This Week in the Markets

by Bryan Goligoski - Axxcess Editor at Large

Welcome, welcome, to the shortest market week of the year. It used to be that the Wednesday before Thanksgiving was the big travel day of the year. Now, post pandemic, it’s no more. People are living different these days, or not traveling at all. Back in the day, and a day that was not that long ago, different media outlets would go live from Los Angeles after the market close and show that it was a river of red and white, headed in every direction. I did a ten-year tour of duty in LA in the from 1992 to 2002. And while I miss many things, this is not one of them.

This year we are getting together as a family in the San Francisco Bay Area. The “Land of Milk and Honey”, as I have often called it. Last week, in something almost out of movie, I was witness to a brand-new silver Ferrari being driven off the Ferrari of Silicon Valley lot on El Camino Real in Menlo Park. The dude who got in it was maybe 35, impeccably dressed in Foot Locker workout shorts and slides. But hey, to the exit event victor goes the spoils. All money is indeed green. You can’t make this up, so why would you?

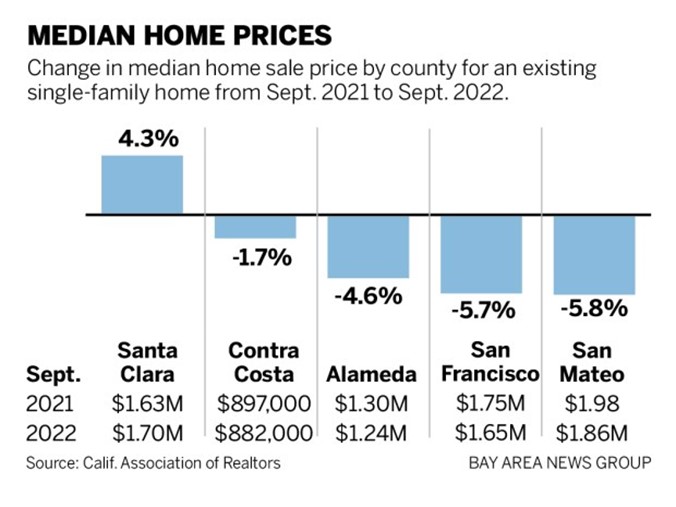

In news that is not so rosy and bright, the real estate market in the 408, 510 & 415 area codes hit an abrupt wall. This is boots on the ground intel from my time in country over the past couple of months. But at this point, you don’t need me to tell you that, it’s showing up in the numbers now too. This was from September, and it has not gotten materially better.

