Market Outlook 2023

with Bryan Goligoski - Axxcess Editor at Large

Welcome to the Axxcess Wealth 2023 Outlook, because it’s always good to wear the contrarian hat and opine on the year when it’s already a third over. But alas, it gives us time to think.

First up, the big question everywhere these days, is the economy headed towards recession? Well, technically it’s always headed towards a recession. Add it to death and taxes, one is always going to show up. But relax, deep breath. Everything is going be okay. It always is in time. Don’t listen to me, listen to Ted.

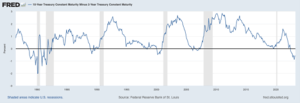

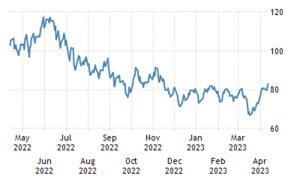

Back to the topic at hand, what are the signs economists are looking at in the here and now? The chart of the yield curve (10’s minus 2’s) is showing clear signs that something is about to change in the economy. When you get paid more to hold money short, than long, there is risk out there. In each of the last six recessions, the curve inverted just prior. That’s a consistent number.

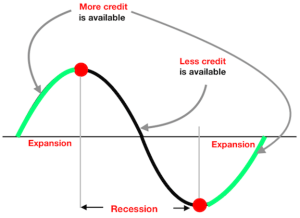

Each recession comes about for it’s own special reasons. In 2001 we were already headed that way before the terrorism hit our soil, plunging us and the world into recession. The 2008 recession was impressive for its sheer size and magnitude as the Great Debt Super Cycle came unwound. While this chart is ubiquitous to all credit cycles, it’s important right now more than ever.

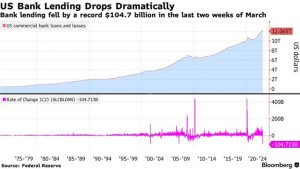

Why is it so important in the here and now? Because between the almost overnight insolvency of Silicon Valley Bank and the rise in interest rates, liquidity is drying up. Last time I checked, $100 billion in a two week period is not a small number.

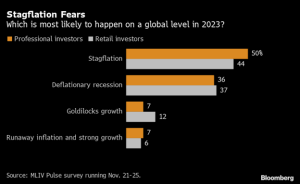

So, we’ve established that a recession sometime in the next twelve months would not be a surprise, let’s identify the likely driver. First off, credit is going to get tight. Credit is key to economic growth, we’ve established that. What are the next two most logical components? Stagnation in the economy, accompanied by pervasive inflation. What’s that spell? Say it with me, kids…

Moving on to the next big subject, or sub-subject, is what happens next with inflation. First off, let’s establish that it’s been bad lately. In everything from the most common daily products, foods, etc. to the super big-ticket items like cars and homes, inflation has been on like Donkey Kong.

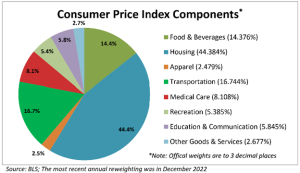

And since we are taking a spin around the economy, might as well pull out the pie chart showing what components make up the biggest slices of CPI. Between housing, transportation, and food, a full 70% of the statistic is spoken for. And it does not take any sort of genius to know that prices for those things have been on a tear higher. Maybe they mellow. That would be great. But if they stay elevated that becomes a problem in an economy where top-line growth is slowing.

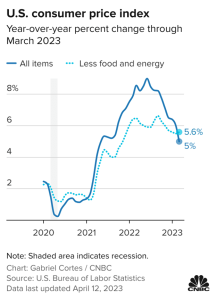

But here is some good news. By most reasonable standards, it would appear the inflation has peaked and is going through a slow cooling off process. And while a print in the mid 5% range isn’t great on its own, it is for sure better than the 8.5% it was in June of last year. If it comes down to anything that looks like 4.5% that will be a 400 basis point, or 4% improvement, from a year earlier.

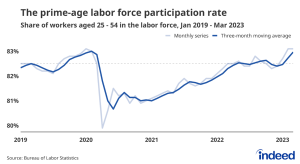

One of the things keeping inflation so high is that there has been little in the way of cooling in an otherwise white hot job market. Using labor participation as your marker, the economy is back above pre-pandemic levels.

