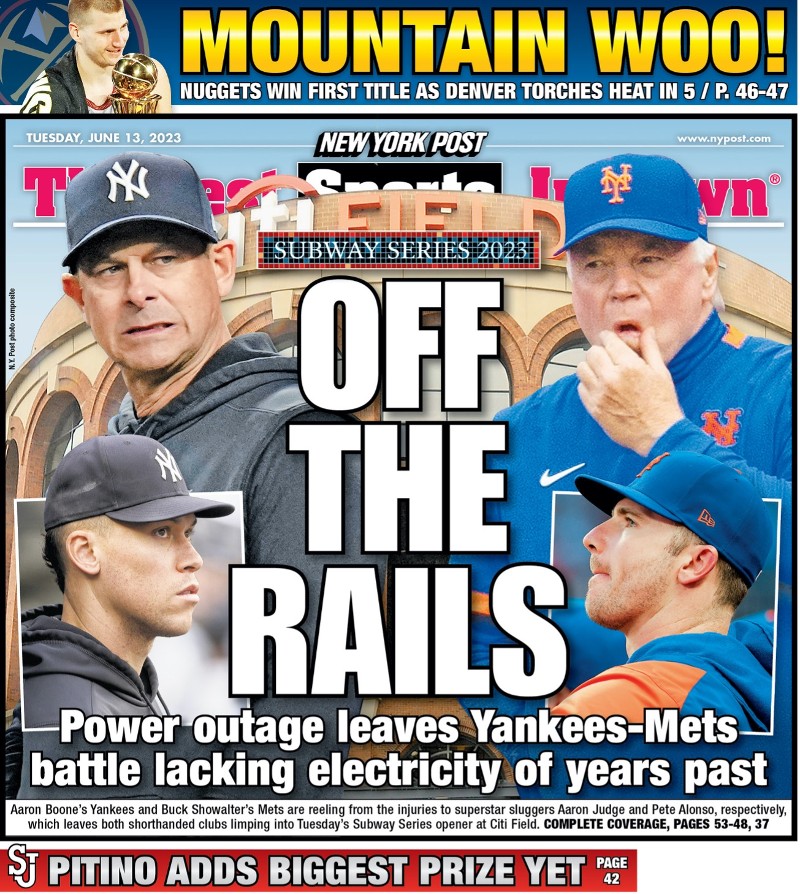

17) My prediction that the Yankee’s would meet up with the Met’s in the second subway series in history last year (2022) didn’t make it past the second round of the playoffs. I’m going to give this one more attempt, and stick with that pick. Plus, who doesn’t want to see Aaron Judge go up against the Fighting Stevie Cohens.

What happened in 2023: Nothing, nada, zip, zero. Neither team wound up making the playoffs. Good job, sukahhs!

What happens in 2024: I’m giving up on the boys from New Amsterdam but holding onto the Bronx Bombers, pairing them up with the Los Angeles Trolley Dodgers. Huge payrolls. Huge names on the marquee. And all the pressure that goes along with it. Let’s gooooo….

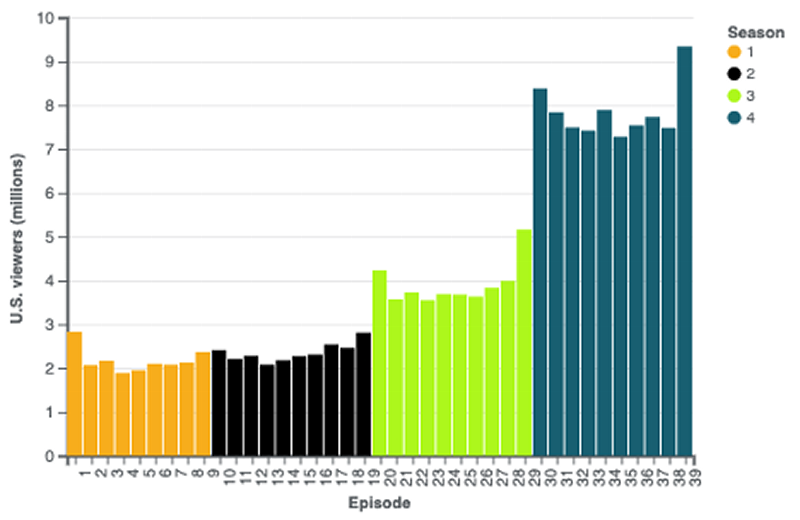

18) Yellowstone, the Taylor Sheridan cowboys pscyho drama, is about to hit the viewership wall. The gravy days are over.

What happened in 2023: Well, that kinda worked. The show is going to end this fall with season five, part two, premiering in November. So, in a way, Yellowstone will be hitting the ultimate viewership wall. That said, it was one hell of a juggernaut, and has turned Taylor Sheridan into a production machine.