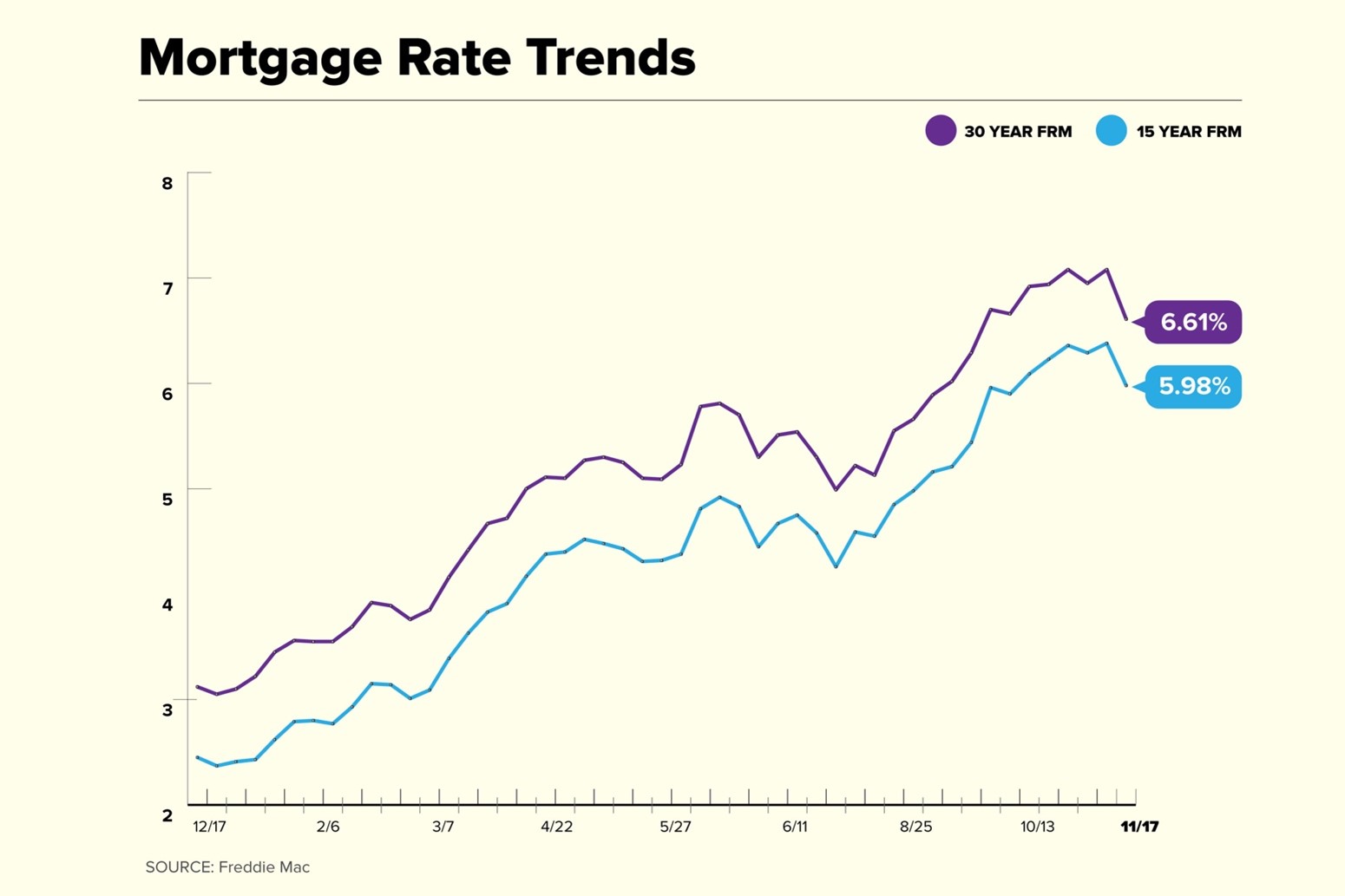

You also don’t need me to tell you what has happened with mortgage rates over the past year. That said, it’s worth looking. In both the 15 year and 30 year borrowing range, rates have well more than doubled. They’ve come off in the past two weeks, as consumer and producer prices have finally shown moderation. But still, these are big moves.

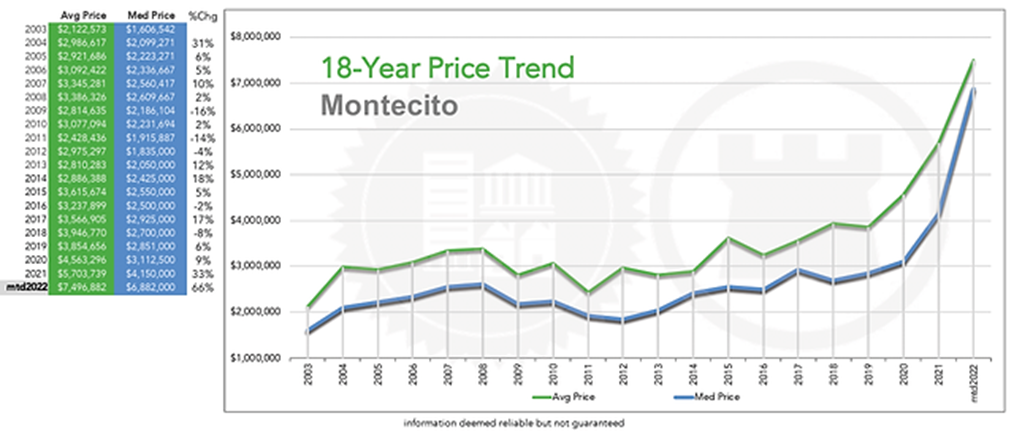

Final piece of anecdotal observations. For the first time in two years, I’ve started to see residential for sale signs on the mean street of Montecito. This is a place where every piece of dirt that had sat vacant has been purchased and new houses are sprouting up everywhere. The average price of a home in 2019 was $3,800, 000. Today that stands at $7,500,000

