The year is only two months old, and I think Ron Burgundy speaks for most of us….

Markets, politics, economics, asset values, crypto, inflation, etc. all of it and more. The world is moving fast, too fast for many. Let’s slow this down a little and get into what’s really going on. At least as best my 30 years in markets can see.

Make no mistake, the ‘fog of war’ is thickening. But don’t worry. We will get through this, and everything else. Always do. Days, months, years, decades, and centuries, we always do. Fade our resolve at your short selling peril.‘Covid? I’ve got your Covid right here…buddy!’ P.S. That’s the inanimate S&P 500 talking, in case you didn’t know.

I don’t have many ‘alerts’ that come though my phone, in fact only one. And that is a Bloomberg updated news feed. It’s a good flow of information, mostly about markets with some economic and special interest stuff thrown in as well. Roughly every other day I get hit with a ‘Trump’s tariffs’ and it’s seeming to be a binary proposal, on or off. With that in mind, here is the breakdown by sector of where companies derive their revenue. If you own a utility, you are totally solid. Got big slugs of tech in that account, not so much. Be aware of what lies beneath.

On earnings, and this is important, technology is going to continue to be the lead horse in driving them for the S&P in 2025. That of course assumes the chart below is accurate. No real reason to think it won’t be, as that’s been the case for a long time.

In a couple of weeks, I’ll be out with a piece that talks about how scared, or not scared, we should be about artificial intelligence. I’m going to do what I need to go deep where deep is needed and keep it irreverent and lively where I can. These are indeed interesting times. We survived 1984. Who says we can’t do it again. A free Costco hot dog for the first person who gets the reference. And a free Costco hot dog for everyone else who does too.

Turning to the economy, as most of the heads that talk do, I’m calling for a year of transition after the ‘Goldilocks’ world we’ve been livening. Behind ‘soft landing’, that’s my second least favorite phrase used to describe the economy. For the love of Mary, can we please get something a little less boring out of this sucker than the consistently good one we’ve been living in? I’m going to be dead before I get to see another recession. And that’s just nor very exciting for a writer of my caliber.

Same subject, like most everyone else who watches markets, I bit hard when the yield curve inverted two years ago. For almost 50 years every time it did, we wound up in a recession. Turns out it was different. For the first time since 1976, the economy did not contract after it cost less borrowers to use money long, than it did short.

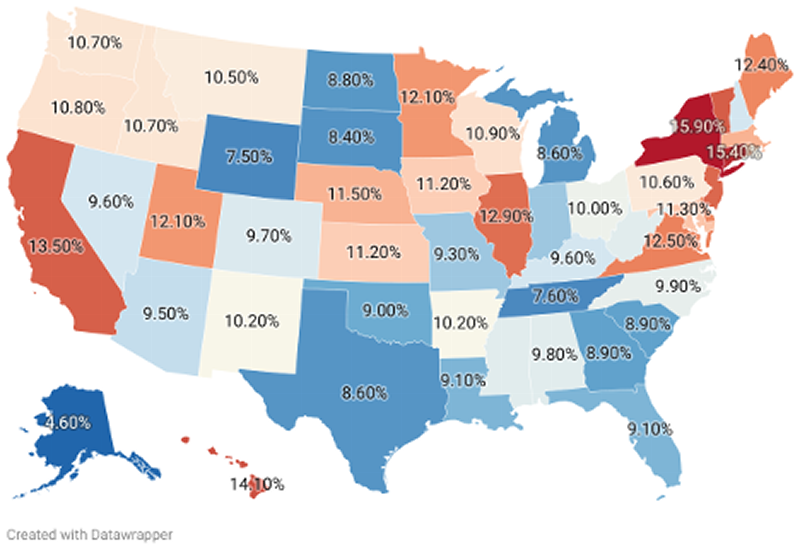

CNBC drilled down by state late last year to rank them, or at least the top ten. What you came away with is pretty much what one would expect. The lower regulation, lower tax, higher job growth states came out ahead of everyone else. California, Illinois, and New York were not on the list, even though they make up a massive percentage of GDP in the United States.

It’s because they are lugging around the most debt. Like a full trillion between the three of them combined.

And because of that, they have the highest state tax rates to help support that ‘lug’. At least for my 14% in Hawaii I get warm trade winds and rum drinks. For many years I was an analytical assassin, full flex. And I loved it when I could find an asset/income vs. debt/loss delta worth speculating on. It wasn’t a matter or ‘if’, but ‘when’ the wheels came fully off if the divide was too deep.

We shall see if a newfound shift center-right slows the descent into a State debt death spiral. Governors and state legislatures don’t go whistling past the graveyard too much longer. The natives have gotten restless.