What happens in 2024: First off, full disclosure, I really liked the show. While there was a ton of suspension of disbelief, the writers did a great job of creating very directionally accurate plots and storylines based around an ever-changing Montana, and the west. What was portrayed has been happening all over the (406), just without all the trips to the ‘train station’. Ironically, that’s where the show is going.

The spoiler alert, plot twist of all plot twists, is if the Dutton’s say ‘fugit’ and turn the ranch into another modern-day Yellowstone Club. Final scene is Kevin Costner, probably like he does in real life, stepping off a G6 at Bozeman airport.

Last line, in faux Montana graveled voice that nobody here sounds like...

John Dutton: “Who knew I would like the smell of money more than cow shit and pine needles?”

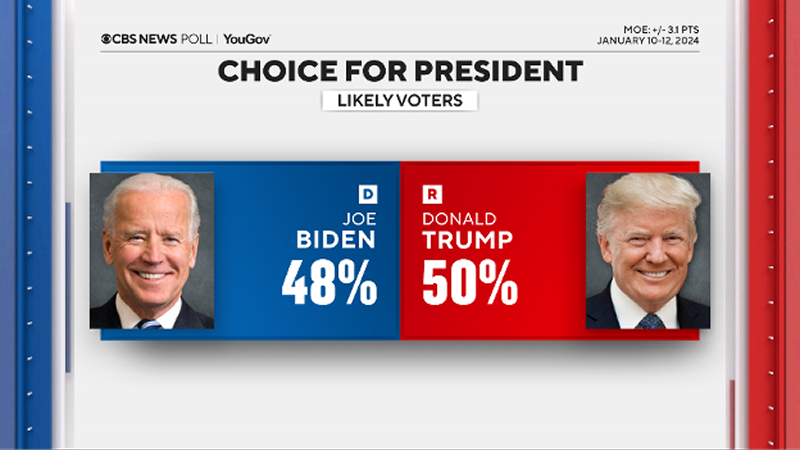

19) The 2024 Presidential Election will begin to come into focus. Joe Biden just clocked 80 years on this earth, and he will bow out as another fight with DJT would be ugly. Republicans are looking better this time around. But if Trump gets some momentum, and he very well could, it’s going get ‘fugly’. This I promise you.

What happened in 2023: Thumbs Up. Welcome to Fugly City, America!

What happens in 2024: I’m not kidding when I say Fugly City. You have no idea how bad this is going to get. I mean to the core of the country and Democracy. There is simply too much out there in terms of material against Trump, that clearly many Americans are putting aside, for it not to be one of the most divisive moments in our history. Lots of hyperbole in there. Enough to make Bill Walton blush.

Final tally, a very old Joe Biden wins narrowly. And we then endure a painful four years of watching him fade into the sunset of his life. Just remember, they skewered Reagan when he showed signs of slipping late in his second term, and he was ten years younger than Biden will be. America, with certainty, we can do better.

20) This year, the two thousand and twenty third since the birth of Baby Jesus, this fifty-year-old Wall Street journeyman, writer, culinary inventor, shitty golfer, respectable story teller, and three time West Coast Raconteur of the Year award winner is going to get back to his 180 pound college fighting weight.

What happened in 2023: Nothing. I wandered through another year on this planet taking good care of myself at times, and then not. Same behavior, similar outcome. Runnrth thy mouth, and then don’t do the work to make it happen. That said, I still cast a mean shadow on the banks of Soda Butte creek in Yellowstone Park. The fish don’t know I’m rocking a 36-inch waist shorts while casting at them….

What happens in 2024: I’m anchoring my fat ass to this trade and look forward to reporting the new and improved ‘dad bod’ come this time next year. High school fighting weight, here I come. For myself, and my little buckaroos. Geddyup!

Or this big buckaroo….

Ski Pants = Levi’s 501 Jeans

Sunglasses = Vuarnet Leather Sided Glacier Glasses

Jacket = Vintage CB Puffy in White

Boots = First Generation Salomon Rear Entry

Skis = Olin Red Sleds

Ski Mountain = Squaw Valley, USA

Stage of Life = The Good Old, nay Best, Days of Our Lives

Stay Golden…Bobby. Stay Golden.

The contents of this commentary: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, and (ii) may not be relied upon in making an investment decision related to any investment offering by Axxcess Wealth Management, LLC (“AWM”), an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where AWM and its representatives are properly licensed or exempt from licensure.

Market data, articles and other content in this commentary are based on generally available information and are believed to be reliable. AWM does not warrant the accuracy or completeness of the information contained herein. Opinions are the author’s current opinions and are subject to change without notice. The views expressed in this commentary are subject to change based on market and other conditions. This commentary may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information contained above is for illustrative purposes only.