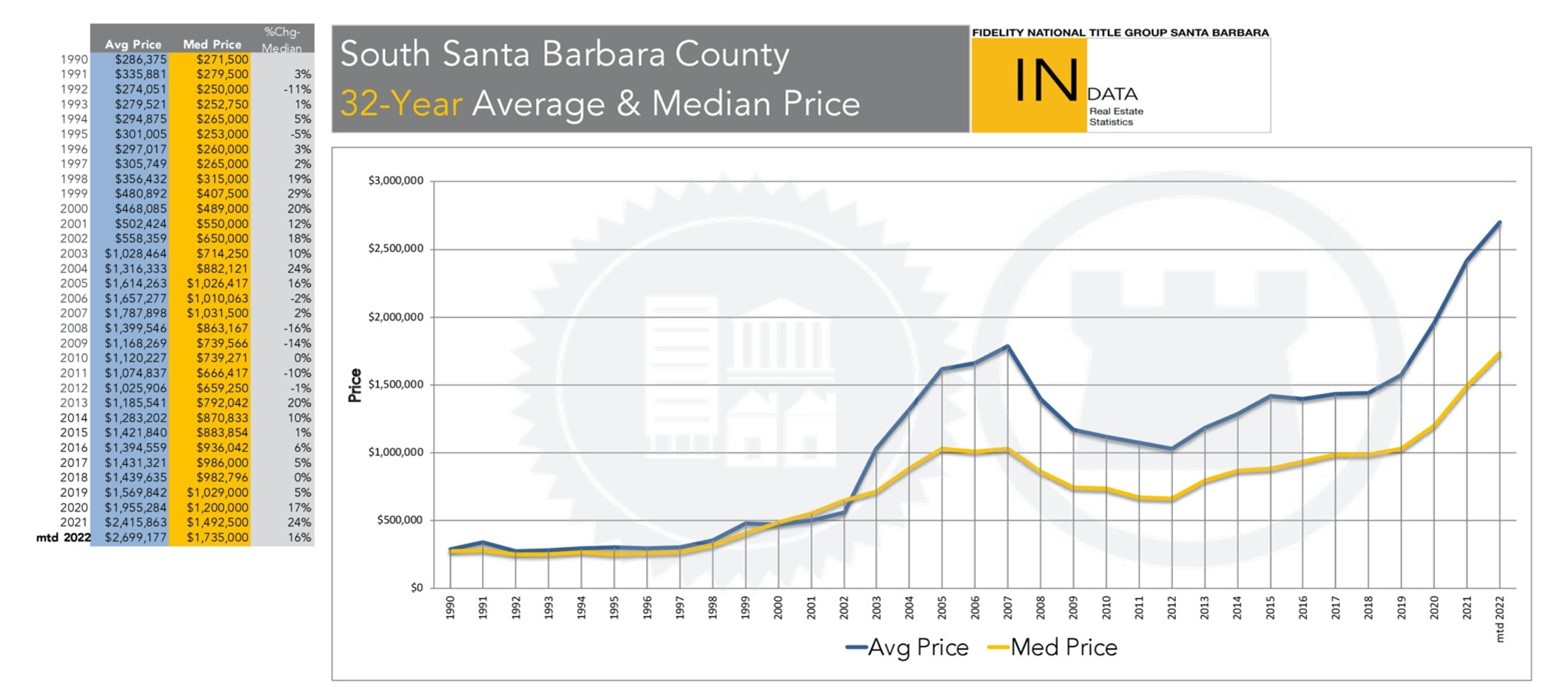

The immigration into this little hamlet by the sea is big money from Los Angeles, San Francisco, and New York. And when we say big money, we mean very big money. These are between 30% and 50% moves higher in value over the course of the past two years. From 2019 until now, the median price for all the South Coast of Santa Barbara has gone from $1,600,000 to $2,700,000. Ouch for the working man and woman.

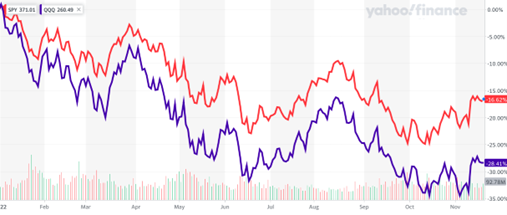

Onward we move to equity markets where we have experienced a period of relative calm over the course of the last couple of weeks. Which is not a bad way to end a year where we have seen losses that were as extreme as 25% for the S&P 500 and 35% for the NASDAQ. Not a bad rebound, if we do say ourselves. Thanks be to the venerable Yahoo/Finance for the market data.