In life, you have chances to achieve enlightenment. I’ve only had a few. But I’m also only halfway to the big ‘dirt nap’, I hope. So, I’ve got time. With that as backdrop I say Crypto is as real as you let it be. Forget Charlie Munger, Jaime Dimon, the Winkelvine, and everyone else. If you believe it to be real, it is.Now, I’m going to read you in on a little secret and you can forget everything else. Crypto is a risk asset. If you think the market is going up, then you buy it. If you think risk going to rise, you short or sell it. These are my independent thoughts, but I think they are clear as the finest crystal.

For the rest of year, beginning in March, I’m going to give the reading audience a ‘Stock O’ The Month’. This isn’t about being a carnival barker myself, it’s telling you what those that bark at the carnival are selling to the world. There are an untold number of ‘names’ out there that are worth reading about. I’ll take care of the written word. All I need you to do is work on your reading. ‘Step right up, step right up!’

As regulars to this post know, I think that central banks are so far up the inflation creek that they are delusional enough to think they can get themselves back down it. They can’t. I don’t think CPI gets anywhere close to 2% this year, and a four handle is far more likely. I will flog this story all year until I’m out of flogs. Linking one and two. We’ve got higher levels of inflation than anyone is at all comfortable with. Forget what the Fed says, there are problems out there in the system.

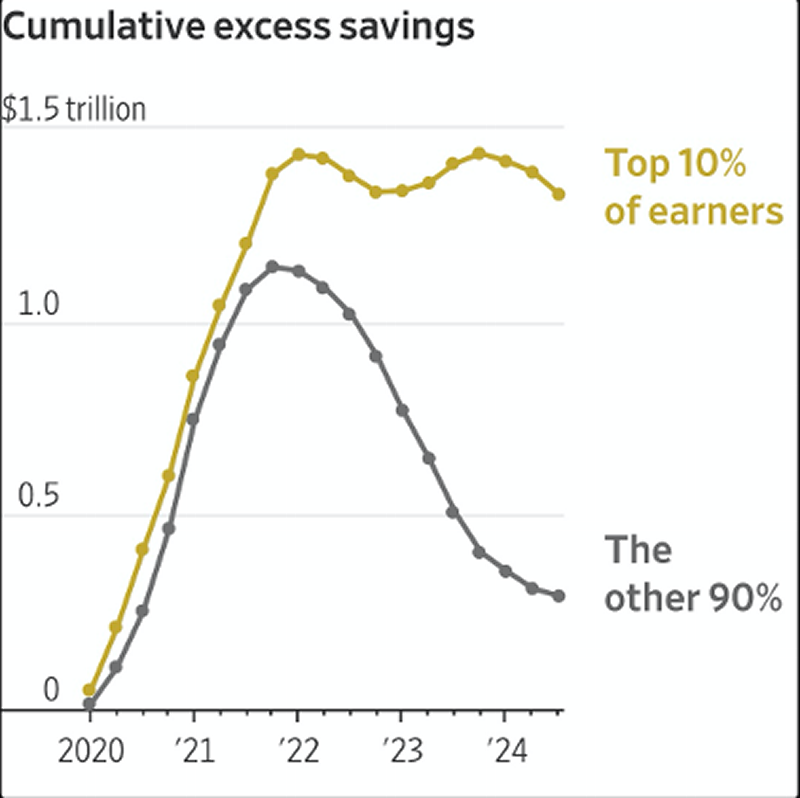

The second part of said problem is that the top 10% of earners have all the money and are in theory insulated from this dumpster fire of (much) higher prices. It’s the other 90% that are taking this kick squarely in the arse. I’ve been trying to articulate this for a decently long enough amount of time, and it took all but one chart from the WSJ to do the same thing.

From ‘Proof there is a God’, Hooter’s is going to file for Bankruptcy protection soon. Just like TGI Friday’s, the chain’s better days were way far behind it. I’ve been twice in my life. Once in San Bernardino where it was a club water polo weekend. Highlight was an LAPD pursuit on the big screen and half the bar was cheering for the police, the other half the dude on the run. Second time, and I’m a little embarrassed to admit it, was around the 2018 Masters when I took the stroll down Washington Road to check out John Daly’s annual circus carnival. I regret both of those decision.

If you’ve made it this far, consider yourself a high achiever. Not everyone does. This is my esoteric gift to you. I hope you enjoy and can find some divine wisdom the mechanics garage of life.

Like just about everyone else, I’m trying to make sense of what seems like an ever-senseless world these days. It feels likes its coming at us from all sides sometimes, and there has been a higher level of stress on the engine. Everyone has one. Exactly everyone. Some think theirs is of the F1 variety…

Mine, proudly, is a Jeep Grand Wagoneer’s V8 circa the Reagan administration… Point all of this is that whether it be ready to do 220 mph, or struggle to push 60, our engines are all processing an ever-increasing set of facts and circumstances that have it running a little hotter than usual. .

But if I hit the wall, nobody is probably going to die. If, on the other hand you are running at ‘red line’ in a twelve cylinder, as the world’s economies are doing, a blowout is going to take a few passengers out. So, as I like to say, ‘buckle up, buttercup’ things are about to get (even more) interesting.