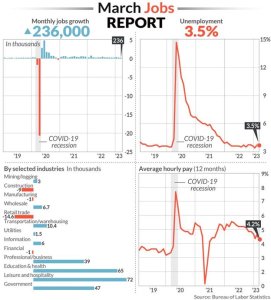

Found this visual analysis of the situation, as told through the March employment report. If you are a bull on the economy, this is a very pretty picture. Job growth is solid, employment rate is low, wage inflation has moderated, and all seems pretty good given the jihad that the Fed declared against low interest rates.

But now wait a minute, you writer with the fancy pen, you said that Gretzky was great because he skated to where the puck was going, not where it had been. If that’s the case, maybe skating to the idea that we’ve gotten everything we are going to out of this cycle is the right thing to do. Looking at this chart from the invaluable data engine at the St. Louis Fed (FRED) shows that going back 70 years, something in the mid-threes to low-fours has been the bottom threshold for the unemployment rate. And that is indeed where we are. Also notice that the rate is often at its lowest for a cycle in the few months right before a recession begins.

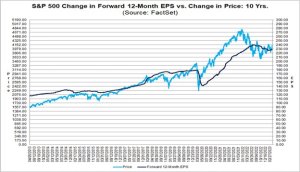

That’s what I have for you in terms of employment. Let’s turn the attention now to earnings, the place where a robust paycheck should find its way into given the strength of the economy. Remember 70% of GDP is driven by the consumer. So, it matters. This chart, which one of my favorite smart friends hate because of how he thinks it can be manipulated, still shows something that I think we know. And that is earnings are having a tough go getting going again as they have been headed sideways for a few quarters now.

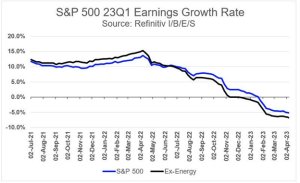

Similar chart, but this one is only showing for the first quarter of 2023. Is this the worst thing in the world? Not really. While it’s put a lid on stock advancement, it shows that the Fed is doing its job of slowing economic growth. If we were still going gangbusters at around 10% to 15%, Chairman Powell and the Powllettes at the Federal Reserve would have multiple 50 basis point hikes in the chamber.

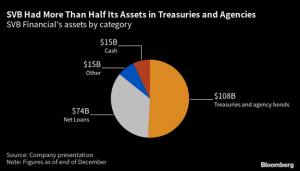

Banks are in the spotlight these days, given the overnight zapping of SVB. And the bears are out looking for more blood. And even though I’m an educated ursine, I don’t see cracks in the foundation of the banking system. On the contrary, the markets have taken this like a champ. And why? Because this wasn’t about risky loans on the books, or more sub-prime. No, it was about being too long treasuries when they spiked in yield and went down big in price.

And because nobody like to self-promote quite like the Mad Trader, Jim Cramer, lets bash his arrogance once again. A month before the bank took a dirt nap, Jim said this…

‘This company is a merchant bank with a deposit base that Wall Street has mistakenly been concerned by,”

Turns out there was a huge problem with the deposit base, it wanted its money. Nothing more, nothing less. One thing that is relevant is the fact that regional banks and smaller local lenders are for sure going to see a headwind in the future. Bottom line, nobody is going to get fired for having your deposits at Bank of America. But you put the company’s cash in the newly opened Small Town Bank, and it goes under, you might go under. Not because the money is gone, because it won’t be. But because you took the risk. Good luck, shooter.

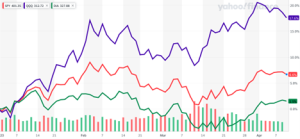

When it comes to the equity markets, it’s been a pretty good start to the year, all things considered. And when I say all things considered, it’s been a lot. Point being so many of the concerns being heaped on the markets are widely known. And if they are widely known, chances are good they are being discounted in the markets. Whistling past the graveyard? Maybe. Telling you that all is not lost? Probably even a better explanation.

The world’s most important commodity has been very well behaved over the past year. Coming down nicely in the face of a slower global economy. Taking a little bit of heat off the inflation gauges. We only spiked last week because OPEC+ decided a production cut was good for business. If it starts heading back to $70 on the way to $60, you will know things are slowing down.

There it is, in all its glory, a look at what could, should, will, won’t, might have been in the year 2023 of our Lord (pick any Lord you want). Like I said in the beginning, whatever is going to be, is going to be. As an individual, it’s beyond your control.

That said, you are the indeed the King or Queen of your own little nation state. If you do one thing this year, besides getting your investing affairs in order, is to rule that piece of metaphorical land the way you want to rule it. It will be gone before you know it, and so you might as well enjoy it while you are still wearing the crown. I like the sound of that.