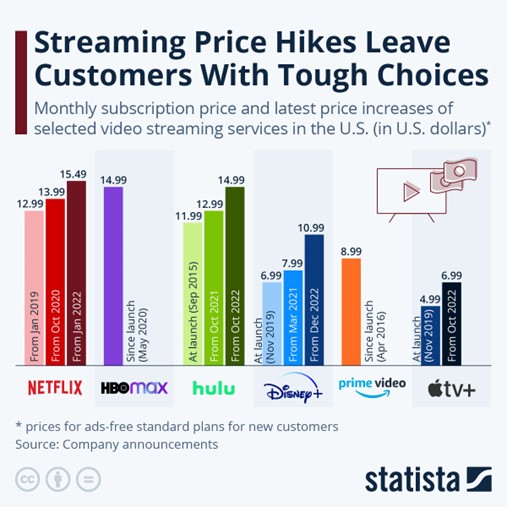

From the ‘rock and a hard place’ department, there is a giant squeeze being put on both the consumer who buys the streaming services and the companies that provide them. As the chart below shows, the race to save margins is on. From Netflix to Disney and everyone in between, price increases to the consumer can’t keep up with the rising cost of content. Case in point, Bob Iger was pulled out of retirement this weekend to step in and put a tourniquet on the bleeding at The House of Mouse.

For the most part, we are leaving FTX to the myriad of financial reporters around the globe who are covering the story. Bottom line, it’s a mess of all messes, and all we ask is that the charlatans who bought big and said so confidently own what they said. Number one on that list is Kevin “Mr. Fabulous” O’Leary of Shark Tank fame.

K Dog went all in when he said the reason he had complete confidence in the company was because Sam Bankman-Fried’s parents were compliance attorneys. Are you kidding me? You went all in, and got paid by FTX because the dude’s mom and dad were in theory on the compliance A-Team? Of course, he is already conning himself out of it by saying he would do it again. Great, just great. Wall Street needs more guys like you, Kevin.

In a moment of literary bravery, I submitted the following to the Wall Street Journal in the hopes they would run it this week as it’s very topical to the Thanksgiving holiday. Hope springs eternal that a little piece of Gonzo journalism in the world of finance can make the fish wrap later this week.

The Federal Reserve and the Thanksgiving Meal

The time of year when we are forced to smile and nod when someone looks at us or writes well wishes about being ‘healthy’ this holiday season is upon us. Healthy? Like the months of November and December are somehow akin to serving a tour in Iraq or Afghanistan? As if the mashed potatoes are going to explode like an IED, or the wine we drink is laced with Rohypnol? For the love of God, just take your seat at the adult table, grab some properly roast turkey, and relax a little. That’s the healthiest thing you can do.

Regarding health and the holiday feast, I want to introduce an idea into the policy making minds of central bankers around the world. Please, for the love of Julia Child, stop messing with the temperature of the monetary policy oven as you attempt to perfect golden brownness. It’s not working, and you are continually serving up turkey tartar or a dried nonedible version. Please, take counsel of the words spoken by the late Ronco founder Ron Popeil, “set it, and forget it”.

Here is how that would look in a way that markets would understand. First, don’t argue about 4% or 6% being the right number for the Fed Funds temperature. Split the difference and call it 5%, admitting that this is by no means an exact science. Data dependency is for the birds, pun intended. And you guys aren’t very good at it.

Next, make the big statement that you aren’t going to mess with the economic oven for a year. Just leave it alone. Let markets and asset classes adjust and normalize to something that looks and feels like a real rate. Don’t open the oven, and don’t let anyone touch the temperature dial. Make everyone take a time out and go for a hike, a walk, a sail, or whatever else makes you happy. If you play football, ditch the flags, and at least make it look like tackle. Our forefathers fought hard for the chance that you might snap a femur and end up in the ER this holiday season.

Now that you have established yourself as Chef de Economic Cuisine, Chairman Powell, you are going to further announce that after one year at 5%, the FOMC will be making two, and only two, fifty basis point adjustments in 2024. Call it ‘dialing in the temperature’. That’s right, you will be projecting out that the rate will be a stable 5% for one year, and then either 4% or 6% in year two. With a high degree of certainty, nobody dies of economic salmonella, or the house burns down in those scenarios.

At the end of the 2024 you are going to invite everyone over for the feast. The table will be set, all the trimmings properly mastered, and at the center will rest that beautiful creation that you masterminded. An economy well mended, asset bubbles tamed, inflation in the rearview mirror, and a host of other dividends paid that we didn’t think about. If at that point the metaphorical Drunk Uncle Dave wants to polish off the bottle of Makers Mark, let him have at it. Go to town, big boy. At least you will have done your job, and for two years provided peace and sanity to an economy and markets gone mad.

To everyone else, have a safe and happy holiday season. Beware the proverbial shot to the head by the relatives you already loathed and are saddened still exist in the family will. Be good to one another. Just like everything served up his time of year, we all go room temperature at some point. Might as well enjoy the ride while you can. ‘Rub a dub dub, thanks for the grub, go Jesus’. Now pass the gravy, por favor.

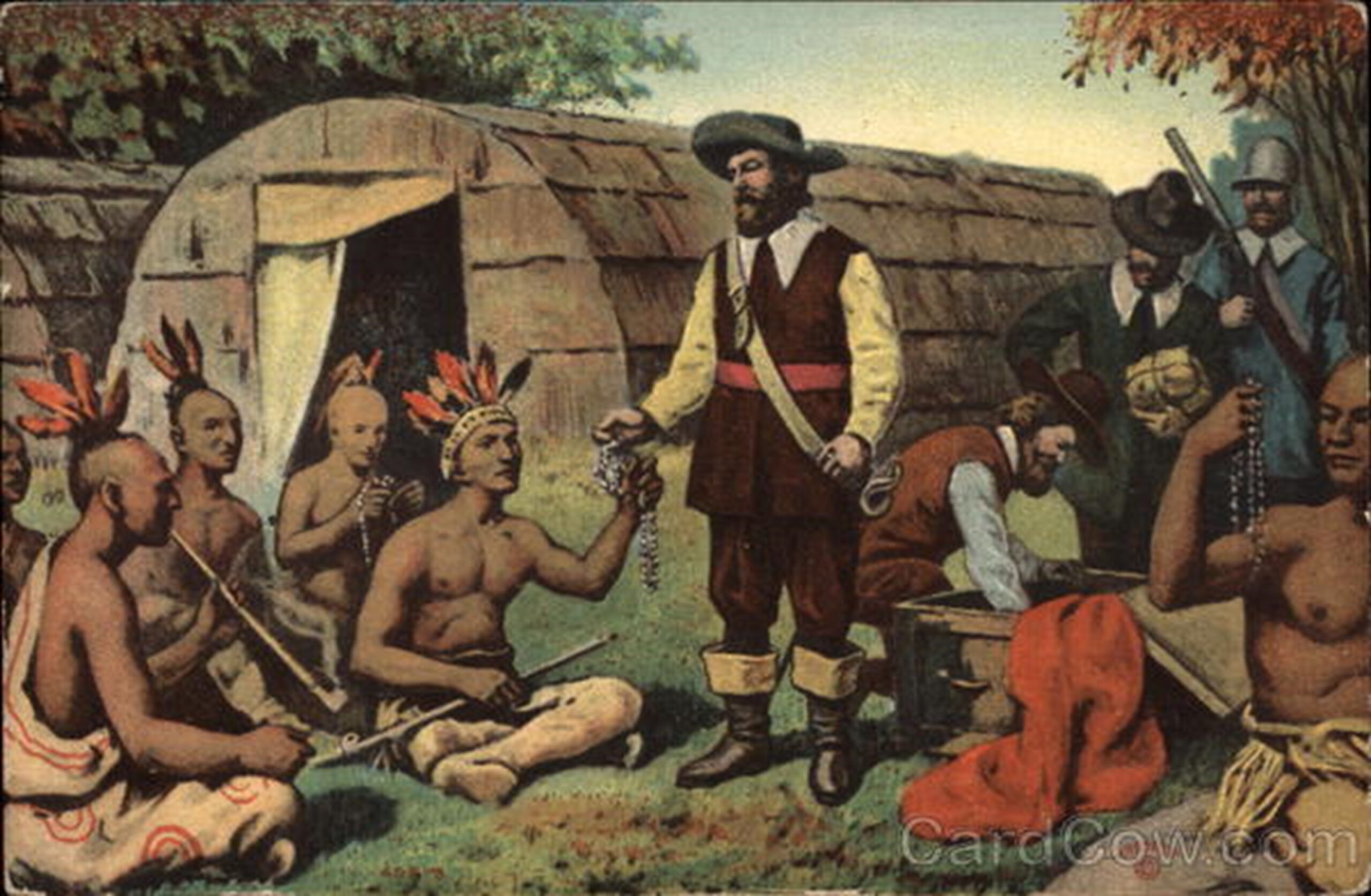

With that, I bid you a Thanksgiving adieu. Just remember this, the Munsee tribe sold Manhattan to the Dutch for $24 worth of beads and trinkets. Today, that’s about what a respectable Bourbon rocks goes for at the Monkey Bar. To which we say, be thankful for what you have, not what you don’t. As painful as that might seem at times.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.